Preview of the Week Ahead

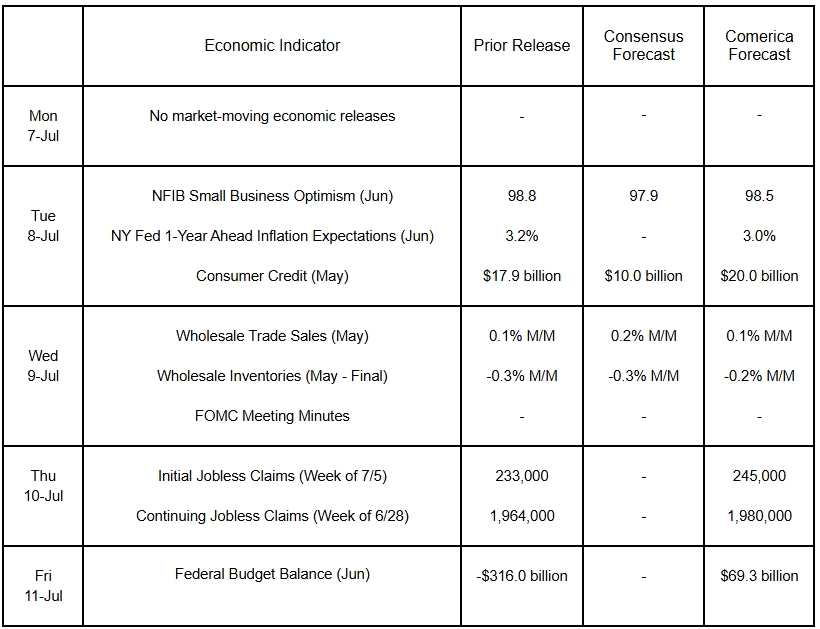

In a quiet week for economic releases, the most important will be the minutes of the Fed’s June decision. They will probably reinforce that the Committee expected to hold interest rates steady at their July decision when they met in June. The federal budget balance likely swung from a deficit in May to a surplus in June, with tariffs boosting receipts. Consumer credit likely rose solidly in June, marking another big monthly increase. Consumers tapped revolving credit to support spending last month with aggregate payrolls flat. Continued unemployment insurance claims likely moved higher in late June as workers losing jobs took longer to find new employment amid anemic hiring.

The Week in Review

The June jobs report had solid headlines but weak details. Nonfarm payroll employment rose 147,000 from May, but 63,000 of those jobs were in state and local government education (Public K-12, colleges, universities). Education jobs fall sharply every year after Memorial Day, so the seasonally-adjusted increase reported for June shows that an unusually large number of workers stuck around schools in summer jobs, a sign of weak labor demand in other industries. Healthcare and social assistance added 59,000, leisure and hospitality added 20,000, and construction added 15,000, but jobs in other industries were mostly flat. Manufacturing shed 7,000 jobs. An alternative measure of payrolls reported by ADP showed private employers trimmed headcount by 33,000 in June.

The unemployment rate edged down to 4.1% in June from 4.2% in May, with employment in the survey of households up 93,000, the labor force contracting 130,000, and unemployment falling 222,000. The labor force participation rate edged down to 62.3% from 62.4% and was the lowest since December 2022. The participation rate fell among workers aged 16-24 and over 55, and was slightly higher among workers aged 25-54. Wage growth slowed to the second-slowest in year-over-year terms since the spring of 2021, and the average workweek shortened. Both are further evidence of weakening labor demand. More broadly, June’s jobs report tells us that while the economy doesn’t look recessionary, it does look stuck in low gear. Other data released last week tell a similar story: Construction spending registered a seventh consecutive monthly decline in May, and unit car and light truck sales fell in June.

The unemployment rate’s dip in June will make the Fed feel more comfortable holding interest rates steady near-term. June’s decline in labor force participation is likely a knock-on effect of tighter immigration policy—in the half decade through January 2025, foreign-born workers accounted for four-fifths of labor force growth. The Fed has a maximum employment mandate, not a mandate for job growth or GDP growth. If tight immigration policy means that the unemployment rate can hold steady or even fall during anemic job creation, the Fed will be sidelined near-term.

The June ISM Manufacturing and Services Purchasing Managers Index (PMI) surveys gave the Fed further reason to hold rates steady, since both show input prices rising at the fastest pace since 2022’s inflation surge. Chair Powell has made clear in recent speeches that he thinks the Fed should monitor the impact of tariffs on inflation near-term in case they are more persistent than expected.

For a PDF version of this publication, click here: Comerica Economic Weekly, July 7, 2025(PDF, 130 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.