Preview of the Week Ahead

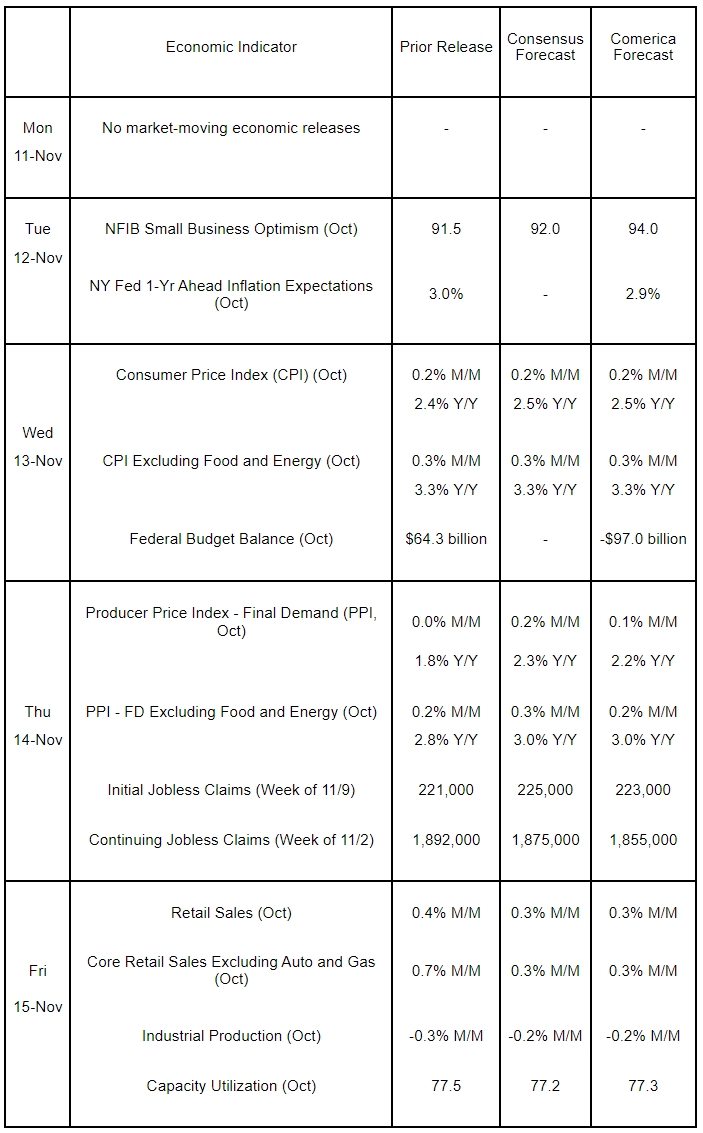

Financial markets will focus on important inflation and retail data releases this week. Headline and core Consumer Price Indices (CPI) likely rose in October at the same benign pace as in the prior month, holding annual increases steady. Prices charged at the producer level probably rose modestly again in October, but annual factory gate inflation is anticipated to pick up due to base effects. The New York Fed’s year-ahead inflation expectation survey will probably show households’ inflation expectations remained well-anchored and within the narrow range observed over the past several months.

Total and core retail sales, which exclude volatile retail categories like sales at gasoline stations, likely took a breather after a brisk increase in September, but are still expected to have grown at a healthy pace. Industrial production probably retreated again due to the disruptions caused by hurricanes and the strike at Boeing. Likewise, capacity utilization likely moved lower last month.

Small business optimism likely rose in October, but is expected to have held below its 50-year average of 98 for the 34th consecutive month.

The Week in Review

As widely expected, the Federal Open Market Committee (FOMC) unanimously decided to cut the fed funds rate by a quarter of a percentage point to a range of 4.50% to 4.75% at its November 6-7 meeting. The Committee tweaked forward guidance to signal less confidence that inflation would continue to moderate. There were no changes to the pace of the Fed’s balance sheet reduction program.

Monetary policymakers judge the economy to be expanding “at a solid pace.” They noted that a broad set of indicators point to a labor market that is less tight than before the pandemic, but assess that it “remained solid.” The FOMC noted the significant progress achieved so far towards achieving its 2% inflation goal, but acknowledged that “core inflation remains somewhat elevated.” The trade deficit ballooned by 19.2% to $84.4 billion in September and was in line with Comerica Economics’ forecast. A large increase in consumer goods imports, likely due to importers front-running the dock workers strike, and a sizeable decline in petroleum exports drove the goods trade deficit higher. The trade balance in services turned positive in September following three consecutive months in the red. The year-to-date trade deficit is up 11.8% to $661 billion from the same period last year.

The ISM Services PMI rose by 1.1 percentage points to 56.0% in October and was well above the 53.0% consensus. Key details of the report were, however, mixed. The index’s increase was largely driven by sharp increases in employment, which respondents noted was mostly hiring to meet temporary staffing needs during the holiday shopping season. Current production of services fell sharply, as did new orders, potentially portending lower production in the coming months. Service-providers noted supplier delivery times lengthened due to hurricane disruptions.

For a PDF version of this publication, click here: Comerica Economic Weekly, November 11, 2024(PDF, 136 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.