Navigating global markets with a dynamic approach

“The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs.” -Warren Buffett

Introduction

Comerica opened its banking doors more than 175 years ago and chartered a trust company at the turn of the century, in 1900. While it may sound cliché, much has changed since then - in both banking and investing. Yet the core values that have made Comerica a long-standing and thriving institution since the mid-1800s - such as “The Customer Comes First” and “A Force for Good” - remain the bedrock of our approach and will continue to guide our investment success for clients in the future.

At Comerica Wealth Management, we believe that successful investors - especially those with fiduciary responsibilities - must prioritize prudence, discipline, and a deep understanding of market psychology to navigate today’s financial uncertainties and protect the interests of those we serve.

I am honored to follow in the footsteps of exceptional leaders and visionaries who came before me, and I am privileged to work alongside a team of outstanding professionals. Together, we are committed to serving our customers, maintaining a consistent and disciplined investment approach, and preserving capital during more challenging periods.

So, let’s begin.

Executive summary

The first half of 2025 has unfolded against a backdrop of ever-shifting economic tides - ranging from evolving fiscal and monetary policies to geopolitical recalibrations in the Middle East and rapid technological breakthroughs in artificial intelligence and digital assets. “Liberation Day” marked the most significant shift in trade policy in more than a century, leaving investors navigating a marketplace defined by both resilience and uncertainty.

The on-again, off-again tariff policies appear to be part of a broader negotiating strategy, with the goalposts moving repeatedly, underscoring the reality that globalization is not easily reversed. However, tax incentives from the “One Big Beautiful Bill Act” (OBBBA) are expected to offset many of the tariff-related costs. As a result, we anticipate a domestic economy capable of powering through and avoiding recession, with corporate earnings grinding higher in the second half of 2025.

As we cross the year’s midpoint, this outlook seeks to identify the major trends shaping the global investment landscape, highlight emerging opportunities and risks, and offer guidance for capital allocation in a world undergoing profound transition.

Key highlights from the 2025 Mid-Year Investment Outlook

- Global resilience amid uncertainty: despite geopolitical tensions and shifting trade policies, global markets show resilience, with the U.S. economy avoiding recession.

- Inflation stabilizing, rates elevated: Central banks maintain a “higher for longer” stance; fixed income markets offer attractive yields and diversification opportunities.

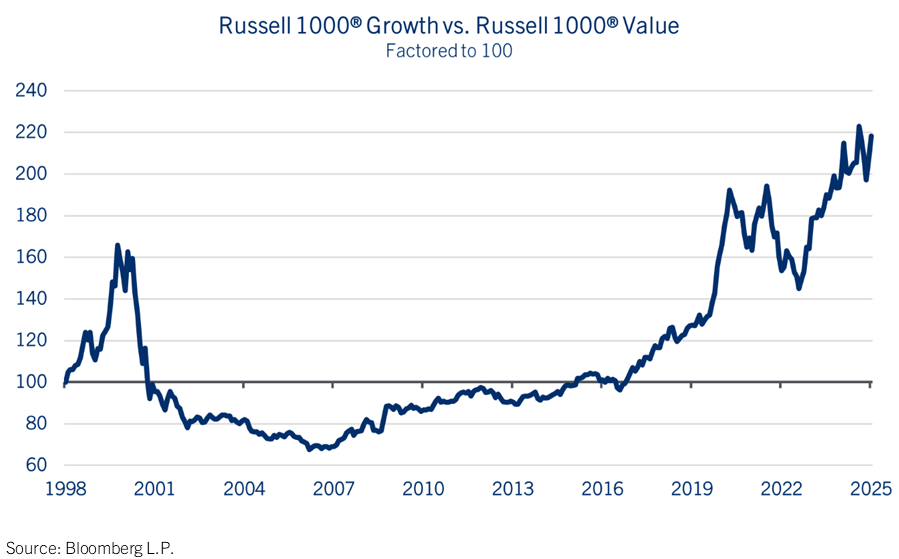

- Equity market rotation: Sector leadership is shifting—AI and tech remain strong, but value sectors like healthcare, financials, and energy are gaining traction.

- Geopolitical flashpoints: U.S.-China trade tensions, the Russia-Ukraine conflict, and Middle East instability continue to influence market sentiment.

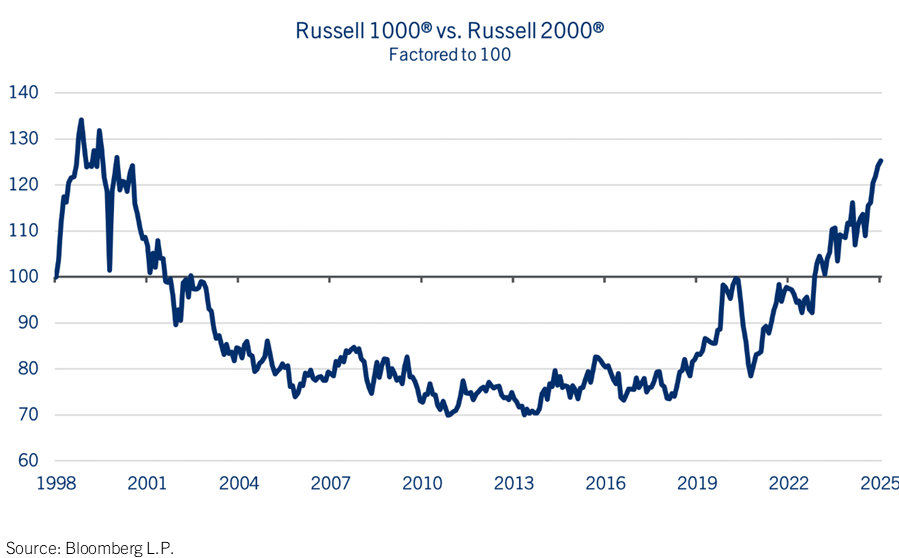

- Opportunities in small caps and international markets: Depressed valuations and shifting supply chains favor small-cap and international equities including emerging markets.

- Real assets and alternatives in focus: Commodities, REITs, and private markets offer inflation protection and portfolio diversification.

- Strategic allocation guidance: Emphasis on balanced portfolios, duration management in bonds, and geographic diversification to navigate volatility.

- Election year volatility ahead: Global elections in 2025 may drive short-term market swings - investors are advised to stay focused on fundamentals.

Global economic overview: Steady as she goes

The global economy in 2025 is marked by modest yet steady growth, supported by divergent regional dynamics. Developed markets - led by the United States and select European economies - have shown surprising resilience despite lingering inflationary pressures and the aftershocks of central bank policy normalization. Emerging markets, meanwhile, present a mosaic of opportunities and challenges, shaped by varied local policy decisions, favorable currency movements, and a mid-cycle commodity environment.

- United States: GDP growth has moderated to a more sustainable pace, with labor markets remaining robust but cooling from post-pandemic highs. The Federal Reserve has remained on hold, balancing inflation concerns with the risk of stifling the recovery. Today the economy is less sensitive to interest rates; a significant amount of easing is required to influence consumer behavior, as most outstanding mortgages carry a 4% coupon and corporate borrowers are locked in at rates well below current levels.

- Europe: The eurozone faces a delicate balancing act, contending with the costs of energy transition and subdued consumer spending. Germany and France continue to anchor regional stability, while peripheral economies strive for greater fiscal discipline.

- Asia-Pacific: China remains in focus as policymakers pivot toward consumption-led growth. India continues its ascent, driven by favorable demographics and digital innovation. Japan is seeing steady gains in productivity and ongoing corporate governance reforms.

- Emerging markets: Volatility persists, but several economies in Southeast Asia, Latin America, and Africa are attracting increased investment as global supply chains shift and tariff impacts prove less severe than in China. Countries with strong fiscal positions, robust commodity exports, and growing domestic consumption offer the most promising prospects.

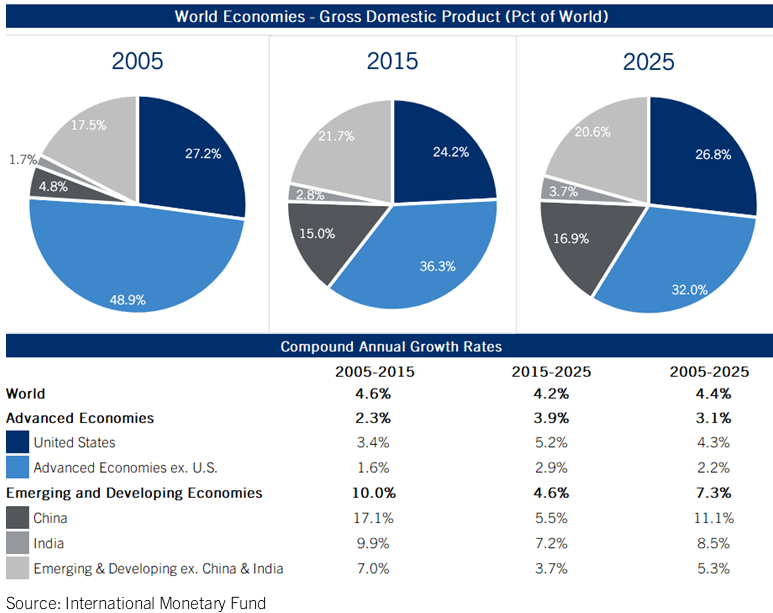

World economies: Decoupling is hard to do

Inflation and interest rates: A balancing act

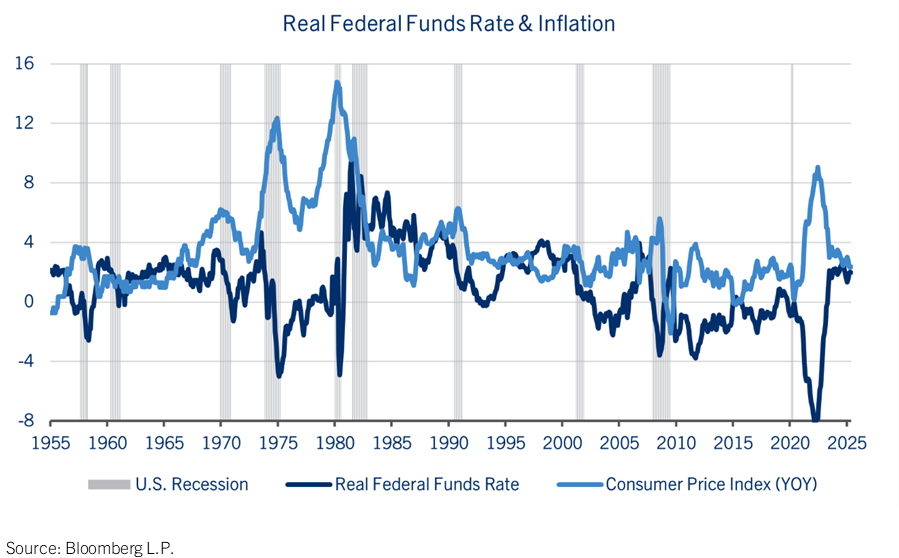

After a period of persistent inflation, headline rates in major economies have stabilized. The Federal Reserve, European Central Bank, and Bank of England have adopted a “higher for longer” stance, keeping rates elevated to anchor inflation expectations. History has shown that a second wave of inflation is not uncommon following an initial surge.

The One Big Beautiful Bill Act (OBBBA), even with new tariff revenues, is expected to increase the budget deficit and push the associated interest burden to record levels. This environment has placed pressure on rate-sensitive sectors but has also created opportunities in fixed income, where yields are more attractive than in recent years.

- Fixed income: The bond market has returned to prominence. Investors are reallocating toward government bonds and high-quality corporate credits, taking advantage of higher yields and seeking shelter from equity market volatility.

- Real assets: Inflation-linked securities, commodities - including gold - and real estate investment trusts (REITs) serve as hedges and offer diversification benefits. However, commercial real estate continues to face secular headwinds from elevated borrowing costs and shifting demand in office and retail spaces.

The bottom line: We see no evidence to suggest that confidence in the United States’ ability to service its debt has been called into question, despite the rise in real rates since 2020 and the recent Moody's rating downgrade. Determining how much federal debt is too much remains a daunting task. However, our outlook suggests that real rates are likely to move higher, influenced by immigration policy, reshoring of production, and ongoing deficit concerns - all of which are weighing on the bond market.

Fed funds and inflation: Inflation contained; real rates elevated

Equity markets: Starting to broaden out

Global equity markets have experienced bouts of volatility, reflecting shifting monetary expectations and sector rotations. The United States remains the world’s largest and most dynamic equity market, though sector leadership continues to evolve.

- Technology and growth: Artificial intelligence, cloud computing, and cybersecurity remain key engines of growth, supported by strong free cash flow generation and operating leverage. However, valuations are increasingly tied to the durability of that cash flow and their sensitivity to real interest rates—as evidenced by April retracements in several high-profile growth stocks.

- Healthcare stability: Innovation in biotechnology, pharmaceuticals, and medical technology is accelerating, driven by aging populations and advances in personalized medicine. Health maintenance organizations (HMOs) appear attractive, with relative valuation multiples near all-time lows due to existential threats to profit margins creating an opportunity to take advantage of marketplace apprehension.

- Financials and banks: These sectors continue to benefit from a steepening yield curve. Banks, in particular, are significantly less risky than in past cycles and offer compelling valuations and yields.

- Energy transition: Renewables and energy storage are central to long-term strategies, while traditional energy companies adapt to regulatory and consumer-driven change. Although contrarian bets in this space take time to materialize, energy firms are demonstrating greater capital discipline than in previous periods.

- Reshoring and industrial renaissance: Manufacturing is experiencing renewed interest in North America and Europe, as companies prioritize resilient supply chains and the reshoring of operations.

Large vs. small: Smaller-cap opportunities emerging

Geopolitical climate: Simmering

The geopolitical landscape continues to cast a long shadow over investment decisions. U.S.-China relations, the ongoing war in Ukraine, and rising tensions in the Middle East - particularly involving Iran, Israel, and the United States - are key sources of uncertainty that we are monitoring closely on behalf of investors.

- U.S.-China relations: Trade policy between the two nations remains an “unknown unknown” following the trade war that began in 2018. Technology export controls and tariffs continue to disrupt supply chains, particularly in semiconductors and green technology. The automotive sector remains especially vulnerable.

- Russia-Ukraine conflict: The war continues to affect global energy markets and agricultural supply chains, with ripple effects on European inflation and defense-related investments.

- Middle East tensions: So far, oil supply has not been disrupted since the conflicts escalated in October 2023. However, a significant spike in energy prices could occur if violence intensifies or if there is an attempt to close the Strait of Hormuz.

- Election year volatility: The 2025 global election calendar includes pivotal votes in several major economies, contributing to short-term market volatility and heightened policy uncertainty.

Risks and opportunities: Glass half full

No outlook is complete without a frank assessment of the risks and opportunities that could shape the remainder of 2025.

Risks:

- A central bank policy misstep - particularly in response to an inflation surprise or unforeseen changes in Federal Reserve leadership.

- Geopolitical escalations or the emergence of new flashpoints in existing conflicts, including the potential for shocking terrorist attacks.

- Corporate earnings disappointments, especially in the richly valued technology sector.

- Climate-related disruptions, including extreme weather events as we enter hurricane season.

Opportunities:

- Locking in higher yields in fixed income as interest rates stabilize.

- Depressed valuations in small-cap and micro-cap stocks relative to large caps, with potential outperformance if interest rates decline and the economic trends remain favorable.

- International small-cap equities may benefit from global supply chain shifts, reduced exposure to U.S. tariffs due to their domestic focus, and a weaker dollar.

- Attractive relative valuations in traditional value-oriented sectors such as financials, energy, healthcare, and industrials—though leadership rotation may remain elusive as long as investor enthusiasm for AI persists.

- Real assets and alternative investments continue to serve as effective inflation hedges and diversification tools for investors.

Growth vs. value: Anticipating some rotation

Global asset allocation strategies: Stay the course

As we navigate the second half of 2025, portfolio diversification and flexibility remain paramount. Investors may consider the following guidelines:

- Balanced portfolios: Adopt a more conservative positioning across equities, fixed income, and alternative assets to manage risk while capturing modest upside potential.

- Duration management: In fixed income, consider a barbell strategy - combining short-duration instruments for flexibility with long-duration bonds to lock in attractive yields.

- Geographic diversification: Spread investments across global regions to mitigate localized shocks and take advantage of varying growth trajectories in international markets.

- Alternative Assets: Private equity, venture capital, hedge funds, and infrastructure can offer diversification, additional return premium for illiquidity, and potential benefits from market volatility and dispersion. However, these asset classes require careful due diligence and a long-term investment horizon.

Conclusion: Balanced optimism

As we enter the latter half of 2025, prudence, adaptability, and long-term vision remain the hallmarks of Comerica Wealth Management. The world is undergoing profound transformation - technologically, demographically, and geopolitically. In this evolving environment, investors should:

- Stay focused on fundamentals, resisting the temptation to chase short-term trends or succumb to fear of missing out.

- Regularly review portfolios to ensure alignment with evolving goals and risk tolerance.

- Maintain diversification and liquidity to navigate volatility and seize emerging opportunities.

The journey through the remainder of 2025 will likely feature more geopolitical and macroeconomic developments than in recent years. Yet, with Comerica’s thoughtful, deliberate approach and disciplined execution, investors can navigate these crosscurrents and remain well positioned for long-term growth and financial success.

IMPORTANT DISCLOSURES

Comerica Wealth Management consists of various divisions and affiliates of Comerica Bank, including Comerica Bank & Trust, N.A. Inc. and Comerica Insurance Services, Inc. and its affiliated insurance agencies.

Comerica Bank and its affiliates do not provide tax or legal advice. Please consult with your tax and legal advisors regarding your specific situation.

Non-deposit Investment products offered by Comerica and its affiliates are not insured by the FDIC, are not deposits or other obligations of or guaranteed by Comerica Bank or any of its affiliates, and are subject to investment risks, including possible loss of the principal invested.

Unless otherwise noted, all statistics herein obtained from Bloomberg L.P.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Wealth Management does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Wealth Management personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Wealth Management, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.

Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The investments and strategies discussed herein may not be suitable for all clients.

The S&P 500® Index, S&P MidCap 400 Index®, S&P SmallCap 600 Index® and Dow Jones Wilshire 500® (collectively, “S&P® Indices”) are products of S&P Dow Jones Indices, LLC or its affiliates (“SPDJI”) and Standard & Poor’s Financial Services, LLC and has been licensed for use by Comerica Bank, on behalf of itself and its Affiliates. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services, LLC (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings, LLC (“Dow Jones”). The S&P 500®® Index Composite is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the S&P Indices.

NEITHER S&P DOW JONES INDICES NOR STANDARD & POOR’S FINANCIAL SERVICES, LLC GUARANTEES THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE WAM STRATEGIES OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNCATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIM ALL WARRANTIES, OR MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY COMERICA AND ITS AFFILIATES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P INDICES OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES OR STANDARD & POOR’S FINANCIAL SERVICES, LLC BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD-PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND COMERICA AND ITS AFFILIATES, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

“Russell 2000® Index and Russell 3000® Index” are trademarks of Russell Investments, licensed for use by Comerica Bank. The source of all returns is Russell Investments. Further redistribution of information is strictly prohibited.

MSCI EAFE® is a trademark of Morgan Stanley Capital International, Inc. (“MSCI”). Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

FTSE International Limited (“FTSE”) © FTSE 2016. FTSE® is a trademark of London Stock Exchange Plc and The Financial Times Limited and is used by FTSE under license. All rights in the FTSE Indices vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE Indices or underlying data.comerica.com/insights