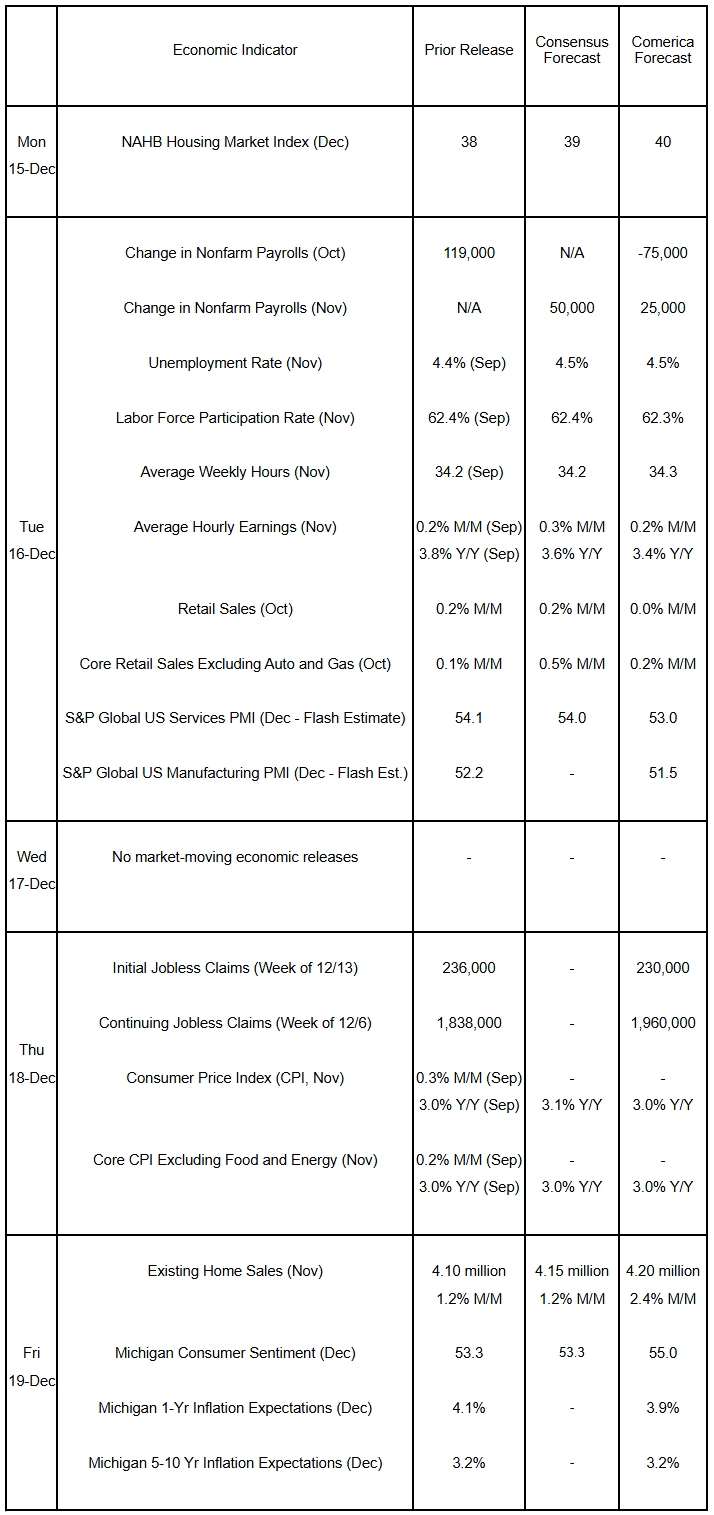

Preview of the Week Ahead

The delayed October and November jobs reports probably will show net job losses of around 50,000 as the federal government shed workers. The unemployment rate likely rose, while wage gains probably slowed. Headline and core CPI inflation likely held steady in November at around 3% from a year earlier. Retail sales were likely soft in October on a decline in new vehicle sales. Weighed down by the government shutdown, core retail sales likely rose at a moderate clip. Boosted by lower gas prices, a rebound in stock prices, and the end of the shutdown, consumer sentiment probably rose in December. Lower gas prices also likely contributed to households’ near-term inflation expectations edging lower.

The Week in Review

As expected, the Federal Open Market Committee (FOMC) lowered the fed funds target by a quarter of a percent to a range of 3.50% to 3.75% at the December 10 decision. In another split vote, St. Louis Fed President Schmid and Chicago Fed President Goolsbee both dissented in favor of no change, while Governor Miran dissented in favor of a larger, half-percentage point cut for the third consecutive meeting. Besides Schmid and Goolsbee, four other non-voting Committee members (Regional Fed presidents) also preferred holding rates steady, indicating fractious policymaking ahead. The 12 regional Fed presidents get five votes at each FOMC decision, always including one for the New York Fed’s president. The other presidents rotate annually on and off the voting roster. Chair Powell indicated that FOMC members think 2025’s cuts brought the fed funds target “within a range of plausible estimates of neutral,” meaning the bar for further cuts in 2026 is likely higher than it was in 2025. Consistent with this, the median FOMC member in December Summary of Economic Projections (“Dot Plot”) projected just one more rate cut in 2026; the Dot Plot also raised the forecast for real GDP growth next year, and trimmed the inflation projection. Powell said the Fed is “well positioned to wait to see how the economy evolves” (our emphasis added), signaling he leans toward the Fed going on hold near-term. However, the Fed’s guidance likely tells us less than usual about the course of policy in the year ahead, for two reasons. First, the Fed knows less than usual about the current state of the economy, since the shutdown is delaying economic releases. Second, the Fed's guidance doesn't account for how Chair Powell’s successor will change the FOMC’s approach after Powell's term ends in May, and President Trump has been unabashed in seeking a replacement who will cut interest rates. Separate from the rate decision, the Fed restarted purchases of Treasuries on December 12 to support liquidity in short-term funding markets, with $40 billion in the first month, “elevated” purchases “for a few months” after that, and lower purchases subsequently.

Job postings jumped in September and October, registering 7.7 million in both months after 7.2 million in August. Vacancies in sectors related to the holiday shopping season (trade, transportation and warehousing) rose substantially. Other details were weaker, with the hires and quits rate tying for the weakest since 2020. The layoffs and discharges rate was low, but still tied for the highest since 2021. The federal fiscal deficit shrank to $173.3 billion in November from $284.4 billion in October. Fiscal year-to-date, revenues are up nearly 18% and expenditures down 4%. The trade balance in goods and services shrank more than expected in September, to $52.8 billion from $59.3 billion in August, as lower imports of computers and computer accessories shrank the goods trade deficit.

For a PDF version of this publication, click here: Comerica Economic Weekly, December 15, 2025(PDF, 250 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.