Preview of the Week Ahead

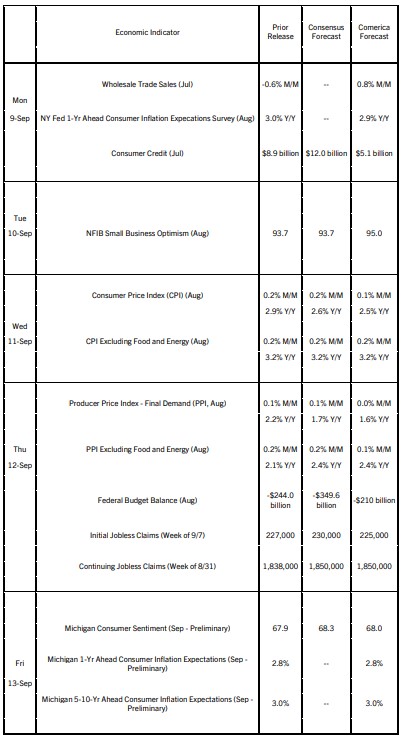

Lower gas and diesel prices are expected to translate into cool CPI and PPI reports for August. Global demand for petroleum products has been soft in 2024 amid tepid growth in Europe and China, and U.S. energy production is at a record high. Core CPI inflation likely held steady in year-over-year terms in August, and core PPI inflation looks to have picked up.

With inflation slowing in the month, consumer sentiment likely improved as well. The University of Michigan Consumer Sentiment Indicator is more sensitive to inflation and cost of living pressures than to labor market conditions; it is constructed to put more weight on the former than the latter.

The federal fiscal deficit likely contracted slightly in August. The U.S. is on course for a deficit of between $1.85 and $1.90 trillion in the current fiscal year, about 6.5% of GDP. The deficit would have to shrink to match nominal GDP growth (5.9% year-over-year in the second quarter and set to slow) to stabilize the ratio of federal debt to the economy.

The Week in Review

The unemployment rate edged lower to 4.2% in August from 4.3% in July, but was still the second-highest since late 2021. Similarly, job growth picked up in August, but downward revisions weakened the recent trend. Employers added 142,000 nonfarm payroll jobs in the month, and job growth in June and July was revised down a net 86,000. Incorporating these revisions, job growth in the most recent three months was just 116,000, down from 170,000 reported in the last jobs report.

After also factoring in the 818,000 downward revision to the level of employment in March 2024 announced in mid-August, the 12-month average of payrolls growth through August was 157,000, considerably weaker than the 209,000 average reported in the July jobs report. The payrolls data now echo the unemployment rate’s uptick over the last 12 months, and show that while the job market is in decent shape, it is moving in the wrong direction. The August jobs report, like the other early indicators for August, increase pressure on the Fed to make interest rates less restrictive to growth.

The ISM Manufacturing PMI signaled a continued contraction of manufacturing activity in August, while the ISM Services PMI signaled modest growth of service-providing businesses. Job openings fell more than expected in July, and (like payrolls) the prior month’s data were revised lower. After the drop and revisions, the ratio of job openings to unemployed workers is back down to its pre-pandemic level.

Unit labor costs were revised down in the second estimate for the second quarter of 2024, and their year-over-year growth rate slowed to below its pre-pandemic rate of increase—in other words, wage-price pressures on inflation are below where they were in 2018 and 2019.

For a PDF version of this publication, click here: Comerica Economic Weekly, September 9, 2024(PDF, 190 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.