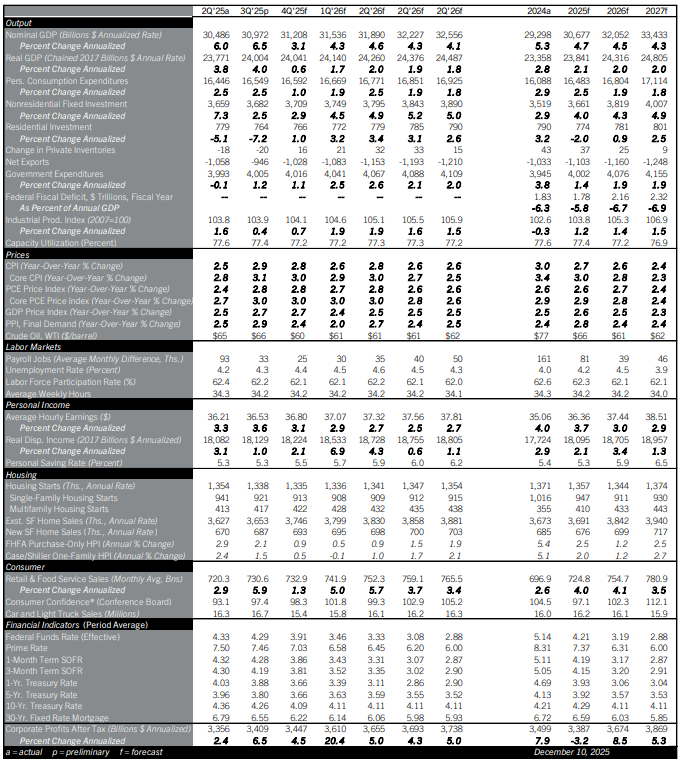

Economic Expansion to Broaden in 2026 on Tailwinds From Lower Interest Rates, Fiscal Stimulus, and an Improving Housing Market; More Fed Cuts Forecast for Next Year

The U.S. economy looks to have registered a good albeit uneven year in 2025, though there is less data available this December than usual to judge since the government shutdown delayed many economic statistics. 2025 saw solid real GDP growth as spending surged on AI-related software, equipment, and data centers. The roaring stock market fueled wealth gains by affluent households, supporting consumer spending. However, job growth was sluggish and inflation held above the Fed’s target, pressuring the finances of lower- and middle-income households.

Employment took a leg down in the fourth quarter as the federal government shed tens of thousands of workers while private hiring slowed to a near-standstill. The December jobs report’s release in early 2026 will likely show the unemployment rate rose about half a percentage point over the course of 2025. Job growth should gain traction in the new year, though, supported by stronger conditions in industries that lagged in the past year. The Fed’s rate cuts between Labor Day and the end of 2025 set the stage for a rebound of existing home sales, which should fuel hiring in real estate, as well as real estate-adjacent industries like retailing of appliances and furniture and home remodeling. Consumer spending on durable goods will get a shot in the arm from the tax cuts included in the July 4 fiscal bill, another tailwind for retailers. Increased federal spending will fuel hiring of federal workers and contractors. In the other direction, rising AI adoption poses an upside risk to white-collar unemployment. Compare AI to the smartphone, another recent technological revolution: Its rise accelerated the decline of print publishing as media consumption habits changed. Smartphones did eventually fuel a boom of gig economy jobs, too, but that took years longer to emerge than the decline of print publishing.

Inflation is forecast to hold above the Fed’s target in 2026 as tariff costs gradually work their way to checkout prices. Next year will likely mark the sixth consecutive year of inflation above the Fed’s target. Even so, consumers are finding relief from prices less affected by trade: In particular, shelter inflation is finally cooling off as house prices and advertised rents hold little changed, and as more housing supply comes to market. Inflation from tariffs is forecast to dissipate in the second half of 2026, moving overall inflation closer to the Fed’s target.

After three quarters of a percent in rate cuts between September and December, the Fed looks likely to continue to reduce rates in 2026. The Fed will want to arrest the downward momentum visible in recent employment data. That momentum will probably be even clearer in early 2026 as delayed job market data are published. Comerica forecasts for the Fed to reduce the federal funds target rate by three quarters of a percent by September, to a range of 2.75% to 3.00%. The ten-year Treasury yield is forecast to average between 4.00% and 4.25% in 2026.

For a PDF version of this publication, click here: December 2025 U.S. Economic Outlook(PDF, 193 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.