Preview of the Week Ahead

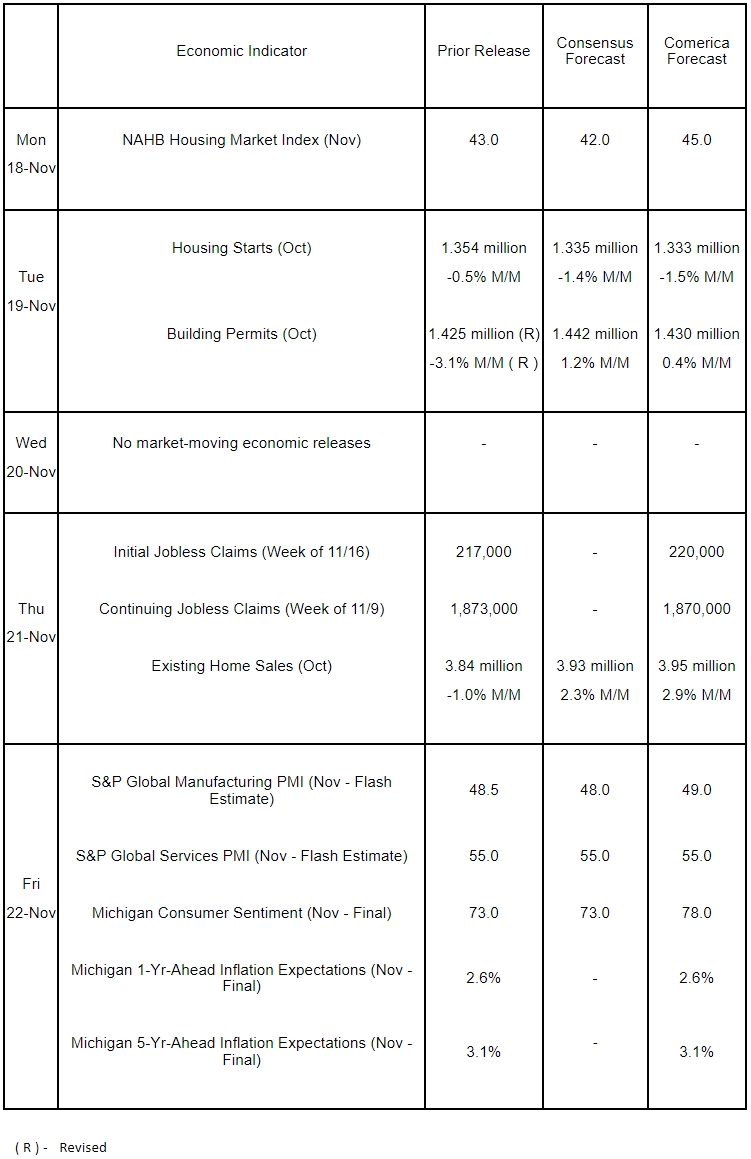

Housing data releases dominate this week’s relatively light economic calendar. Housing starts probably tumbled due to hurricanes Helene and Milton, while permit issuance, which is less affected by severe weather, likely rose. Pending home sales, which track signed sales contract activity, soared in September, presaging a strong rebound in existing home sales last month. Homebuilder sentiment likely improved for the third consecutive month.

S&P Global’s Flash Manufacturing and Services PMIs will provide first glimpses of business sentiment post-election. Businesses’ comments about the cumulative impact of the incoming administration’s tax, regulatory, trade, and immigration policies will be of particular interest. The University of Michigan’s initial Survey of Consumer Sentiment for November, concluded the day before elections, showed households’ expectations surged across all dimensions to reach a nearly three-and-a-half year high. The final sentiment reading is expected to soar, as households’ outlook brightens even more post-election.

The Week in Review

Economic data releases last week were largely in line with Comerica Economics’ forecasts. The total and core Consumer Price Indices (CPI) rose 0.2% and 0.3%, respectively, and were up 2.6% and 3.3% from a year earlier. Progress on reducing core inflation, which excludes the volatile food and energy components, has stalled in recent months, with annual core inflation holding around 3.2%-to-3.3% for five consecutive months. Led by a sharp decrease in fuel oil prices, energy costs were unchanged in October. Food prices rose moderately after a sharp increase in the prior month. Shelter costs, the single biggest cause of inflation in recent years, once again contributed to around two-thirds of the increase of core inflation. Supercore service prices excluding energy and housing rose 0.3% and continued to hover between 4.25% and 4.75% on an annual basis for the tenth month in a row.

Producer prices rose by 0.2% in October and were 2.4% higher from a year earlier. Prices paid by producers for goods rose by a tame 0.1%, largely due to declines in energy and food prices. Prices of services were up 0.3% primarily due to large increases in transportation costs. Airline passenger costs soared by 3.2% last month. On a positive note, most components that constitute other services, the single largest component of the producer price index, were down last month. Households’ year-ahead inflation expectations edged down to 2.9% in the New York Fed’s consumer survey and matched Comerica Economics’ forecast. The NFIB Small Business Optimism Index rose by 2.2 points to 93.7 and was also in line with expectations. Acknowledging the passage of a key uncertainty that clouded small business owners’ decision-making, the report noted, “with the election over, small business owners will begin to feel less uncertain about future business conditions.”

Retail sales rose by 0.4% in October after an upwardly revised 0.8% increase in September. Sales rose in most retail subsectors, with a big jump at motor vehicle and parts dealerships. Control (Core) retail sales, which exclude some volatile components and are used to calculate nominal spending on most goods in the GDP report, edged down 0.1% after jumping an upwardly-revised 1.2% in September.

For a PDF version of this publication, click here: Comerica Economic Weekly, November 18, 2024(PDF, 140 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.