Preview of the Week Ahead

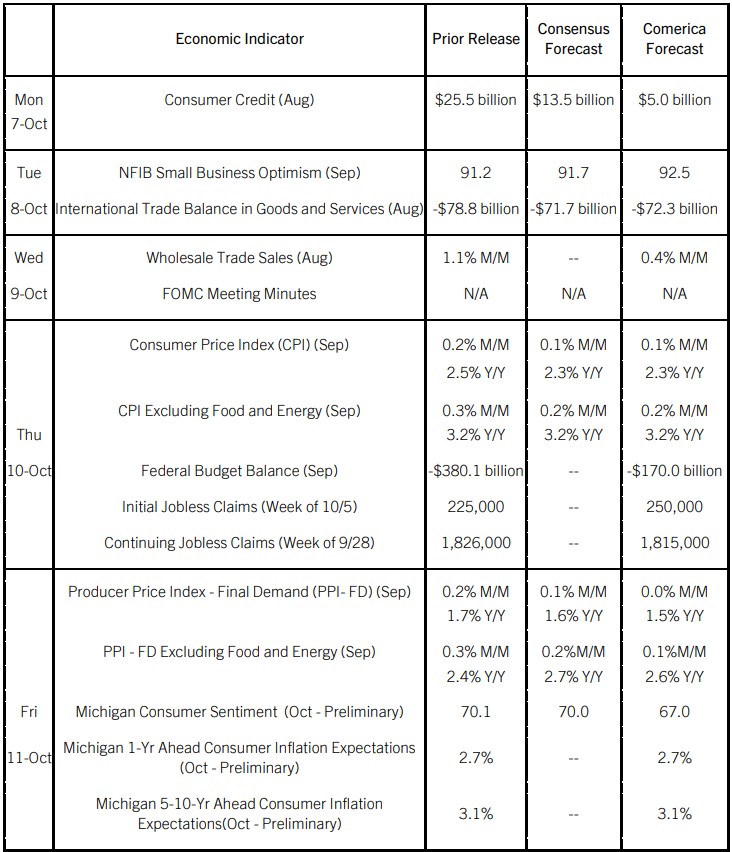

On the back of lower energy prices, headline Consumer Price Index (CPI) inflation probably slowed further in September, while core inflation probably held steady for the third consecutive month. Producer prices for final demand were likely unchanged in September, and annual factory gate inflation likely eased a notch to a modest pace. Core producer prices, excluding volatile food and energy prices, are expected to have risen slightly on the month, resulting in faster core inflation than the headline; even so, core producer price inflation likely eased slightly from August.

In the final month of the 2023/24 fiscal year, the federal government’s deficit probably narrowed after a $380 billion shortfall in August. The deficit for the entire fiscal year likely topped $2 trillion, or about 7% of nominal GDP.

Initial jobless claims likely jumped in the first week of October due to Hurricane Helene and strikes.

The Week in Review

Key data released last week point to a healthy labor market and solid growth of service-providing businesses, but ongoing contraction of manufacturing and construction. 254,000 jobs were added last month in September, well above the 150,000 consensus. July and August’s employment figures were revised higher by a combined 72,000 jobs. The unemployment rate edged lower for the second successive month to 4.1%. The labor force participation rate held steady for the third consecutive month at 62.7%. The average workweek edged lower to 34.2 hours. Average hourly earnings rose a solid 0.4% last month and August was revised up to a 0.5% increase from 0.4% previously. Annual wage inflation has accelerated to 4.0% in September from 3.6% in July. Financial markets pared back rate cut expectations following the release of the jobs report, pricing in quarter percentage point cuts at each of the Fed’s next three decisions.

Released at a one-month lag to payrolls, job openings rose by 329,000 to 8.040 million in August and topped the 7.693 million consensus forecast. Increased openings in goods-producing industries were largely in construction, while vacancies in service-providing industries rose more broadly. Despite the increase in vacancies, the number of quits and the quits rate, widely-watched proxies for labor market mobility, fell further to four-year lows, indicating workers are much less confident about taking risks in the job market than a few years ago.

The ISM Services PMI rose by 3.4 percentage points in September to 54.9, the highest reading since February 2023. Business activity and new orders subindices jumped, indicating continuing vitality of the services sector, which accounts for most of the economy. The ISM Services PMI’s respondents corroborated the findings of the PMI survey released by S&P Global, noting challenges from worker shortages and high labor costs. The ISM Manufacturing PMI, unchanged at 47.2, pointed to a sixth consecutive month of contraction. Manufacturing production and new orders declined at a slower pace, while headcount fell faster than in the prior survey. Input prices rose faster for service-providing businesses in September, while input prices paid by manufacturers fell.

Construction spending fell 0.1% in August, and July’s decline was revised down to 0.5% from a 0.3% decline previously. June was revised to a 1.1% drop from no change. In August, private single family construction spending fell sharply, while multifamily spending and private nonresidential spending registered smaller decreases and public spending rose. From a year earlier, construction spending grew 4.1%, with single-family construction up 0.8%, multifamily down 7.5%, private nonresidential up 3.6%, and public spending up 7.8%.

For a PDF version of this publication, click here: Comerica Economic Weekly, October 7, 2024(PDF, 191 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.