Preview of the Week Ahead

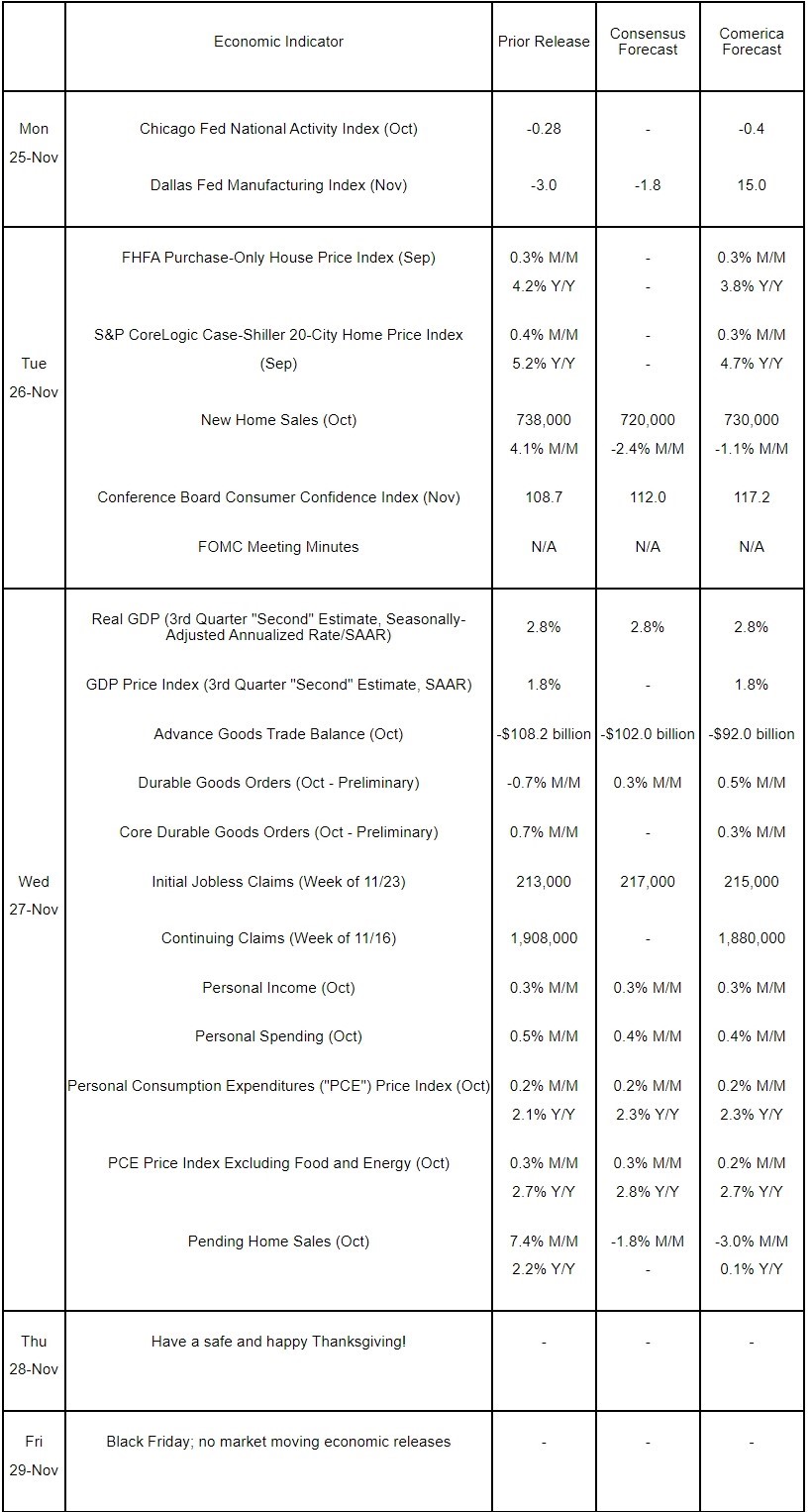

Several key economic releases will be published in this holiday-shortened workweek. Markets will likely focus on the minutes of the Fed’s November meeting. Data released since the Fed last published forecasts in September show a resilient economy and persistent inflation, calling into question whether the Fed will reduce rates as quickly as they projected in those forecasts.

Third quarter GDP and the GDP price index, the broadest barometer of price changes in the economy, will probably both be unrevised in the second estimate. Personal incomes, consumer spending, and both headline and core PCE inflation are likely to have increased at around the same pace in October as in September. Pending and new home sales probably fell after robust increases in September. Home listings rose in September and likely contributed to more moderate house price increases.

The Week in Review

Hurricanes Helene and Milton were big disruptions to residential investment. Building permit issuance decreased by 0.6% in October, while housing starts tumbled 3.1%. Both were below consensus. By contrast, existing home sales were a bright spot, with transactions up 3.4%. The median sale price rose by 4.0% from a year earlier to $407,200. The number of homes listed for sale rose to 1.370 million units and matched the multimonth high recorded in August. Housing inventory rose and was equivalent to 4.2 months of supply at last month’s pace of sales. That was the highest October level of months’ supply since 2018 (Months’ supply is highly seasonal so comparison to other months is unreliable).

Business sentiment improved materially post-election. The NAHB / Wells Fargo Housing Market Index rose by three points to 46 in November, largely on optimism about future conditions. The release noted, “Builders are expressing increasing confidence that Republicans gaining all levers of power in Washington will result in significant regulatory relief for the industry that will lead to the construction of more homes and apartments.” Manufacturers and service-providers surveyed by S&P Global share the optimism of homebuilders. Driven largely by a sharp increase in new orders, the S&P Global Composite PMI rose to a nearly three-year high of 55.3 in the November flash release. The survey reports, “Firms’ expectations of output in the coming year rose to the highest since May 2022, attributed to the prospect of lower interest rates, improved economic growth, and more supportive business policies from the new administration in 2025.” November’s improvement is not limited to new orders and expectations. Manufacturers, who have struggled for well over two years, raised headcount for the first time in four months. The report notes, “the promise of greater protectionism and tariffs has helped lift confidence in the US goods-producing sector, which is already feeding through to higher factory employment.”

The latest lower-frequency, but more accurate jobs data in the Quarterly Census of Employment and Wages (QCEW) release for the second quarter of 2024 points to another round of negative revisions to payrolls in the next comprehensive revision, slated to be released in February 2025.

For a PDF version of this publication, click here: Comerica Economic Weekly, November 25, 2024(PDF, 154 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.