Key Takeaways:

- Understanding your choices of retirement plans is key to maximizing your savings and tax efficiency over time.

- Knowing the current tax benefits to traditional plans if you qualify, but later tax benefits to Roth accounts if you fund them early in your working years.

- Contributing to multiple plans to maximize your savings and your retirement income - is this an option?

What is a Traditional Account

Traditional IRAs became available in 1975 after the Employee Retirement Income Security Act of 1974. Employees not covered by an employer plan are allowed to contribute pretax dollars up to an annual amount. These dollars are invested in the IRA and are taxed at ordinary income rates when distributed during retirement. If a person or their spouse is covered by an employer plan, there are income limitations to pretax deductibility of the dollars added to the plan.

Traditional 401Ks were added to employer benefits with the passing of the Revenue Act of 1978. Employees are allowed to contribute pretax dollars up to an annual limit into the plan. These dollars are invested in the 401K and are taxed at ordinary income rates when distributed during retirement.

What is a Roth account?

Roth individual retirement accounts (Roth IRAs) are qualified retirement plans introduced by Congress in 1998, under IRC Section 408A.

The Roth 401K became an option when The Economic Growth and Tax Relief Act of 2001 was passed although it wasn’t implemented until 2006. This provision is in IRC Section 402A.

Roth accounts are distinct from Traditional accounts in many ways. The primary difference is that Traditional accounts are funded with pre-tax dollars and distributions are subject to income tax. With Traditional accounts, there is a minimum amount that must be distributed each your after the account owner reaches a certain age. These are called Required Minimum Distributions (RMDs). Roth accounts are funded with after-tax dollars and generally are not subject to tax upon distribution. Unlike Traditional accounts, Roth accounts do not have have required minimum distributions.

Because investments in Roth accounts grow tax-free and are not subject to income tax upon distribution, long-term deferral of Roth distributions can be a powerful income tax planning strategy and may be good options for legacy planning. The longer assets remain in a Roth account, the greater the opportunity for tax-free growth, and ultimately tax-free income for the account owner or beneficiaries.

This article discusses tax deferral opportunities as well as the fundamentals of both types of 401Ks and IRAs.

Subscribe now so you don't miss out on our upcoming series on retirement strategies including ROTH conversions and other options for maximizing your savings.

Traditional vs. Roth 401Ks

Employer retirement plans determine whether an employee has the option of a Roth and/or Traditional 401K. Employees under age 50 can contribute up to $23,500 in 2025. Employees over age 50 can make a catch-up contribution of an additional $7,500. Therefore employees age 50 and older can generally contribute $31,000 to their retirement account in 2025. Under a change made in the SECURE Act 2.0, a higher catch-up contribution limit applies for employees aged 60, 61, 62 and 63 who participate in 401Ks. For 2025, this higher catch-up contribution limit is $11,250 instead of $7,500, with a total contribution of $34,750. Starting in 2026, Secure Act 2.0 also requires high earners to make any catch-up contributions to Roth 401Ks as opposed to Traditional 401Ks.

Many employers offer to match the employee’s contribution up to a certain percentage of the employee’s compensation. If you have chosen a Roth contribution, most employers make the match in a traditional account. However, employers may change their plans to allow the employer to make matching contributions to the Roth account. However, if the match is made to the Roth account, the employee will owe taxes on the match in the year it is made. Like Roth IRAs, as part of the Secure Act 2.0, Roth 401Ks have no Required Minimum Distributions (RMDs).

Traditional vs. Roth IRAs

In 2025, the maximum permitted contribution to an IRA is $7,000 for those under 50, and $8,000 for those age 50 and older by the end of the year, with the "catch-up" contribution being $1,000. The following contribution limitations also apply.

- A participant may contribute to an IRA only if he or she has qualifying income in an amount no less than the amount of the contributions. “Qualifying income” is income from employment and alimony (if pursuant to a separation instrument signed before December 31, 2018) and does not include investment income.

- The maximum amount a participant may contribute to an IRA is reduced by the amount the participant contributed to any other IRA during that same tax year.

Taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or the taxpayer’s spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income . (If neither the taxpayer nor the spouse is covered by a retirement plan at work, the phase-outs of the deduction do not apply.) The phase‑out ranges for 2025 are:

- For single taxpayers covered by a workplace retirement plan, the phase-out range is between $79,000 and $89,000. At $89,000 or above, there is no pretax deduction.

- For married couples filing jointly, if the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is between $126,000 and $146,000. At $146,000 and above, there is pretax deduction.

- For an IRA contributor who is not covered by a workplace retirement plan and is married to someone who is covered, the phase-out range is between $236,000 and $246,000. At $246,000 and above, there is no pretax deduction.

- For a married individual filing a separate return who is covered by a workplace retirement plan, the phase-out range is between $0 and $10,000. At $10,000 and above, there is no deduction.

Taxpayers may also choose to make post-tax contribution to a Roth IRA.

- The income phase-out range for taxpayers making contributions to a Roth IRA is to between $150,000 and $165,000 for singles and heads of household.

- For married couples filing jointly, the income phase-out range is to between $236,000 and $246,000.

- The phase-out range for a married individual filing a separate return who makes contributions to a Roth IRA is between $0 and $10,000.

There are several ways an individual can contribute to a Roth IRA:

- An individual with compensation income may make a regular contribution to a Roth IRA, subject to adjusted gross income limitations; and

- A participant who owns a Traditional IRA can roll over funds from the IRA to a Roth IRA, which is called a conversion.

- In addition, there are several less common ways to fund a Roth IRA, including a rollover of a designated Roth account and a designated beneficiary rollover from an inherited IRA to a Roth, among others.

There is no age limitation for contributions to an IRA with the passing of SECURE Act 1.0. Participation in an employer plan is only relevant when determining whether a contribution to a Traditional IRA is deductible.

The deadline for contributing to a Roth IRA is the same as the deadline for contributing to a Traditional IRA, i.e., the unextended due date of the tax return for that year, which is generally April 15 of the following year.

Required Minimum Distributions (RMD)

The Secure Acts 1.0 and 2.0 adjusted the ages when required minimum distributions begin, based on the following dates of birth for traditional accounts:

- Born before 7/1/1949 – RMDs begin at age 70.5

- 7/1/49-12/31/1950 – RMDs begin at age 72

- 1/1/1951-12/31/1959 – RMDs begin at age 73

- After 12/31/1959 - RMDs begin at age 75

If your traditional account is with your employer and you work past your RMD, you can delay your RMD until April 1st of the year after you end employment. The exception to this rule is if you are a 5% or more owner of the company. Other family members with control could impact the 5% rule. Please check with your tax advisor for further guidance.

- There are no exceptions for traditional IRAs.

- Roth 401K and Roth IRAs have no RMDs.

Distributions

Qualified Distributions

A qualified distribution is any distribution made no sooner than five years after January 1 of the year in which the participant makes his or her initial contribution to the 401K or IRA, and is distributed to any of the following:

- The account owner on or after attaining age 59 ½ (and separation of service for a 401K)

- A beneficiary or the participant’s estate,

- A beneficiary who is considered disabled, as defined in the statute, or

- A qualified first-time homebuyer (limited to $10,000).

Inherited IRAs

When the IRA owner dies, the IRA becomes payable to the IRA designated beneficiary. Different rules apply when the beneficiary is a surviving spouse or a non-spouse beneficiary.

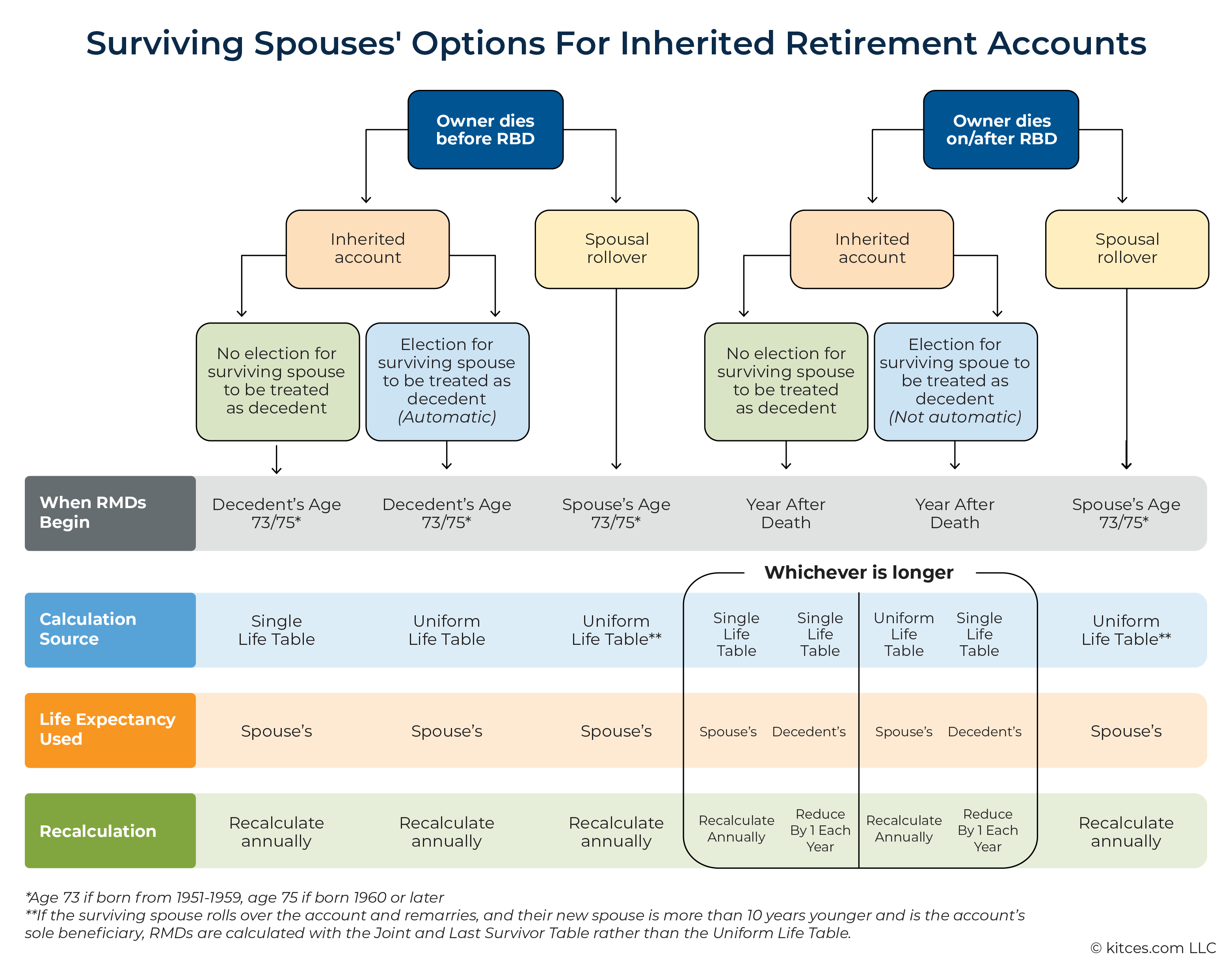

Spouse as Beneficiary

A Spouse Beneficiary has the following options when inheriting a IRA, depending on if the participant’s death occurred prior to or after the required beginning date:

- Spousal Rollover: The surviving spouse may treat the IRA as his or her own.

- Continuing the decedent’s account: The surviving spouse may keep the account as an inherited account and treat the account as if it was the decedent/participant’s retirement account and begin taking RMDs when the participant would have been required to take RMDs (if it isn’t a Roth account).

- If the participant died prior to the required beginning date for taking RMDs, the surviving spouse can either (i) fully withdraw the inherited IRA by December 31 of the tenth year following the death (the ten-year rule), or (ii) distribute the IRA balance over the surviving spouse’s life expectancy (the life expectancy rule).

- If the participant died after the required beginning date, the surviving spouse must take distributions following the life expectancy rule (he or she cannot follow the ten-year rule).

Source Image: https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

Non-Spouse Beneficiary

The options available to non-spouse beneficiaries depends on whether the beneficiary is an Eligible Designated Beneficiary, a Designated Beneficiary, or a Beneficiary that is not an individual. An Eligible Designated Beneficiary is (i) a spouse or minor child of the decedent/participant; (ii) a disabled or chronically ill individual; or (iii) an individual who is not more than 10 years younger than the participant. A Designated Beneficiary is an individual who is not an Eligible Designated Beneficiary. The following options are available to these non-spouse beneficiaries:

- Ten-Year Rule: The ten-year rule is the default rule governing the distribution of inherited retirement accounts to Designated Beneficiaries, which provides that the entire amount of the inherited account must be distributed by December 31 of the tenth year after the participant’s death. Eligible Designated Beneficiaries may choose to follow this ten-year rule only if the participant died prior to the participant’s required beginning date for taking RMDs.

- Five-Year Rule: The five-year rule is the default rule governing the distribution of inherited accounts to Beneficiaries that are not individuals (such as to the participant’s estate), which provides that the entire amount of the inherited retirement account must be distributed by December 31 of the fifth year after the participant’s death.

- The Life Expectancy Rule: For Eligible Designated Beneficiaries the life expectancy rule permits withdrawals over the beneficiary’s “life expectancy” based upon the IRS Uniform Lifetime Tables. This beneficial rule can only be used by an “Eligible Designated Beneficiary.” If the Eligible Designated Beneficiary elects to use the life expectancy rule, then the Eligible Designated Beneficiary must begin taking RMDs from the IRA on or before December 31 following the year of the participant’s death.

There are many options for retirement plans. This article explores just a few of them. Subscribe now to receive additional articles in this series on retirement savings plan options and strategies.

If you would like to know more about retirement plans contact your Comerica Relationship Manager or request a Comerica Wealth Professional contact you. If you prefer to speak to a banking representative in person, visit one of our banking center locations near you.

NOTE: IMPORTANT INFORMATION

Comerica Wealth Management consists of various divisions and affiliates of Comerica Bank, including Comerica Bank & Trust, N.A. and Comerica Insurance Services, Inc. and its affiliated insurance agencies. Non-deposit Investment products offered by Comerica and its affiliates are not insured by the FDIC, are not deposits or other obligations of or guaranteed by Comerica Bank or any of its affiliates, and are subject to investment risks, including possible loss of the principal invested. Comerica Bank and its affiliates do not provide tax or legal advice. Please consult with your tax and legal advisors regarding your specific situation.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Wealth Management does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Wealth Management personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Wealth Management, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.