Preview of the Week Ahead

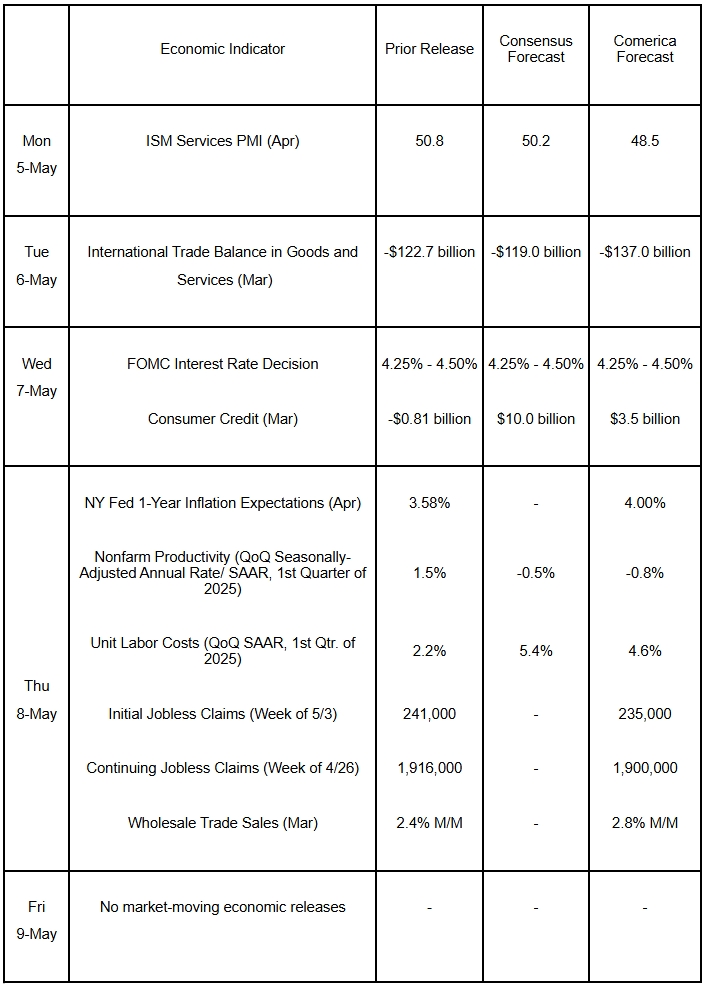

The FOMC is expected to keep the fed funds target rate on hold at a range of 4.25% to 4.50% at Wednesday’s interest decision meeting. Policymakers will not release updated forecasts for real GDP, unemployment, inflation, or the fed funds rate; those quarterly forecasts will next be updated in June. Markets will be extra attentive to Chair Powell’s comments on the tradeoff between controlling inflation and supporting the job market. The foreign trade deficit in goods and services registered another monthly record in March on surging goods imports. The ISM Services PMI will probably report a decline in business activity. With real GDP down in the first quarter and employment up, nonfarm productivity will be lower and unit labor costs higher in the quarter’s release this week.

The Week in Review

The economy shrank 0.3% annualized in the first quarter as importers front-ran tariffs and the trade deficit surged to a record high. Net exports subtracted 4.8 percentage points from annualized growth. Some of those imports fed into sharply higher business investment in equipment, up a blistering 9.8%, as firms bought imported IT and electronics. Inventories jumped, adding 2.25 percentage points to real GDP. Consumer spending decelerated sharply to 1.8% annualized from 4.0% annualized in the prior quarter. Government spending fell for the first time in nearly three years mostly due to a retrenchment in federal expenditures, particularly on defense. The GDP Price Index, the broadest measure of prices, jumped 3.7% annualized and is up from a 1.9% increase six months earlier. The Personal Consumption Expenditures Price Index, the Fed’s preferred measure of inflation, rose 3.6% due to a 4.2% increase in “stickier” services prices. The release pulls monetary policymakers in opposite directions, with higher inflation and falling economic activity.

By contrast, the labor market held up better than expected in April. Employers added 177,000 jobs, well above the 138,000 consensus forecast. The prior two months’ job growth was revised down a combined 58,000. After revisions, the economy added 144,000 jobs per month in the first four months of 2025, down from 168,000 in 2024 and 216,000 in 2023. The unemployment rate held steady in April at 4.2%. The labor force participation rate edged higher to 62.6% as around half a million persons entered the labor force. The average workweek held steady at 34.3 hours. Average hourly earnings rose a modest 0.2%, holding the annual wage increase steady at 3.8%. In data lagged to the jobs report, job openings fell nearly 300,000 to 7.192 million in March and were down nearly a million from a year earlier. Vacancies fell in nine out of 11 industries. The quits rate, a widely-watched proxy for workers’ bargaining power, was essentially unchanged and indicates employees continue to be hesitant to switch jobs.

The ISM Manufacturing PMI indicated a second consecutive month of contracting manufacturing activity, with the survey reporting declines in production, new orders, and employment. The index for manufacturers’ input costs is up 15 percentage points over the last six months to the highest since June 2022. Supplier delivery times lengthened as tariff changes complicated shipping procedures.

For a PDF version of this publication, click here: Comerica Economic Weekly, May 5, 2025(PDF, 133 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.