Preview of the Week Ahead

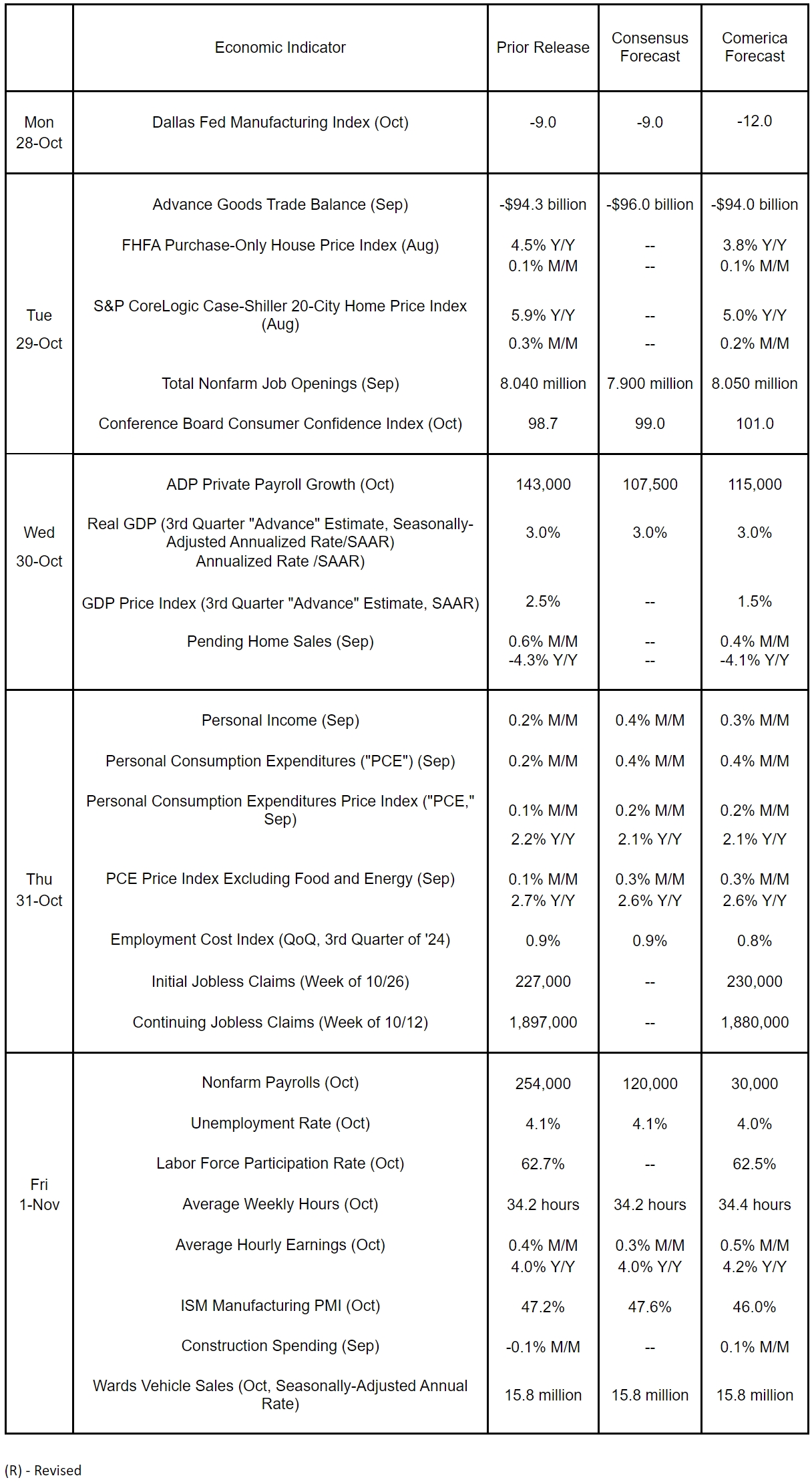

The economic calendar this week will be among the busiest in 2024. The October jobs report will likely show a severe, but short-lived hit from hurricanes Helene and Milton. Employment probably rose at the slowest pace this year, and the disasters likely distorted the unemployment rate, average earnings, participation, and the average workweek. The report will tell us little about the economy’s trend. The job openings report, released with a one-month lag to the jobs report, is likely to show job openings held steady at around 8 million vacancies in September.

The “Advance” GDP report for the third quarter will likely show the economy was expanding solidly before the hurricanes struck. The September Personal Income and Outlays report will likewise show solid growth of incomes and spending capping off the quarter. The Personal Consumption Expenditures Price Index, the Fed’s preferred barometer of inflation, is expected to have risen at the slowest annual pace since early 2021, near the Fed’s 2% target, although core PCE inflation continues to run hotter.

Home prices are expected to have risen modestly in September, at a slower annual pace than in August. The ISM Manufacturing PMI, like its S&P Global equivalent, is anticipated to show the manufacturing sector in contraction. Overall construction spending probably edged higher on the back of an uptick in nonresidential construction expenditures. Vehicle sales were likely little changed on the month in October, but will pick up later this year as auto loan rates fall, and as Americans who lost cars to the hurricanes start replacing them.

The Week in Review

Reflecting continued strained affordability, house sales remain weak overall. Sales of existing homes, which accounted for nearly 80% of homes sold last month, fell by 1.0% to an annualized rate of 3.840 million units, the lowest level in nearly 15 years. The median sale price rose 3.0% on the year. Listings, which have risen every month this year, climbed again to 1.390 million units and represent 4.3 months of supply at last months’ rate of sales. New home sales, which account for around 20% of homes sold, jumped a larger than expected 4.1% to an annualized rate of 738,000 units, near the highest since the Fed started raising rates in early 2022. The prior three months’ sales, however, were revised down substantially. The median price of a new home sold, $426,300, was essentially unchanged from a year earlier, while inventory of new homes for sale pulled back to a still ample 7.6 months’ of supply.

The October flash releases of S&P Global’s Manufacturing and Services PMIs were largely in line with expectations. Activity in the manufacturing sector contracted for a third successive month, albeit at a slower pace. The services sector, on the other hand, rose further into solidly expansionary territory. Manufacturers’ order books fell for the fourth consecutive month. Service-providers, by contrast, reported the largest increase in orders in nearly two and a half years. The disparities in new workflows suggest the divergence between manufacturers and service-providers is likely to continue. Input costs eased, while prices charged rose at the slowest pace since May 2020.

For a PDF version of this publication, click here: Comerica Economic Weekly, October 28, 2024(PDF, 256 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.