On the Horizon

A Perennial Gale; not a Minsky Moment for now…

Oh, hush thee, my babe, granny’s bought some more shares, Daddy’s gone out to play with the bulls and the bears, Mother’s buying on tips, and she simply can’t lose, And Baby shall have some expensive new shoes!

— Saturday Evening Post – late 1920s

Introduction

As we pass the halfway mark of the 2020s, comparisons now abound between our current decade and the roaring 1920s. F. Scott Fitzgerald best captured the opulence of the Flapper Era in The Great Gatsby, “They were careless people, Tom and Daisy — they smashed up things and creatures and then retreated back into their money or their vast carelessness.”

Despite some parallels of excess and concentration of wealth in America, let me suggest we are not retracing the 1920’s when markets lacked regulations and any sort of supervision that ultimately led to a cascading of failures and policy mistakes igniting the Great Depression.

Likewise, those of us who professionally came of age in the 1990s may find a closer comparison to the booming New Economy era when the market peaked at 35 times earnings and investors anticipated a technological revolution that would disrupt the economy with the internet at centerstage. Eventually, tighter credit conditions, oversupply, and spending pulled forward due to Y2K lead to a spiraling downward market, otherwise described as a “Minsky Moment” defined by American economist, Hyman Minsky who observed a repeated pattern throughout financial history of leverage, speculation, corruption, and then collapse.

Today’s market has notable differences including the financial attributes of the technology leaders and the underlying macro-economic conditions. Although, we are still monitoring the evidence; it is more likely a “Perennial Gale” which is a phrase borrowed from an Austrian economist Joseph Schumpter who lived in the early 1900s. Schumpeter published his contributions to economics during WWII at a time when the future of capitalism was yet undetermined. The capitalist economy is often swept by a ‘Perennial gale of creative destruction’- a gale of innovation. However, this advancement is a natural process of industrial mutation that leads to dramatic economic changes but also enormous benefits to society and business.

It is this transformation that alters industries. For instance, during the industrial revolution in 1947, 35% of the American workforce was in manufacturing but today less than 15%. We produce fewer textiles in North Carolina and steel in Pennsylvania, and the disruptive innovation has rendered many jobs and companies obsolete, but what the Cassandras do not tell you-- is that in 1947, manufacturing was 11% of GDP and today it is roughly 10% of GDP. We are just doing it more productively and with far fewer workers.

So, resist the temptation to follow the investing “Toms and Daisys.” Stay prudent, avoid being overly aggressive and apply a bit of caution at each turn, even when everyone else is optimistic. That is exactly what we plan to do next year.

Finally, we are particularly excited about our future banking combination and the opportunities it affords our clients across our footprint with increased scale and sophistication to deliver on our promise! So, let us look at what is in store for next year…

Executive Summary

The year 2026 presents a complex yet promising economic landscape. While the global economy continues to demonstrate resilience, it also faces a variety of challenges that require careful navigation. Our outlook aims to provide an understanding of some key economic drivers, market trends, regional dynamics, sectoral insights, and risks that investors should consider as they plan their strategies for the year ahead.

Global Economic Landscape

Growth Prospects

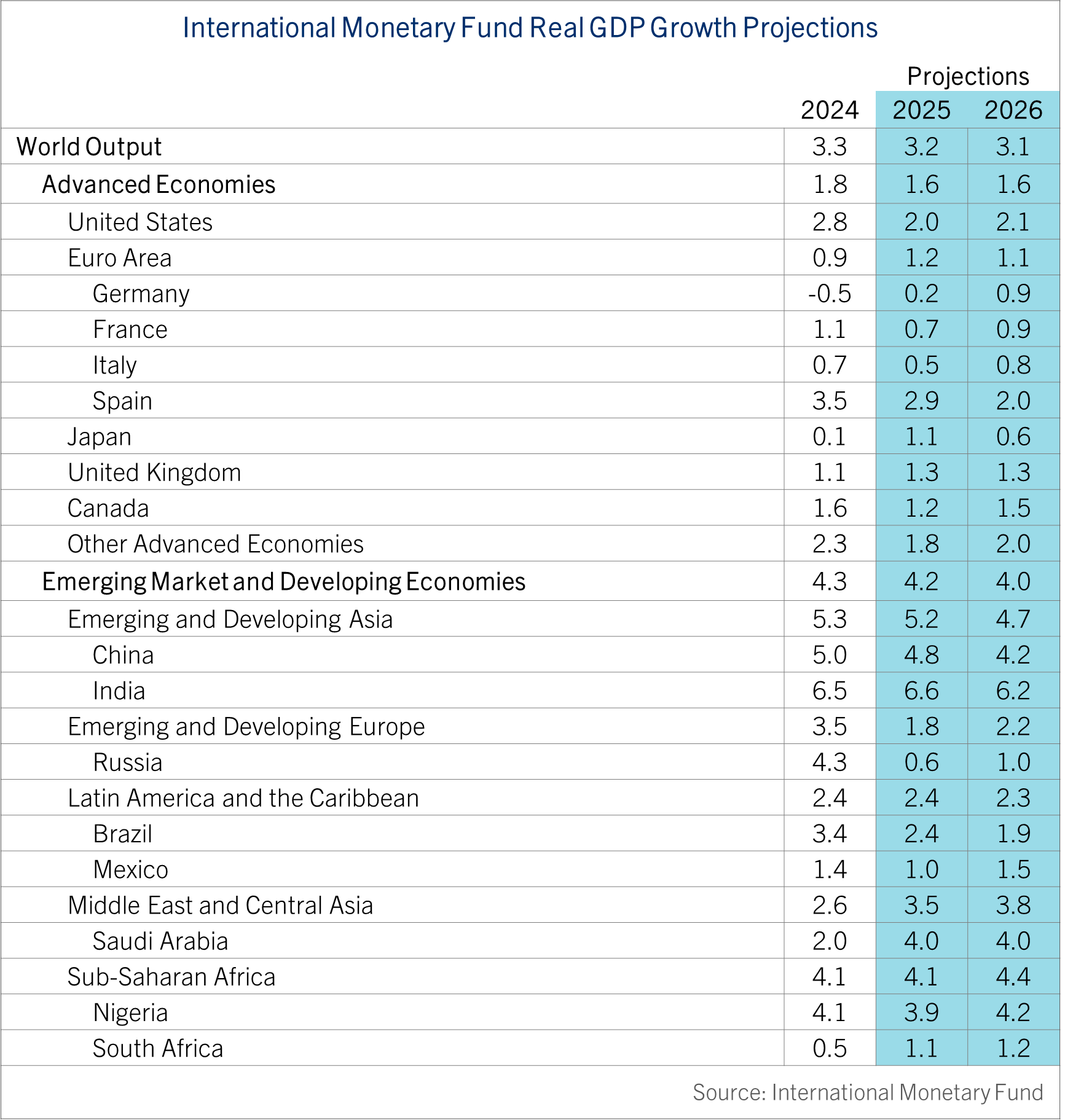

Global GDP growth is projected to hover around 3%, reflecting a steady pace that balances optimism with caution. The United States is recovering from previous tariff-induced shocks, bolstered by ongoing consumer spending and significant infrastructure investments. Meanwhile, Asia remains the primary engine of growth, with India, Korea, and Southeast Asia leading the advance. China's economy is stabilizing, showing moderate growth rates between 4% and 5%, while Japan experiences modest gains driven by technological innovation, export demand, and stimulative policies.

Inflation Dynamics

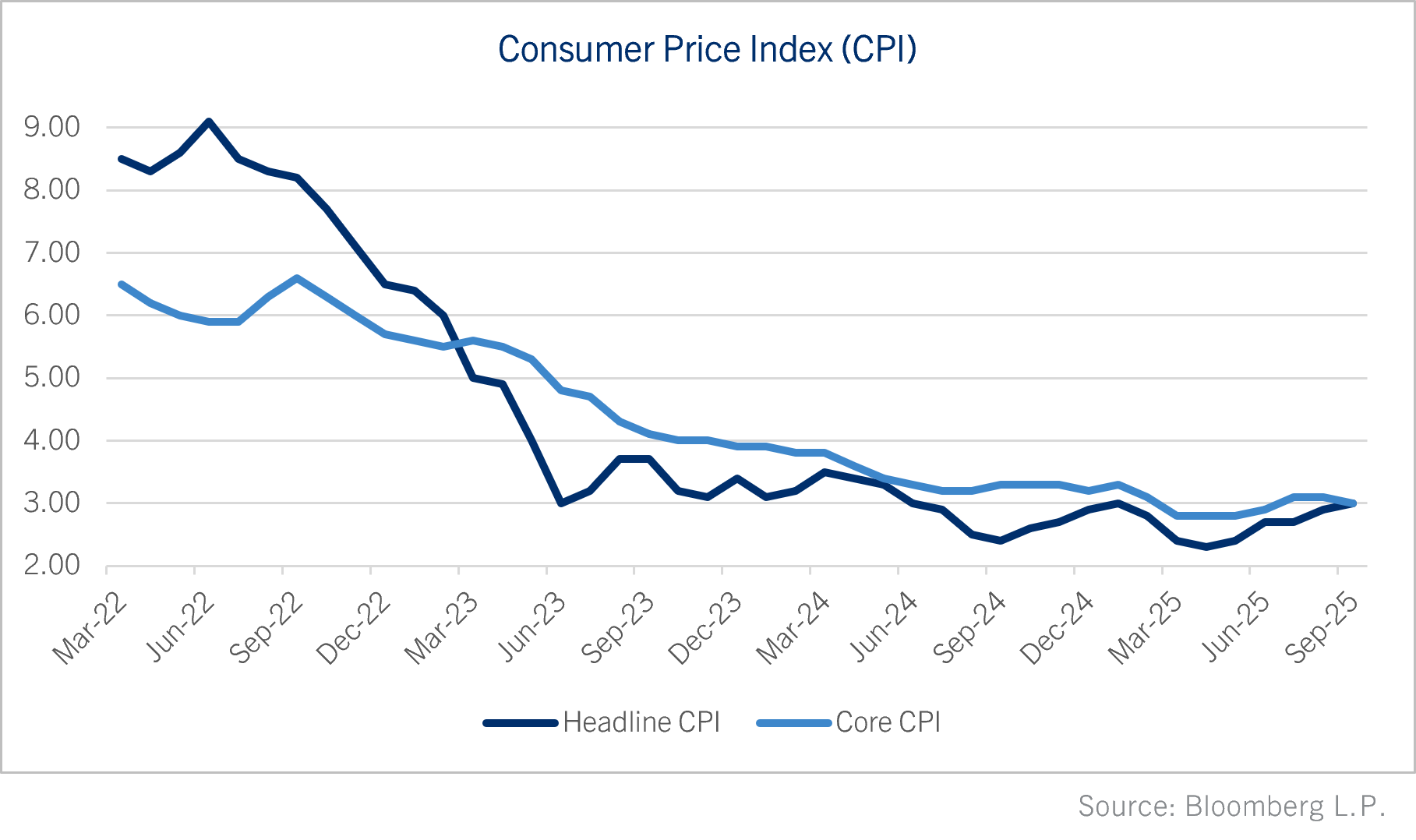

Inflation pressures are anticipated to moderate in most major economies during Q4 2025. Supply chain disruptions have largely abated, and commodity prices have stabilized, contributing to easing input costs. The U.S. Consumer Price Index (CPI) is sticky and expected to run higher than the Federal Reserve’s 2% target, while the Eurozone’s Harmonized Index of Consumer Prices (HICP) should hover around 2%. In emerging markets, inflation remains a concern in select economies due to currency volatility and elevated food prices, but overall global inflation is expected to moderate.

Recession Risks

Despite positive growth indicators, recession risks remain elevated but less than 30%. This underscores the importance of maintaining diverse portfolios and preparing for the potential increase in market volatility. Factors contributing to recession risks include ongoing geopolitical wars and tensions, monetary policy uncertainties, and external shocks such as commodity price fluctuations.

Regional Economic Highlights

United States

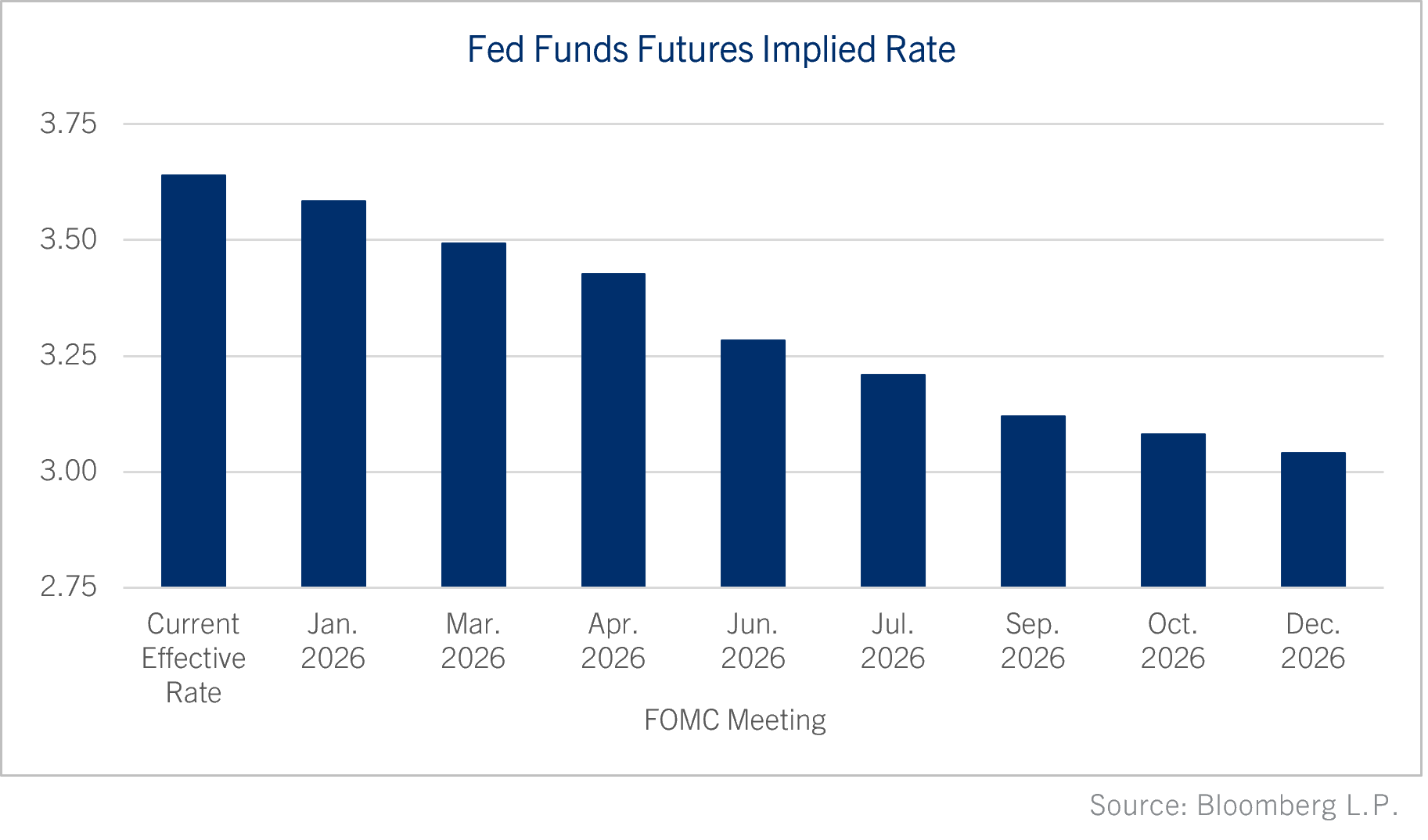

The U.S. economy is expected to benefit from a trifecta of growth drivers: infrastructure spending and fiscal stimulus form OBBBA tax cuts and deductions, accelerated adoption of artificial intelligence technologies, and resilient consumer demand. Infrastructure projects, fueled by recent government initiatives, are set to enhance productivity and create jobs. AI adoption is transforming industries, boosting efficiency and innovation particularly in software and professional services. Consumer spending remains robust, supported by a resilient labor market and wage growth. The Federal Reserve is anticipated to reduce interest rates two to three times during the coming year to support economic expansion.

Europe

Europe faces a mixed economic outlook. Green investments and digital transformation initiatives offer significant growth opportunities, particularly in renewable energy and technology sectors. However, demographic challenges, including an aging population, and elevated energy costs pose headwinds. Policymakers are focused on balancing economic growth with sustainability goals, which may influence fiscal and monetary policies.

Asia-Pacific

India continues to be a standout performer with growth rates exceeding 6%, driven by domestic consumption, infrastructure development, and a burgeoning technology sector. China’s economy is stabilizing with growth between 4% and 5%, supported by government stimulus measures and a focus on high-tech industries. Japan’s economy is facing rising interest rates and only expected to grow modestly, benefiting from export demand and technological advancements.

Emerging Markets

Emerging markets present a diverse picture. Latin America benefits from commodity exports but faces political uncertainties that could impact economic stability. Africa is experiencing growth through infrastructure investments and digital adoption, positioning it as a region with long-term potential despite short-term challenges.

Market Outlook

Equities

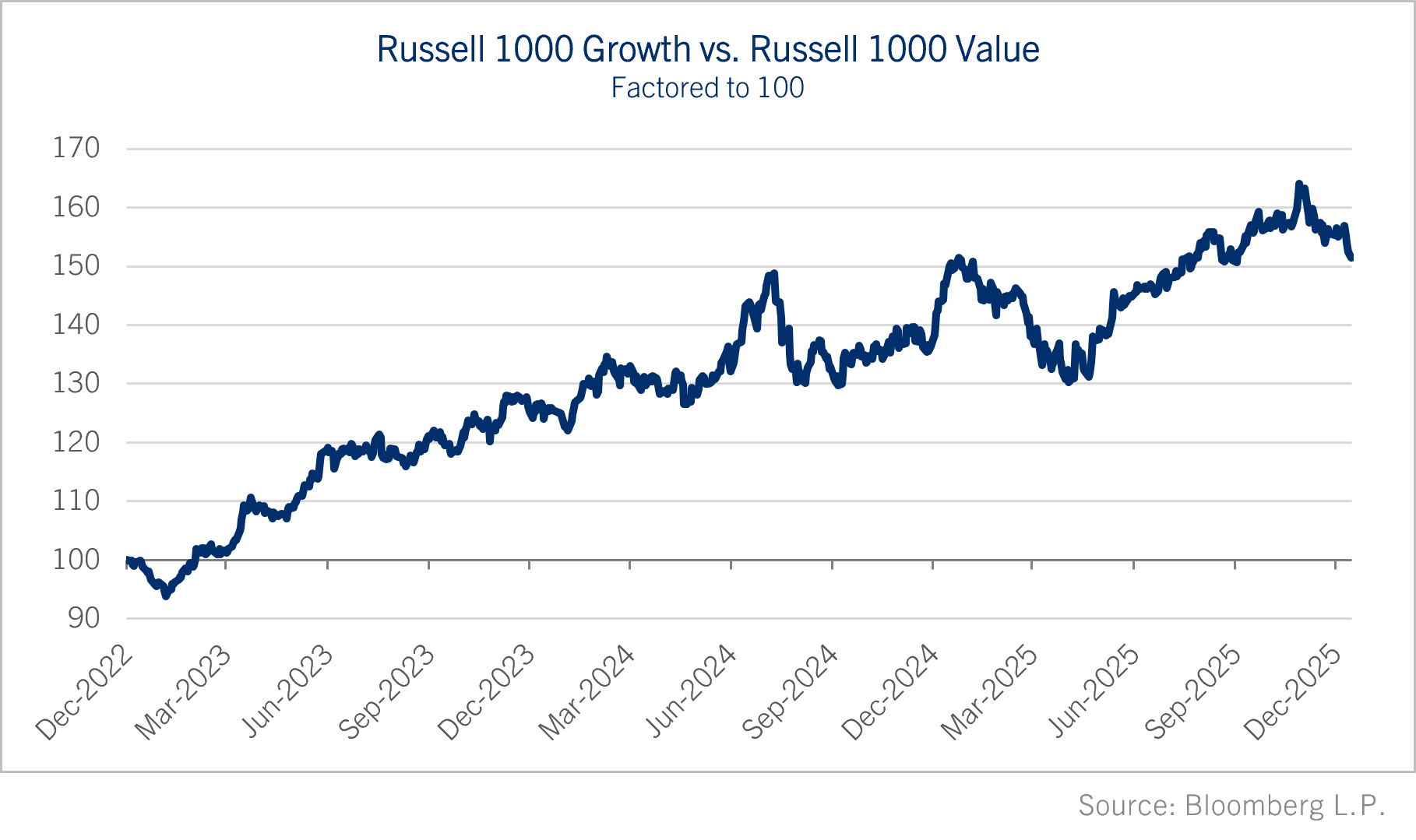

U.S. equities have enjoyed a prolonged bull run, now entering a fourth consecutive year. While valuations appear stretched, selective opportunities remain, particularly in sectors aligned with a steeper yield curve including traditional value sectors like financials.

European markets also offer relative value, with potential upside as economic reforms take hold. Emerging markets, especially India, presents robust growth prospects, supported by demographic trends and economic reforms.

Fixed Income

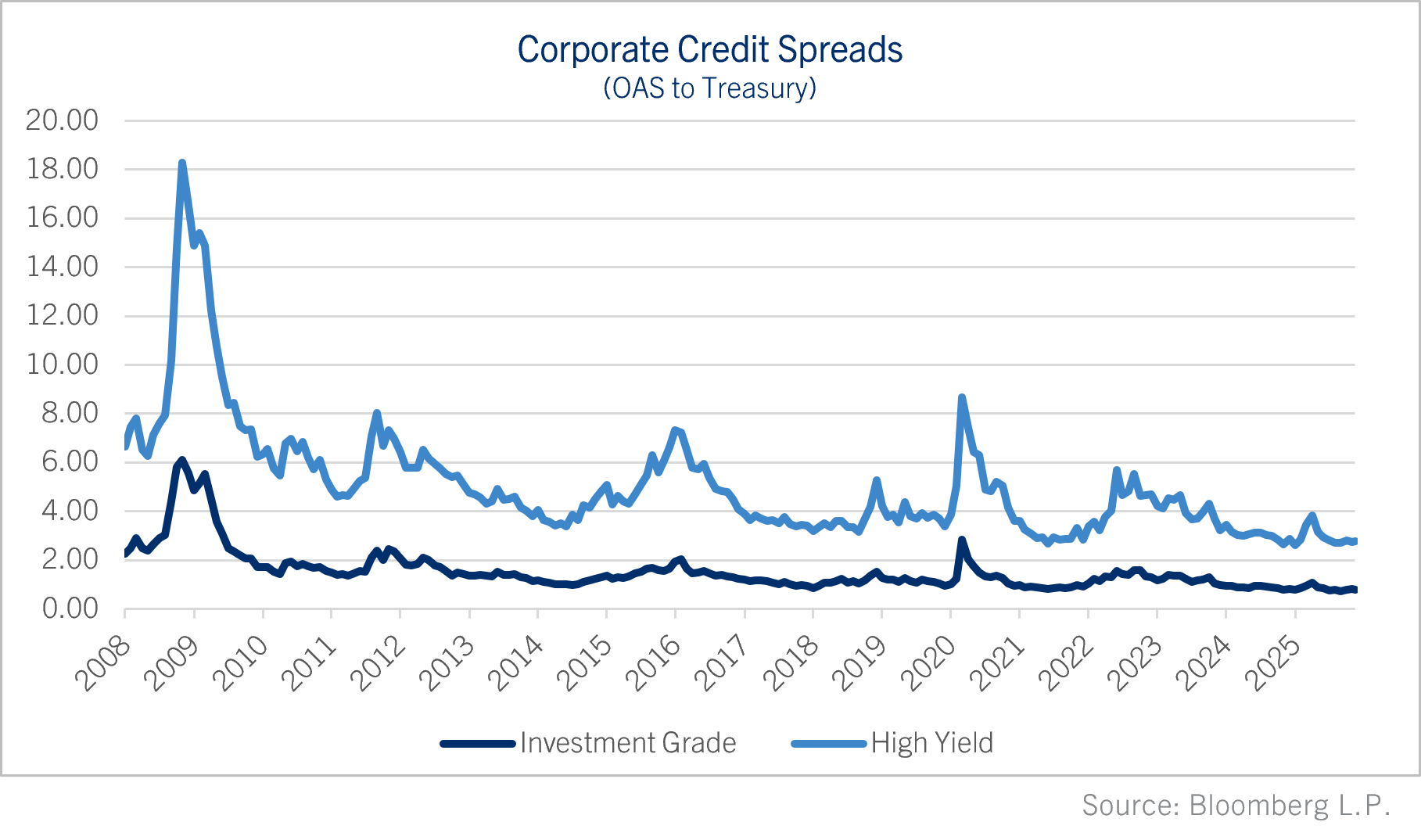

Fixed income markets offer attractive income opportunities amid a backdrop in moderating interest rate cuts. Municipal bonds provide tax-advantaged income and stability, while global bonds offer further diversification benefits. Investors should be mindful of duration risk and credit quality in their fixed income allocations and wary of extremely tight credit spreads.

Commodities

Demand for commodities is shaped by energy transition and climate considerations. Clean energy materials, including rare earth elements, are in high demand due to their critical role in renewable technologies. Agricultural commodities remain volatile, influenced by climate variability and geopolitical factors. Commodities remain a hedge for inflationary pressures and an important allocation for well diversified portfolios.

Sectoral Insights

Technology

Artificial intelligence continues to be a transformative force, driving productivity gains across industries. Despite the enormous cash flow margin advantage, technology valuations are elevated, warranting cautious investment as we have been in a record momentum-driven market with controversy brewing around valuations, retail and high-frequency trading, and debt financing. Cybersecurity remains a critical area of growth as digital threats evolve across industries.

Energy & Infrastructure

Traditional energy cash flow yields appear provocative as concerns develop around a supply glut and Ukraine/Russian peace prospects have placed downward pressure on oil prices. Renewable energy and modern power infrastructure are central to economic growth and climate goals. Investments in these sectors are expected to accelerate, supported by government policies and private sector initiatives.

Healthcare

Demographic shifts, particularly aging populations in developed markets, underpin long-term demand for healthcare services and biotech innovation. The sector serves as a good hedge to technology. Advances in personalized medicine and digital health technologies offer new growth avenues.

Financials

The financial sector benefits from deregulation trends and the rapid adoption of fintech solutions. Banks are adapting to digital transformation, enhancing efficiency and customer experience. The nature of corporate lending has changed and is evident in the low default rates versus private debt.

Consumer

Consumer spending remains a pillar of economic growth, with e-commerce and luxury goods sectors showing resilience. Shifts in consumer preferences toward sustainability and digital engagement are shaping market dynamics.

- Trade and Tariffs: Ongoing trade tensions and tariff policies could disrupt global supply chains and increase costs. Except for the automotive and machinery sectors, tariffs negate the beneficial impact of the OBBBA in most industries. The pass through of tariffs is ongoing and the impact has weighed more on the bottom income earners.

- Monetary Policy: Central banks face the challenge of balancing inflation control with growth support, with potential for policy missteps. A substantial degree of monetary easing will be necessary to boost the economy and revive the housing market. We anticipate the yield curve will continue a bullish steeping pattern.

Risks and Uncertainties

Several risks warrant close monitoring:

- Trade and Tariffs: Ongoing trade tensions and tariff policies could disrupt global supply chains and increase costs. Except for the automotive and machinery sectors, tariffs mostly negate the beneficial impact of the OBBBA in most industries. The pass through of tariffs is ongoing and the impact has weighed more on the bottom income earners.

- Monetary Policy: Central banks face the challenge of balancing inflation control with growth support, with potential for policy missteps. A substantial degree of monetary easing will be necessary to boost the economy and revive the housing market. We anticipate the yield curve will continue a bullish steeping pattern.

- Geopolitical Tensions: U.S.-China relations, energy security in Europe, and regional conflicts pose risks to economic stability. Immigration policies will have a greater impact on economic data next year and may impact growth and boost wages in several industries like construction and leisure/hospitality.

Long-Term Structural Trends

AI and Automation

The integration of AI and automation technologies is reshaping labor markets, productivity, and competitive dynamics. Businesses that adapt effectively stand to gain significant advantages. The market is discounting margin improvement from the logarithmic deployment of AI; so, there is little room for error.

Demographic Shifts

Developed markets face aging populations, increasing demand for healthcare and retirement services. Emerging markets benefit from young, growing populations, driving consumption and innovation.

Digitalization

Digital technologies continue to revolutionize commerce, finance, and communication. E-commerce, fintech, and cybersecurity remain critical growth areas.

Investment Implications

Investors should consider the following strategies:

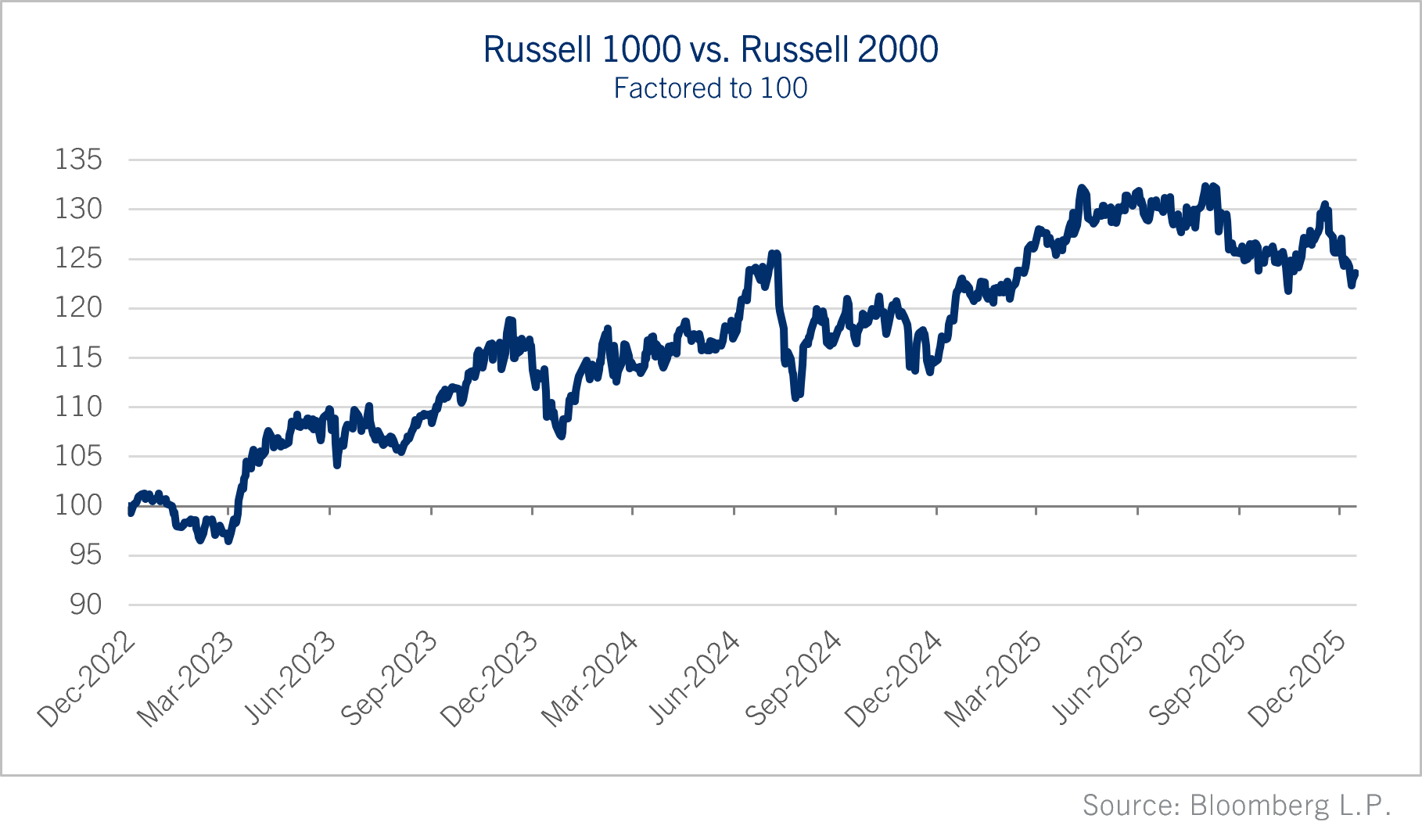

- Equities: Prioritize quality companies with sturdy growth and reasonable valuations. Relative value opportunities have emerged in financials, healthcare, and energy and infrastructure. Small and even micro-cap companies will continue to outperform during a period of falling rates and a broadening out that began four months ago.

- Fixed Income: Emphasize municipals and global bonds for income and diversification. Corporate and high yield spreads remain tight; so avoid reaching for return and investing in lower quality.

- Commodities: Target selective exposure to clean energy materials and agricultural commodities. Precious and base metals remain a hedge against risk and the prospect of a second wave of inflation.

- Diversification: Balance portfolios with international exposure to mitigate regional risks. Concentration in the U.S. market has never been greater; thus, the need to diversify by geography, style and factor, and capitalization is imperative for investors.

- Risk Management: Maintain a defensive stance to navigate a likely increase in volatility and uncertainty as a pronounced “January Effect” where winners are sold and laggards rally following a period of powerful momentum.

Conclusion

The 2026 economic and market outlook is characterized by cautious optimism. While growth drivers are robust, risks remain significant. A balanced and well diversified approach that emphasizes higher quality, relative valuation, and income generation will be essential for investors seeking to capitalize on opportunities while managing uncertainties.

By staying informed and adaptable, investors can position themselves to thrive in the evolving economic landscape of 2026.

NOTE: IMPORTANT INFORMATION

All references to Comerica Bank or Comerica Bank & Trust, N.A., shall mean Fifth Third Bank, N.A., successor by merger to Comerica Bank and to Comerica Bank & Trust, N.A. All references to Comerica Incorporated shall mean Fifth Third Bancorp, successor by merger to Comerica Incorporated.

Comerica Wealth Management consists of various divisions and affiliates of Comerica Bank, including Comerica Bank & Trust, N.A. and Comerica Insurance Services, Inc. and its affiliated insurance agencies. Comerica Bank and its affiliates do not provide tax or legal advice. Please consult with your tax and legal advisors regarding your specific situation.

Non-deposit Investment products offered by Comerica and its affiliates are not insured by the FDIC, are not deposits or other obligations of or guaranteed by Comerica Bank or any of its affiliates, and are subject to investment risks, including possible loss of the principal invested.

©2026, Comerica Bank. All rights reserved

Unless otherwise noted, all statistics herein obtained from Bloomberg.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Wealth Management does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Wealth Management personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Wealth Management, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.

Information supplied from another source.

While the information contained within has been provided/compiled from source(s) which are believed to be reliable and accurate to the best knowledge of Comerica Wealth Management. Comerica Wealth Management does not guarantee its accuracy. It should not be considered a comprehensive statement on any matter and should not be relied upon as such.

Past performance does not guarantee future results.

The S&P 500® Index, S&P MidCap 400 Index®, S&P SmallCap 600 Index® and Dow Jones Wilshire 500® (collectively, “S&P® Indices”) are products of S&P Dow Jones Indices, LLC or its affiliates (“SPDJI”) and Standard & Poor’s Financial Services, LLC and has been licensed for use by Comerica Bank, on behalf of itself and its Affiliates. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services, LLC (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings, LLC (“Dow Jones”). The S&P 500® Index Composite is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the S&P Indices.

NEITHER S&P DOW JONES INDICES NOR STANDARD & POOR’S FINANCIAL SERVICES, LLC GUARANTEES THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE WAM STRATEGIES OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNCATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIM ALL WARRANTIES, OR MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY COMERICA AND ITS AFFILIATES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P INDICES OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES OR STANDARD & POOR’S FINANCIAL SERVICES, LLC BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD-PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND COMERICA AND ITS AFFILIATES, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

“Russell 2000® Index and Russell 3000® Index” are trademarks of Russell Investments, licensed for use by Comerica Bank. The source of all returns is Russell Investments. Further redistribution of information is strictly prohibited.

MSCI EAFE® is a trademark of Morgan Stanley Capital International, Inc. (“MSCI”). Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

FTSE International Limited (“FTSE”)© FTSE 2016. FTSE® is a trademark of London Stock Exchange Plc and The Financial Times Limited and is used by FTSE under license. All rights in the FTSE Indices vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE Indices or underlying data.