Preview of the Week Ahead

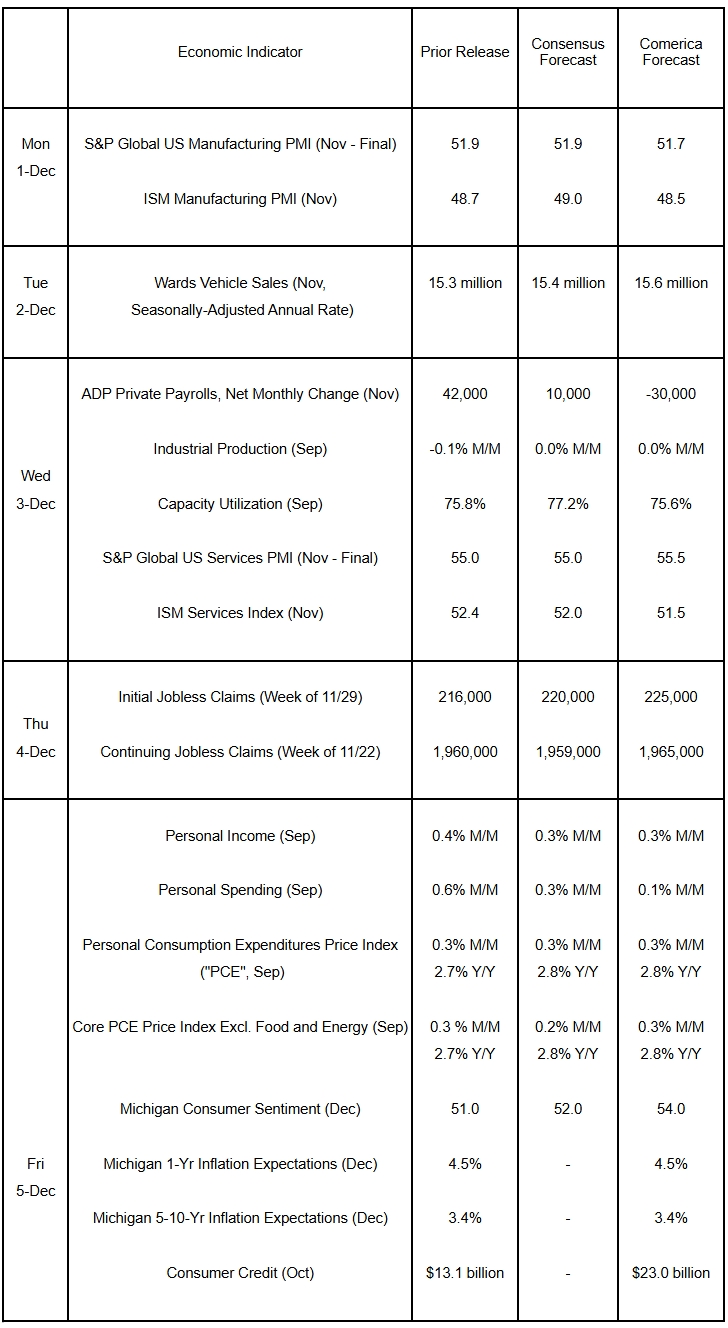

The ISM PMI surveys are expected to show the manufacturing sector in continued contraction, while the services sector expands at a slower pace. Industrial production probably held steady while capacity utilization eased, in line with softer conditions in manufacturing. Personal incomes likely rose modestly in the delayed September release, while spending probably took a breather after rising robustly in August. Headline and core Personal Consumption Expenditures (PCE) Price Indices are forecast to have risen moderately, holding near 3% in annual terms. Consumer sentiment likely brightened in early December after the end of the government shutdown, while short-and long-term inflation expectations remained elevated.

The Week in Review

Retail and food service sales rose by 0.2% in September, below the 0.4% consensus. Motor vehicle and parts dealership sales pulled back after a sizeable gain in August. September’s modest increase was nevertheless broad-based, with eight out of thirteen subsectors reporting higher revenues. Core retail sales, which exclude sales at auto dealerships, gas stations, and a few other volatile categories, and which are used to calculate nominal consumer goods spending in the GDP report, shrank by 0.1%. Core retail sales in the first two months of the third quarter were, however, strong, pointing to another solid contribution from consumer spending to third-quarter GDP. In a more up-to-date read on consumer spending, Mastercard SpendingPulse reported Black Friday spending rose 4.1% from 2024 this year.

Led by a large increase in food and energy prices, the Producer Price Index for Final Demand rose 0.3% in September and was up 2.9% from a year earlier for the third month running. Energy prices were driven higher by sharp increases in gasoline, up 11.8%, and home heating oil, up 5.9%. Food prices spiked higher on big increases in meat, fresh fruit and melon prices. Beef and veal jumped another 15.8% and were around 40% higher from a year ago. Prices paid by producers for services, overall, were unchanged last month, primarily due to a modest increase in services excluding trade, transportation and warehousing. Many services affected by energy price fluctuations, such as airline passenger transportation, increased in step with higher energy costs.

The federal government posted a deficit of $284 billion in October, the first month of the 2025/26 fiscal year, a 10% increase compared to the $257 billion shortfall run during the same month in the prior year. Government revenues rose 24% from a year earlier to $404 billion, while spending rose 18% to $689 billion. Interest on public debt, up 27% year-over-year, topped the $100 billion mark.

Consumer confidence tumbled to the lowest level since April in November and was worse than expected. Households were downbeat in their assessments of current conditions and in their expectations six months ahead. Consumers cited prices and inflation, tariffs and trade, politics, and the government shutdown as factors affecting their views of the economy (Most of the survey responses were collected before the shutdown ended). Households’ expectations for inflation a year in the future rose to 4.8%. The share of consumers saying jobs were “plentiful” less the share saying they are “hard to get” edged lower and was the second weakest (after September) since early 2021.

For a PDF version of this publication, click here: Comerica Economic Weekly, December 1, 2025(PDF, 150 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.