Preview of the Week Ahead

Markets are on the edges of their seats watching the election and its implications for economic policies in the coming years. This includes the different economic visions of the presidential candidates, as well as the reinstatement of the debt ceiling scheduled for January 2, and the fate of the individual income tax cut and Obamacare marketplace subsidies which expire at the end of 2025.

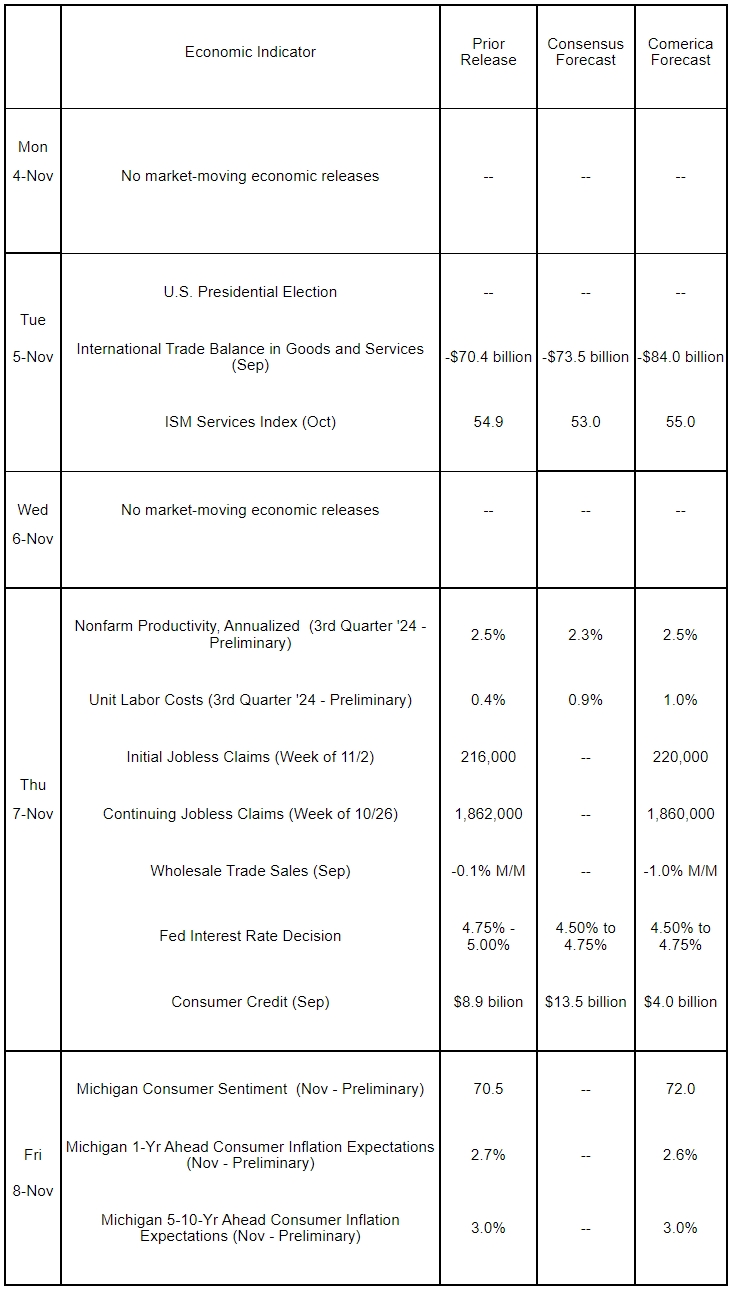

The other key event this week will be the Fed’s interest rate decision on November 7. Comerica Economics forecasts a quarter of a percentage point federal funds rate cut to a range of 4.50% to 4.75%. Important economic releases this week include the ISM Services PMI and the international trade report. Business activity in the services sector likely rose further, while the trade deficit is expected to widen notably on the back of a large deterioration in the goods trade balance—importers increased their purchases of consumer products ahead of the dock workers’ strike, while exporters’ sales of petroleum products fell as benchmark prices moved lower.

The Week in Review

U.S. real GDP grew 2.8% in the third quarter, led by strong growth of consumer spending. Sharp increases in government and business spending also boosted growth, while net exports, residential investment, and inventory destocking were headwinds. The GDP Price Index, the broadest measure of price pressures in the economy, and the Personal Consumption Expenditures (PCE) Price Index, the Fed’s favored inflation gauge, tumbled to below 2% annualized, strengthening the case for further monetary policy easing at this week’s decision. PCE inflation slowed to a 2.1% annual increase in the September monthly report, only a hair above the Fed’s 2% target, although core PCE inflation continues to run faster.

As expected, hurricanes and two major strikes weighed on employment in October, with the Bureau of Labor Statistics reporting a paltry 12,000 jobs added in the month. Revisions reduced August and September’s employment by a combined 112,000. The unemployment rate held steady at 4.1%, but the labor force participation rate dipped to 62.6%. Average hourly earnings rose 0.4% on the month and 4.0% on the year, picking up as the hurricanes weighed on employment in lower-paid industries with many hourly workers. Job openings tumbled to 7.443 million in September from a downwardly-revised 7.861 million openings in August, with lower hiring intentions across most industries.

Boosted by a strong increase in wages and salaries, household incomes rose 0.3% in September. Personal consumption expenditures rose a strong 0.5%, up from an upwardly revised 0.3% increase in August. Households spent broadly, with purchases of new vehicles particularly strong. The personal saving rate declined for the third consecutive month and was about a percentage point below January’s level. Reflecting waning imbalances in the housing market, annual house price increases, as measured by the FHFA Purchase-Only House Price Index and the S&P CoreLogic Case-Shiller 20-City Home Price Index, moderated further to increases of 4.2% and 5.2%, respectively, in August. House price increases are likely to slow further as more homes are listed for sale.

For a PDF version of this publication, click here: Comerica Economic Weekly, November 4, 2024(PDF, 134 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.