Preview of the Week Ahead

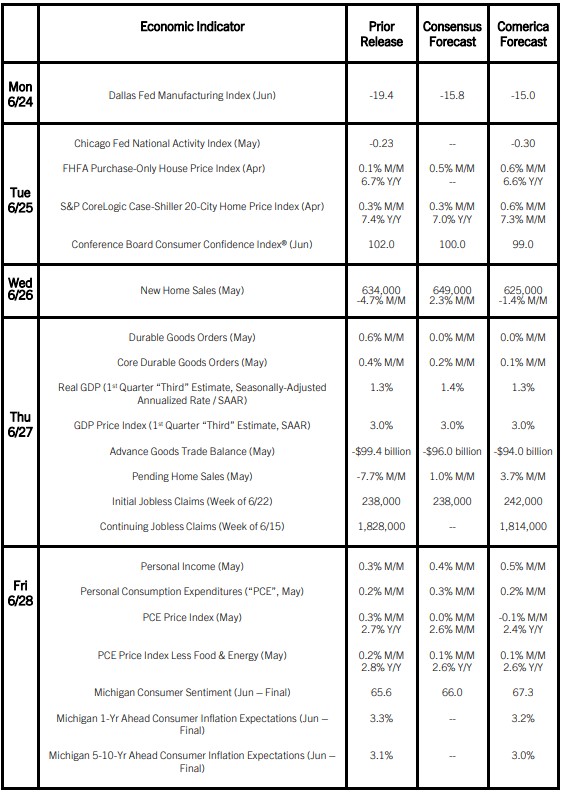

Home prices likely rose faster in monthly terms in April, but decelerated in year-over-year terms as high interest rates weighed on homebuyers’ purchasing power. New home sales and pending home sales likely were weak in May as well, also due to headwinds from high mortgage rates.

The Fed’s preferred measure of inflation, the personal consumption expenditures (PCE) price index, likely dipped slightly in May, largely reflecting a pullback in gasoline prices during the month. In annual terms, PCE inflation likely slowed to the least since inflation began skyrocketing in early 2021. Personal consumption expenditures likely rose modestly in May, while incomes rose more rapidly. The personal saving rate likely rose from April, when it was only about a quarter percentage point above 2022’s depressed level.

The Week in Review

Recent economic releases point to slow growth in the second quarter. Sales at retail stores and food and drinking establishments rose by a paltry 0.1% in May. April’s sales were revised down to a 0.2% decline from no change in the prior estimate. Core retail sales, which excludes auto dealers and gas stations, building material and supply stores, and a few other volatile categories, and which is used to compute nominal GDP, rose 0.4% in May after a downwardly-revised 0.5% drop in April. A number of major retailers announced price cuts in recent weeks in reaction to flagging sales, which should put downward pressure on goods inflation in the coming months.

Housing construction and sales remain depressed. Building permits fell by 3.8% in May to an annualized rate of 1.386 million and were down 9.5% from a year earlier. Permits for multifamily projects with five or more units plunged 6.1% on the month and 31.4% on the year. Housing starts fell by 5.5% to an annualized rate of 1.277 million units in May and were down 19.3% from a year earlier. Multifamily was notably weak, down 10.3% on the month and plunging 51.7% on the year. The National Association of Home Builders (NAHB) / Wells Fargo Housing Market Index, a measure of homebuilder sentiment, slipped by 2 points to 43 in June, the lowest since December 2023. All three constituent components of the index fell. The NAHB attributed low homebuilder sentiment to high mortgage rates, elevated construction financing costs, chronic labor shortages, and scarcity of buildable lots.

Existing home sales, which account for most homes sold in the U.S., fell 0.7% in May to an annualized rate of 4.11 million and were down 2.8% from a year earlier. The median sale price rose by 5.8% to a record $419,300. On a positive note, inventories rose by 6.7% to 1.280 million units and were up 19% from a year earlier, representing 3.7 months of supply at the current sales rate. Industrial production rose by 0.9% in May on the back of strong gains in manufacturing and utilities production. Mining output also rose. The increase in manufacturing was broad-based, with durable and nondurable manufacturing output up sharply. The strong increase in electricity demand is due to the sweltering heat waves affecting large swathes of the country and rising demand from technology industries.

For a PDF version of this publication, click here: Comerica Economic Weekly, June 24, 2024(PDF, 136 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.