Preview of the Week Ahead

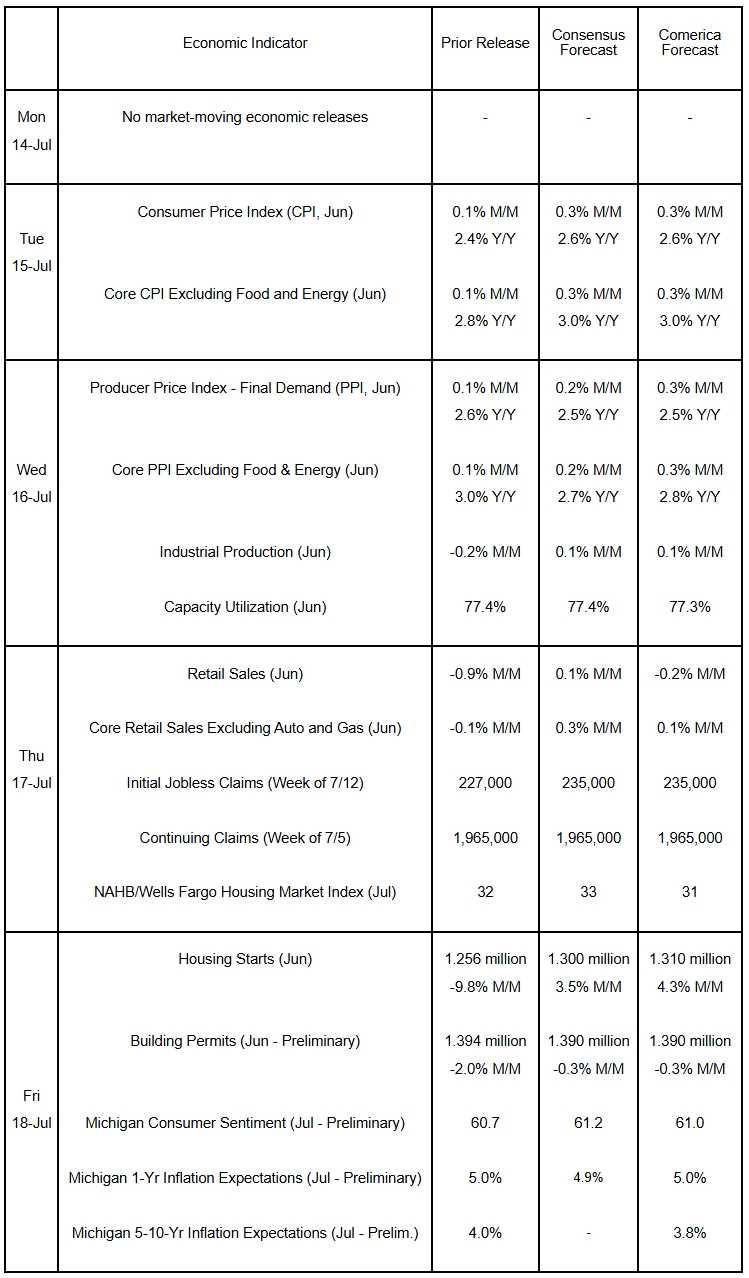

Passthrough of tariff costs and the short-lived surge in energy prices during the 12-day war between Israel and Iran are expected to have pushed consumer and producer prices higher in June. Utilities production likely rebounded sharply as vast swathes of the country were blanketed by hot weather, contributing to an uptick in industrial production. Vehicle sales fell sharply for the third consecutive month in June, likely contributing to another disappointing retail sales report. Core retail sales, which exclude sales at vehicle dealerships and a couple other volatile categories, likely edged higher. Homebuilder sentiment likely fell again in July. Similarly, June likely saw another decline in building permit applications and issuance. Housing starts are anticipated to have rebounded after a sharp fall in May. The University of Michigan’s preliminary read of consumer sentiment for July probably will show sentiment and inflation expectations holding steady.

The Week in Review

The U.S. government delayed implementation of the tariff hikes originally scheduled for July 9 to August 1, and notified trading partners that the U.S. intends to significantly raise tariffs beginning then. Major trading partners affected include Japan, South Korea, Malaysia, and Brazil, whose imports are to be tariffed at rates ranging from 25% to 50%. Last year, the U.S. imported nearly $380 billion worth of goods from those four countries. The planned tariff increases also include a 50% tariff on copper imports, and possibly raising the tariff on Canadian imports to 35% and the tariff on pharmaceuticals to 200%, although the scope and timing of those latter increases continue to be in flux.

The minutes of the FOMC’s June 17-18 meeting show “most” monetary policymakers judge that “some reduction” in the fed funds rate will be appropriate this year, since the inflationary effects of tariffs could be temporary or modest. “A couple” of FOMC members were open to reducing the fed funds rate as early as the July 30 decision, while “some” see holding rates steady through year-end as more appropriate. In light of ongoing uncertainty over tariffs and the significant fiscal boost from the One Big Beautiful Bill Act’s tax cuts and increased defense and immigration enforcement spending, the consensus of “most” policymakers to cut interest rates this year could be fracturing.

The NFIB Small Business Optimism Index eased slightly to 98.6 in June, but held slightly above its 51-year average of 98. The number of small business owners reporting excess inventories increased, which could indicate softer consumer demand or giveback after businesses pulled forward purchase plans earlier this year to avoid tariffs. Taxes overtook poor labor quality and high labor costs as the foremost problem faced by small business owners for the first time in nearly four years.

Consumer credit rose by a modest $5.1 billion in May and undershot the $10 billion consensus forecast. The lackluster increase was due to a decline in revolving credit, which is mostly made up of credit card loans. Nonrevolving credit, which is mostly student and auto loans, held up well for the third successive month.

For a PDF version of this publication, click here: Comerica Economic Weekly, July 14, 2025(PDF, 150 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.