Preview of the Week Ahead

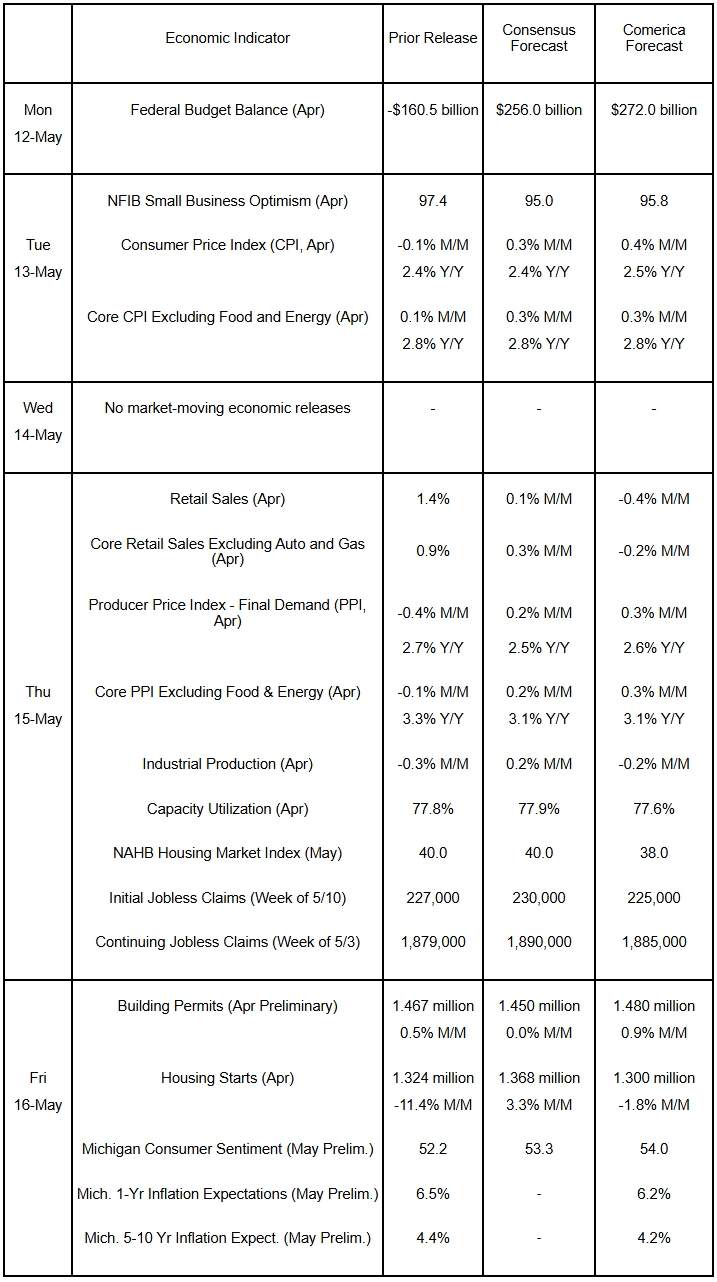

Treasury Secretary Bessent announced a 90-day reduction of the tariff rate on most imports from China to 30% from 145%; Chinese retaliatory tariffs on U.S. imports will fall to 10% and China will suspend nontariff retaliation against U.S. businesses and industries. Businesses are likely to ramp up imports of Chinese goods during the 90-day window to hedge against tariff rates potentially rising again. Consumer prices likely rebounded in April after March’s mild decline on higher durable goods prices; retailers started passing on the tariffs last month. Producer prices likely rose as well, as futures prices of many commonly used manufacturing inputs rose. The federal government likely posted its first monthly surplus of the current fiscal year in April as Americans paid personal income tax bills. The budget statement will show the impact of DOGE’s spending cuts at the end of the government’s first 100 days in office. Tariff revenues likely jumped in the month, too. Retail sales likely tumbled in April following a one-off jump in purchases of autos and other big ticket durable goods in March, before the tariff hikes. Industrial production and capacity utilization probably eased as an uncertain outlook and supply chain disruptions snarled production. Mining output likely fell on lower oil prices. Housing data were likely mixed. Consumer sentiment likely edged higher in the University of Michigan’s initial survey for May, with inflation expectations receding, as the U.S. partially rolled back tariff increases enacted in April.

The Week in Review

In addition to the China deal, the U.S. reached a trade deal with the U.K. that lowers tariffs on imports of British primary metals and autos; tariffs on most goods imports from the UK will be 10%. The deal opens some incremental access to British markets for U.S. agricultural exporters of beef and ethanol.

As expected, the FOMC held the fed funds target unchanged at a range of 4.25% to 4.50% at its May 7th decision. The Committee noted “uncertainty about the economic outlook has increased further,” and thinks the “risks of higher unemployment and higher inflation have risen.” At the post-decision press conference, Chair Powell explained that FOMC members feel no rush to change interest rates now, since “There is so much uncertainty about the scale, scope, timing, and the persistence of tariffs.”

The U.S. international trade deficit in goods and services widened to an all-time high of $140.5 billion in March on a $163.5 record shortfall in the goods trade balance, partially offset by a $23.0 billion surplus in services. The services trade surplus, however, shrank for a fourth consecutive month and was down 7.8% from a year earlier, mostly due to foreign tourists spending less in the U.S.

The ISM Services PMI rose to 51.6 in April, beating the 50.2 consensus, helped along by a pickup in new orders. Other details of the report were less upbeat: Business activity rose at a slower pace; employment contracted for a second month in a row; and prices paid registered the highest increase since January 2023. Consumer credit rose by $10.2 billion in March on a $8.3 billion increase in nonrevolving credit, mostly auto and student loans. Revolving credit, largely credit card loans, rose a more modest $1.9 billion.

For a PDF version of this publication, click here: Comerica Economic Weekly, May 12, 2025(PDF, 152 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.