Preview of the Week Ahead

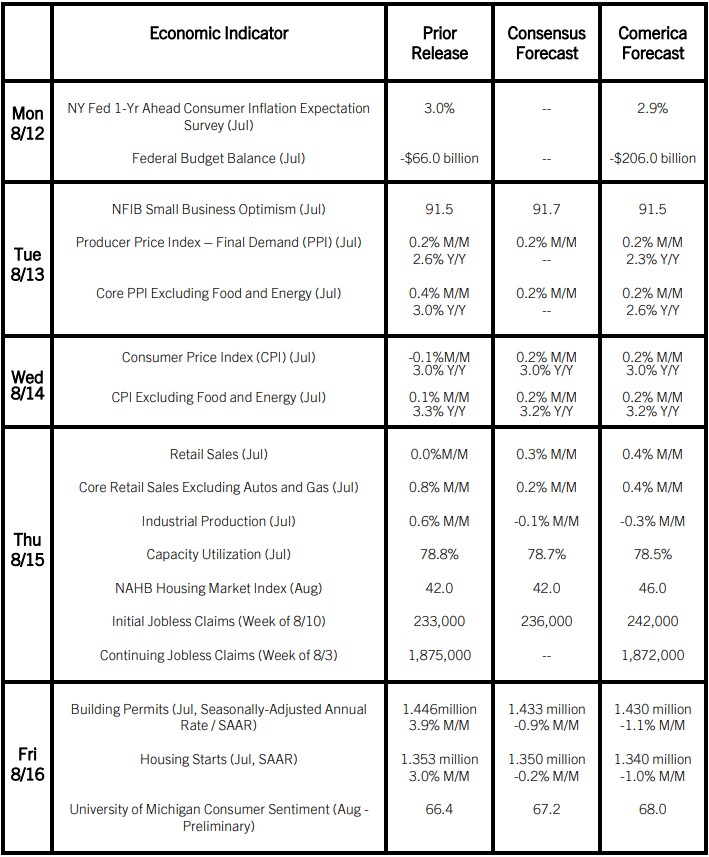

Consumer price inflation was likely unchanged in year-over-year terms in July, holding near the bottom of its range since mid-2021. Core CPI likely edged lower in year-over-year terms. Cooling inflation of shelter costs is helping to bring down core inflation. Inflation of core services excluding energy and housing was likely little changed.

Retail sales likely bounced back in July after a soft June, supported by higher auto sales and slightly higher gas prices. Core retail sales excluding these and a few other volatile categories likely also grew moderately. Industrial production likely fell in July as seasonally-adjusted utilities demand softened; temperatures were closer to historical averages in July than June. Mining output likely declined.

Building permits and housing starts likely edged lower in July. But if the big drop of long-term interest rates since the end of July holds (The national average mortgage rate pulled back to the lowest since May 2023 last week), housing activity should pick up into the close of the year. Homebuilder sentiment likely improved in the August release as lower mortgage rates brightened the outlook.

The Week in Review

The ISM Services PMI rebounded into expansionary territory in July, easing fears that the economy could be entering a recession. The PMI rose to 51.4 from 48.8 and was above the 51.0 consensus estimate. Key subindices, such as business activity, new orders, and employment, rose by around five percentage points and were all in expansionary territory, indicating the services sector was on solid footing last month.

The trade deficit narrowed to $73.1 billion in June from a slightly upwardly-revised $75.0 billion deficit the prior month. The improvement in the trade balance was due to a solid increase in exports, up 1.5%, which sharply outpaced the 0.6% increase in imports. Despite the improvement in June, the inflation-adjusted deficit in goods exports widened notably by 6.4% in the second quarter. Trade is likely to be a drag on growth in the upcoming revisions to second quarter GDP estimates.

Consumer credit increased by $8.9 billion in June, below May’s $13.9 billion increase and also lower than the $10.0 billion consensus expectation. The increase in consumer credit was primarily due to a $10.6 billion jump in nonrevolving credit, potentially student loans. Auto loans, the other key constituent component of nonrevolving loans, probably fell in June due to large disruptions caused to auto dealers by the CDK hack. Revolving credit, mostly credit card loans, fell by $1.7 billion in June. Revolving credit growth has been slowing in the past two years, which is unsurprising as financial institutions have tightened lending standards to households.

For a PDF version of this publication, click here: Comerica Economic Weekly, August 12, 2024(PDF, 135 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.