California’s economy to outperform the national economy in 2026

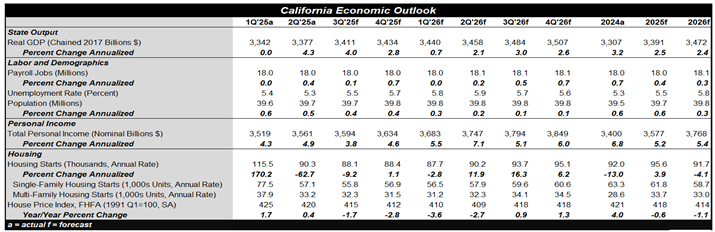

The Golden State’s economy looks to have outperformed the rest of the nation in 2025, fueled by the Artificial Intelligence boom (It is harder than usual to judge the second half the year, since the government shutdown delayed recent data). The tech sector and AI are forecast to fuel another year of strong economic growth in 2026, with robust business investment and strong consumer spending by households with high-paid workers in the industry. California’s undisputed leadership of the global innovation economy will again offset the state’s economic shortcomings: High costs for main street businesses, slow population growth, cool labor demand, and post-pandemic headwinds to big cities’ central business districts. Californian tourism faced a challenging year in 2025, but should do better in 2026 as the FIFA World Cup boosts leisure and hospitality businesses. Trade disputes may simmer down in 2026, another potential tailwind.

Population growth will likely be negligible in 2026 as more stringent immigration policies limit international migration. At the same time, outmigration will be less appealing to Californians due to a low-hire, low-fire national job market, a cooler market for home sellers, and fewer remote work opportunities, an offsetting support to the state’s population. Payroll growth is projected to moderate further in 2026. Tracking national trends, the Golden State’s unemployment rate probably will remain elevated in the first half of next year, then come down in the second as the economy strengthens. Total personal income growth will likely be little changed from 2025, but disposable personal incomes will accelerate after the OBBBA’s tax cuts. In particular, California will see an above-average boost to affluent households’ spending from the increased State And Local Tax (SALT) deduction, since it has the nation’s highest proportion of high income households and relatively high state income and property taxes.

California’s housing starts jumped in the first quarter of 2025 amid the post-election bounce in homebuilder sentiment, then weakened after April’s tariff hike shock. Single-family construction is forecast to edge lower again in 2026, while multifamily housing is forecast to hold steady. California has among the lowest vacancy rates in the nation, a key support for multifamily construction. House prices will likely ease in the first half of 2026 due to strained affordability, homeowners insurance issues, and more existing home listings, then return to increases in the second half of 2026.

For a PDF version of this publication, click here: 2026 California Annual State Economic Outlook(PDF, 137 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.