Preview of the Week Ahead

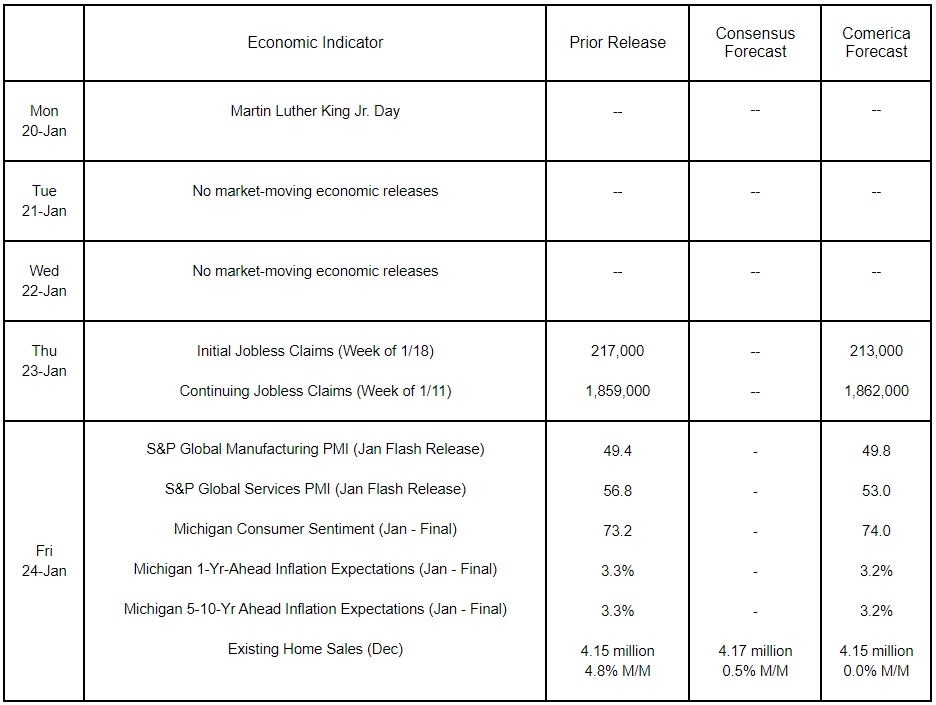

The economic calendar is very light in this holiday-shortened week. The flash estimate of S&P Global’s Manufacturing PMI is likely to show the manufacturing sector contracted at a slower pace in January than December, while the Services PMI will probably reveal continued expansion of service providers. The final release of the University of Michigan Survey of Consumers for January is anticipated to show inflation expectations rose slightly less in the month than reported in the preliminary release. Existing home sales were likely flat in December after a big increase in November, as high mortgage rates weighed on affordability.

The Week in Review

Matching Comerica Economics’ forecast, the Consumer Price Index (CPI) rose by 0.4% last month and accelerated in annual terms to 2.9% from 2.7% in November. Core CPI increased by a tamer 0.2% and was up 3.2% from a year ago. The energy subindex, up 2.6%, rose sharply due to large increases in gasoline and utility (piped) gas prices. Grocery and restaurant food prices were both up 0.3%. New and used car prices rose sharply, but were lower than a year earlier. Shelter costs—the single biggest contributor to inflation in the past couple of years—increased by 0.3% for the second consecutive month and were up 4.6% in annual terms, a marked improvement from the 6.0% increase recorded in January. This very “sticky” component needs to improve further to bring inflation sustainably down. Prices of services excluding shelter rose by 0.4% and were up 4.0% from a year ago. Unsurprisingly, transportation service prices jumped higher, with airline fares soaring by nearly 4% or 7.9% from a year earlier. Progress in taming inflation slowed in 2024: Annual headline CPI ended the year at 2.9%, down half a percent from the end of 2023, and the December core CPI reading of 3.2% was down 0.7 percentage points. By comparison, both fell around 2 percentage points from December 2022 to December 2023.

The federal fiscal deficit narrowed to $86.7 billion in December. The deficit in the first three months of the current fiscal year ballooned to $710.9 billion, a staggering 39.4% increase from the same period last year. Declines in revenues, down 2.2%, and sharp increases in spending, up 10.9%, contributed to the wider shortfall. Personal income tax collections are 1.3% lower fiscal year-to-date (YTD), while corporate tax receipts are down 27.0%. All five major expenditure categories are significantly higher: Social Security, up 6.7%; defense, up 10.0%; health (primarily Medicaid), up 9.3%; net interest, up 12.0%; Medicare, up 38.4%. YTD interest expenditures of $241.5 billion have eclipsed the $232.7 billion spent on Medicare and are only a few billion dollars short of the $245.8 billion spent on Medicaid.

Sales at retail, food services and drinking establishments rose by a healthy 0.4% in December after an upwardly revised 0.8% increase in November. A 0.3% decline in sales at food services and drinking establishments—the sole services category in the report—weighed on the overall figure. Excluding it, retail sales were up a robust 0.7%. Sales were up in almost all retail categories and were up notably at motor vehicle and parts dealerships for the fourth consecutive month. Pointing to another quarter of strong consumer spending, “control” (core) retail sales—used in computing nominal consumer spending on most goods in the GDP report—accelerated to 0.7% in December from 0.4% in November.

For a PDF version of this publication, click here: Comerica Economic Weekly, January 20, 2025(PDF, 132 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.