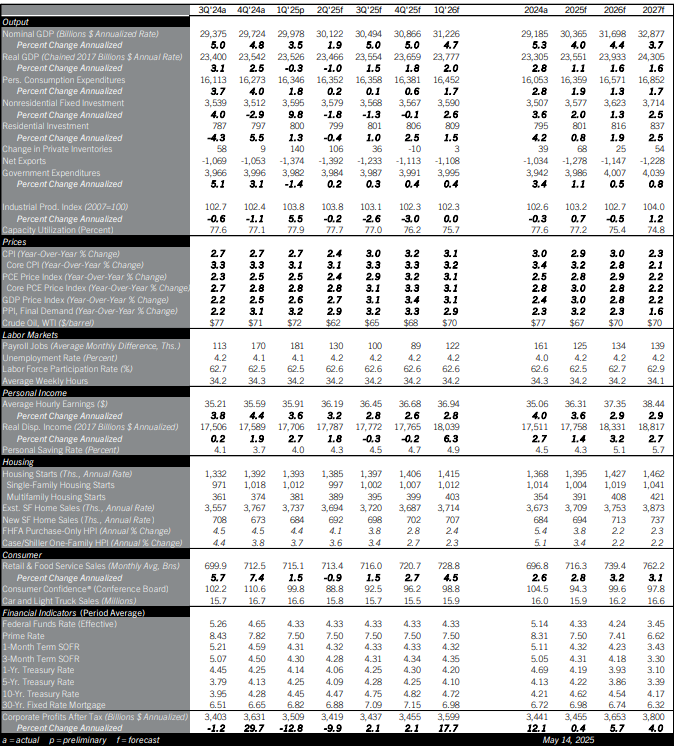

Growth Outlook Looking Less Cloudy After Partial Tariff Rollback;

Rising Inflation and Bigger Fiscal Deficits to Keep the Fed on Hold This Year

April’s tariff increases were partially reversed by mid-May, leaving the U.S. average tariff rate about 15 percentage points higher than on January 19th. Higher tariffs are set to weigh on growth and raise inflation, but are less likely to trigger a recession than feared last month. Tariffs do seem to have shifted economic growth into a lower gear, though. Discretionary consumer spending has softened in the first half of 2025, and hiring has slowed. Even so, the May forecast foresees a stronger outlook for real GDP and the job market than the April forecast did. The Fed has signaled that the bar to cut interest rates is higher during an economic shock that raises inflation and lowers growth than during a conventional economic shock, which reduces both. The economy still looks set to register slower growth in 2025 than in 2024. But recession risk is unlikely to worry the Fed enough to corral them into cutting rates. Instead, the Fed is forecast to hold the federal funds target unchanged through the end of 2025.

While tariffs will raise the price of a foreign-made product relative to a domestically-made one, they would have to stay in place for quite a while to spur a big wave of reshoring. Manufacturers who are already on the fence about locating production domestically or internationally face an easy decision to reshore. But many companies produce globally for global customers, or face lower costs sourcing from abroad even after tariffs—they face harder decisions. Many manufacturers are likely to wait to see whether tariffs are made permanent in the 2026 tax law before making expensive, multi-year investment decisions because of them.

Economic growth will get another shot in the arm in 2026 as the 2025 reconciliation bill (“Big Beautiful Bill”) cuts taxes and widens the fiscal deficit. Moody’s downgraded the U.S. sovereign credit rating on May 16 in reaction to a decade of big deficits that look set to continue for years to come. The fiscal outlook is another reason for the Fed to forgo rate cuts this year. Longer-term interest rates will likely be higher in the second half of 2025 than in the first half, including the 30-year fixed mortgage rate. As a result, the outlook for residential construction, house sales, and house prices in 2025 and 2026 is softer than in Comerica’s April forecast. Multifamily construction is forecast to grow faster than single-family construction as high mortgage payments keep young families in rentals for longer.

Risks still seem skewed to the downside. The trade war could re-escalate and tariffs could go back up, raising inflation. The Fed may have to hike. The deficit or other issues could shake investors’ confidence in the U.S. and its currency, damaging financial conditions. But there are upside risks as well. Public sentiment could refocus from tariffs to potential benefits from tax cuts and deregulation. That could fuel a recovery of businesses’ risk taking and hiring, and help consumer spending to stabilize.

For a PDF version of this publication, click here: May 2025 U.S. Economic Outlook(PDF, 203 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.