Winter Cold Snap and Tariffs to Keep Inflation Above the Fed’s Target in 2025;

Increased Supply in the Housing Market to Slow Services Inflation This Year

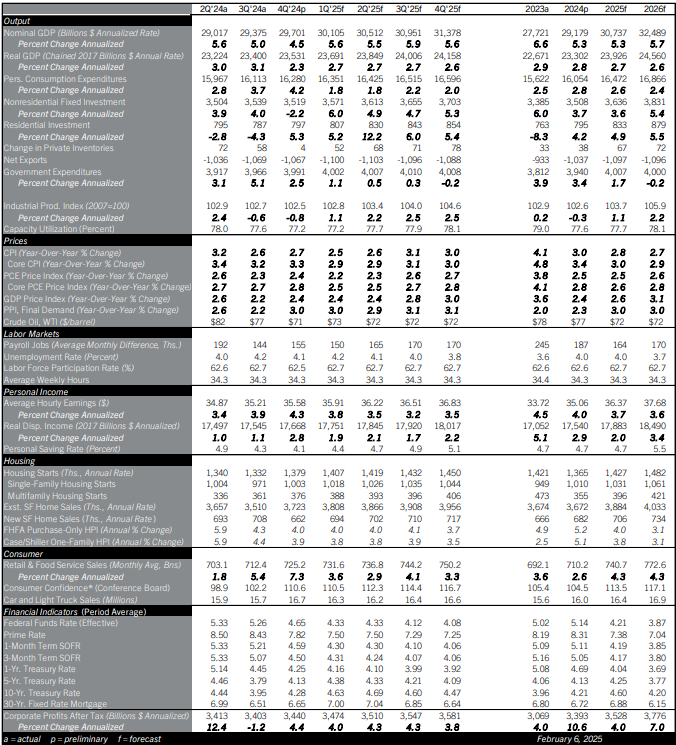

A number of shocks to food and energy prices at the turn of the year will raise inflation near-term. The H5N1 bird flu caused big disruptions to food supply chains in January, pushing wholesale egg prices to a record high and chicken to the highest since mid-2023. The cold snap across most of the continental U.S., as well as new tariffs on Russian energy products, pushed up prices of natural gas, diesel, and gas in the month, too. Inflation ran hot in December 2024 and will likely do so again in the January reports. Later this year, higher tariffs will contribute to higher prices as well. President Trump imposed new tariffs on American purchases of Chinese goods in February, and is contemplating tariffs on imports from other regions. In addition to the direct effect of tariffs raising prices, they will allow American manufacturers who compete against imported goods to raise the prices they charge, too—good news for those companies and their workers, but paid for by other businesses and consumers.

However, inflationary pressures from the housing market should cool this year. Homebuilders are delivering new units at the fastest pace in many years, and homeowners who delayed sales because of high mortgage rates are gradually reconciling themselves and getting on with it, raising listings incrementally. The contribution to inflation from the housing component of the CPI and PCE indexes slowed throughout 2024, and should continue to move lower in 2025. While housing is expensive relative to incomes, that picture should improve incrementally this year.

The job market largely held steady at the turn of the year. The unemployment rate may be revised higher in the January release as the BLS incorporates more accurate data about the number of recent immigrants participating in the workforce. Also, January’s cold snap, the LA wildfires, and a bad flu season kept many hourly workers from jobs in parts of the month. But the unemployment rate is likely at a near-term peak, and Comerica forecasts for it to fall over the course of 2025. Small businesses’ hiring plans rose to the highest since mid-2023 in December, and other surveys like the ISM PMI reports provide more evidence that businesses are inclined to be more aggressive in hiring this year, at the same time that tighter immigration policies slow growth of the labor force.

The Fed held its monetary stance unchanged in January after three consecutive cuts from September to December, and signaled they are in ‘no hurry’ to cut further. Comerica forecasts for the Fed to hold short-term interest rates steady at current levels through mid-year. The Fed is forecast to make a single quarter percentage point rate cut in mid-2025, likely around the end of their program of reducing holdings of Treasury bonds and mortgage-backed securities. Longer-term interest rates will average around current levels in 2025 as financial markets anticipate inflation from tariffs, a hotter job market, and fiscal stimulus from Congress extending tax cuts.

For a PDF version of this publication, click here: February 2025 U.S. Economic Outlook(PDF, 195 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.