Preview of the Week Ahead

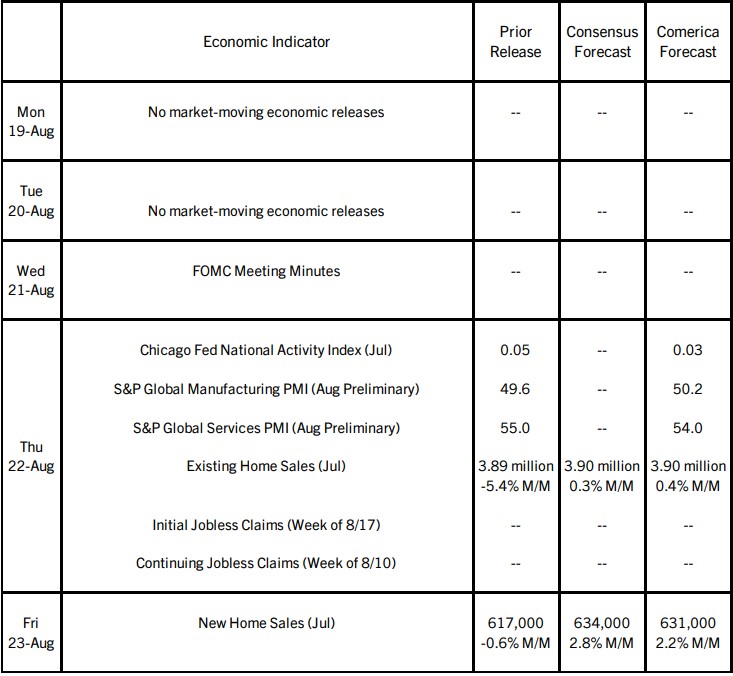

In a week with few economic data releases, financial markets’ attention will likely focus on the minutes of the July 31st FOMC meeting. Following last week’s tame inflation prints, markets are pricing in a meaningful possibility of a half percentage point rate cut at the next meeting in September. However, a quarter percentage point cut seems more likely, since monetary policymakers are still concerned about the momentum that built up in inflation in recent years, consumer spending is solid, and the unemployment rate is only slightly above the level where Fed policymakers expect it to average over the longer run.

New and existing home sales likely rebounded in July after depressed readings in June. Mortgage rates averaged nearly a quarter percentage point lower in July than June, and fell further in August, which should help home sales in the rest of 2024. The preliminary estimates of PMI reports for August will likely show continued growth of service-providing industries, and a rebound of manufacturing.

The Week in Review

Markets focused on key inflation and retail data last week. Overall, inflation was in line with expectations. The Consumer Price Index (CPI) rose by 0.2% in July, as did the core CPI excluding food and energy, and both indexes registered their smallest year-over-year increases since the spring of 2021. Food prices rose modestly by 0.2% in July and energy prices were flat. Prices of several key consumer goods, such as new and used vehicles and apparel, declined outright. Discounting by large retailers is contributing to lower goods prices. Shelter costs rose 0.4%, a major negative, with both constituent components—rent and owners’ equivalent rent of residences—up sharply. The FOMC will be delighted to see a third consecutive flat reading of service prices excluding shelter, which include some of the stickiest components of inflation.

The Producer Price Index (PPI) for Final Demand rose by 0.1% in July and was up 2.2% from a year earlier. Core PPI, which excludes the volatile food, energy, and trade services components, increased by 0.3% last month and was 3.3% higher from a year ago. The benign increase in overall PPI masks a notable divergence between final demand goods and services. Higher prices of gasoline and diesel propelled goods prices higher, while trade services, which measure wholesaler and retailer margins, led services prices lower. The PPI components that are most closely correlated with the PCE price index ran cool in July, suggesting the PCE inflation report to be released at month end will report moderating price pressures by the Fed’s preferred measure of inflation.

Sales at retail, food services and drinking establishments soared by 1.0% in July from a downwardly revised 0.2% decline in June and were led by a 3.6% jump in purchases of motor vehicles and parts as the CDK hack’s drag on car dealer sales ended. Control retail sales, which leave out motor vehicle dealers, gas stations, and a couple of other volatile categories, and which go into the calculation of nominal GDP, rose a good 0.3% after a 0.9% jump in June. However, industrial production fell a large 0.6% in July, with manufacturing down 0.3%, mining flat, and utilities down 3.7%. Hurricane Beryl weighed on industrial production during July, so much of the report’s weakness will likely be made up in August.

For a PDF version of this publication, click here: Comerica Economic Weekly, August 19, 2024(PDF, 153 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.