For better or worse, taxes are one of life's few certainties. Each year, millions of Americans track their expenses between tax seasons in the hopes that they may have a chance to deduct those costs later on in a tax return. And each year, many are surprised by what they may and may not be allowed to claim. This is especially true for homeowners, who occasionally encounter discrepancies in what they are allowed to deduct from one tax season to the next based on shifting policy.

It's not always possible to anticipate where the federal government will land on certain tax policies, but homeowners certainly have the option of staying up to date on the general tax ramifications of having a mortgage.

Knowing what is deductible is half the battle

Homeowners benefit from understanding the expenses tied to different types of mortgages. For example, mortgages offered with a down payment of less than 20%, such as some FHA loans, usually require the purchase of private mortgage insurance (PMI). Simply knowing whether or not the PMI costs are deductible could help you gain a better sense of what tax advantages you may be eligible for.

That is only the tip of the iceberg, though. The Tax Cuts and Jobs Act of 2017 introduced some new caps that became effective in 2018. Relatively new homeowners in particular may benefit from brushing up on what they may and may not deduct in order to feel a little more prepared for when tax season rolls around.

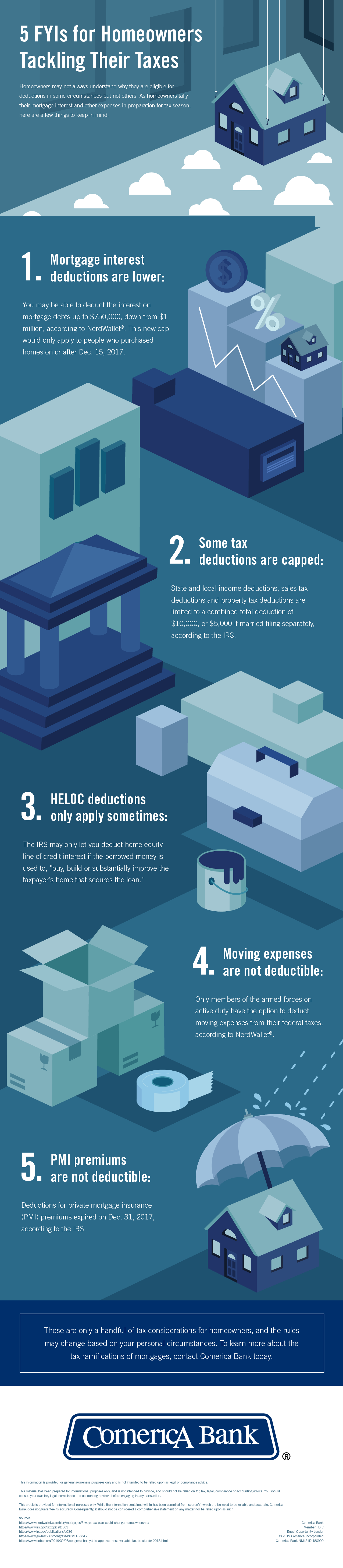

To help cement your knowledge of mortgage tax advantages, our infographic highlights some of the core considerations to make as you document your home-related expenses this year.