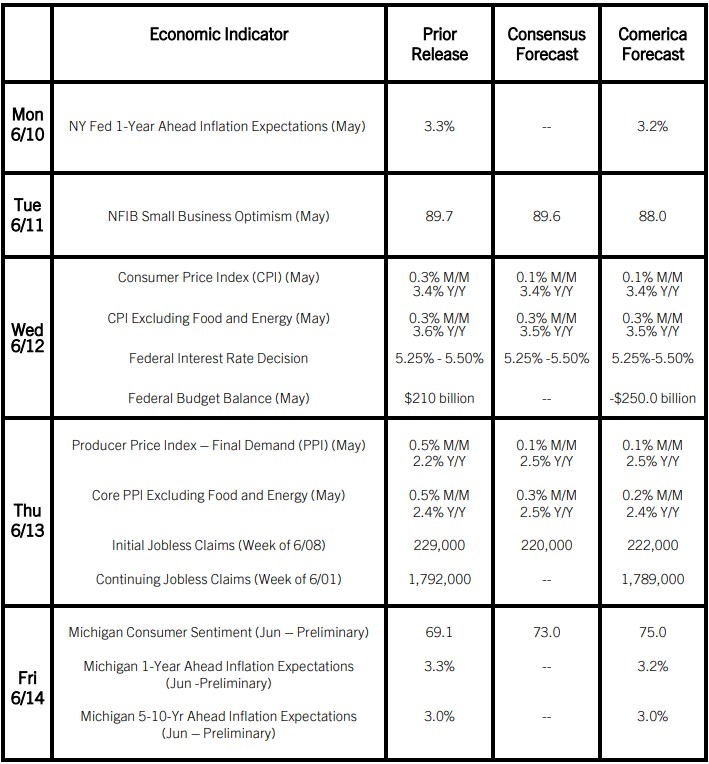

Preview of the Week Ahead

Annual CPI inflation likely held unchanged in May after mostly moving sideways since the fall of 2023. Gasoline prices fell, but the base comparison with May 2023 is unfavorable, since that month also saw a more modest increase in consumer prices than the month before it. Core CPI likely slowed modestly last month and registered the slowest increase since the first half of 2021 as shelter costs contributed less to inflation, and as new and used car prices moved down again.

With inflation holding above the Fed’s target, the central bank is expected to hold monetary policy unchanged at the June decision. June’s quarterly update of the Fed’s dot plot—projections for real GDP, unemployment, and inflation, as well as policymakers’ views about the most appropriate course for monetary policy—will likely show a majority of policymakers think two interest rate cuts of a quarter percentage point each will likely be appropriate before the end of 2024. The Fed will likely hold its forward guidance largely unchanged: On the one hand, the Fed would not hesitate to raise rates further if they assess that interest rates need to be higher to control inflation. On the other hand, most Fed policymakers think rates are already high enough to keep inflation headed lower, and expect it to cool later this year and open the door to interest rate cuts.

The Week in Review

The latest data paint a mixed picture of the labor market. Nonfarm employment rose by 272,000 in May, blowing past the 180,000 consensus forecast. The prior two months’ employment figures were revised down by a combined 15,000. But the unemployment rate rose by a tenth of a percentage point to 4.0%, and the details were weaker than the headline, with a decline in the labor force participation rate to 62.5% from 62.7% as the labor force contracted 250,000. The average workweek held steady at 34.3 hours. As a result of notable gains in wages and salaries in a number of high paying industries, such as financial activities and professional and business services, average hourly earnings rose by 0.4% in May and were 4.1% higher from a year earlier, picking up from April’s 4.0%, the lowest since mid-2021.

The Job Openings and Labor Force Turnover Survey, released at a lag to the headline jobs report, reported vacancies fell by 296,000 to 8.059 million in April from a downwardly-revised 8.355 million in March, and are down by nearly two million from April 2023. The number of quits was little changed, and the quits rate held steady at 2.2% for the sixth consecutive month, below February 2020’s 2.3%.

The ISM Services PMI rebounded to 53.8 in May from 49.4 in April and was the highest since last August, overshooting the 50.7 consensus. The latest reading assuages fears of a slowdown in the services sector after the PMI fell below 50 in April; service-providing businesses account for most private sector employment and output. Services production soared in May, while new orders rose further. Prices paid by service-providers rose at a slower pace. By contrast, the ISM Manufacturing PMI fell to 48.7 from 49.2 in April, led by a sharp contraction in new orders. Manufacturing output was little changed. Manufacturers’ input costs rose at a slower pace than in April.

For a PDF version of this publication, click here: Comerica Economic Weekly, June 10, 2024(PDF, 127 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.