Labor Market Normalization Bolsters Odds of Fed Rate Cuts Later in 2024

Unemployment Rises; Earnings Rise at the Slowest Pace Since Mid-2021

• Job growth was decent in April although slower than expected, with modest downward revisions to February and March.

• The unemployment rate rose slightly on the month, with rounding making the headline increase look bigger than the details did.

• The report’s other details point to a healthy job market. The employment-population ratio for workers ages 25-54 was near the highest since 2002 in April, and for workers 16-24 was near the highest since 2008.

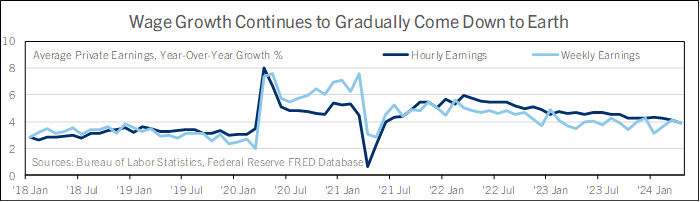

• Most important for the interest rate outlook, wage growth moderated to the slowest since mid-2021.

• The April jobs report will reassure the Fed that the economy is still moving toward their inflation target, two steps forward, one step back.

U.S. employers added 175,000 nonfarm payroll jobs in April, below the 240,000 consensus forecast. Private employers added 167,000 jobs, including 14,000 more in high wage goods-producing industries, of which 8,000 were manufacturing jobs and 9,000 in construction. Private service-providing industries added 153,000 jobs, with an 87,000 increase of health care and social assistance jobs accounting for more than half. Transportation and warehousing rose 22,000, retail rose 20,000, and wholesale rose 10,000. Leisure and hospitality added just 5,000 jobs. Job growth in February and March was revised down a net 22,000. Even so, after revisions job growth in the last three months still averaged a solid 242,000.

The unemployment rate edged up to 3.9% from 3.8% in March, versus a consensus forecast for no change. But before rounding, it only edged up to 3.86% from 3.83%, a change which is within the survey’s margin of error, so the increase was less than meets the eye. The unemployment rate is calculated from a survey of households that is more volatile than the survey of employers. In that survey, employment edged up 25,000 after surging 498,000 in March, unemployment rose 63,000, and the labor force rose 87,000.

The unemployment rate for adult men rose to 3.6% from 3.3%, for women edged down to 3.5% from 3.6%, and for teenagers fell to 11.7% from 12.6%. The unemployment rate for White Americans edged up to 3.5% from 3.4%, for Black Americans dropped back to 5.6% from 6.4% and matched the February level; for Asian Americans rose to 2.8% from 2.5%, and for Hispanic or Latino Americans rose to 4.8% from 4.5%. Unemployment for Americans with a disability was 8.4%, up from 8.0% a year earlier. Unemployment for native-born workers rose 0.3% on the year to 3.4%, while unemployment among foreign born workers rose 0.8% to 3.9% over the same period. Year-over-year comparisons of these last few time series are more reliable than monthly comparisons since the Bureau of Labor Statistics does not adjust them to remove regular seasonal variations.

The labor force participation rate was unchanged on the month at 62.7%. The labor force participation rate for Americans 25-54 years old rose to 83.5% and tied for the highest since 2002. Over the last year, the unemployment rate’s increase from 3.4% to 3.9% in part reflects higher (better) labor force participation among workers under 55. The employment-population ratio of workers ages 25 to 54 was a tenth of a percent shy of the highest in over twenty years in April. The employment-population ratio for workers 16-24 is near the highest since 2008. The employment-population ratio for Americans with a disability rose to tie for a record high. These are signs of a healthy job market. The reason the labor force participation rate for all workers is still below the pre-pandemic level is because the employment-population ratio for workers over age 55 is still depressed by the many early retirements taken between 2020 and 2022.

The average workweek edged down to 34.3 hours from 34.4 hours in March. With a decent increase in employment offset by a shorter workweek, aggregate hours worked by private payroll employees edged down 0.1% in April after rising 0.4% in March. Average hourly earnings rose 0.2% on the month, below the 0.3% consensus. From a year earlier, they rose 3.9%, undershooting the 4.0% consensus forecast and registering the slowest increase since mid-2021. Combining higher employment, a shorter workweek, and a modest gain in pay, aggregate earnings of workers on private payrolls were unchanged in April after rising 0.8% in March and were up a solid 5.6% from a year earlier. This outpaces inflation and will support further growth of consumer spending over the rest of 2024.

There’s a big divergence between employment growth by the payroll survey over the last year, up a solid 234,000 per month, and much more modest employment growth in the household survey, up just 44,000 per month. The discrepancy is likely related to the household survey’s challenges in measuring employment among recent immigrants to the United States, who are less likely to be counted in a government survey than longer-established workers.

Most important for the interest rate outlook, wage growth was a little cooler than expected in April, and in year-ago terms moderated to the slowest since mid-2021. The Job Openings and Labor Turnover Survey for March, released shortly before the April jobs report, showed that the quits rate has fallen to below the level that prevailed in most of 2018 and 2019. These stats provide tangible evidence that the job market has gone from an overwhelming jobseekers’ market in late 2021 and 2022 to one with balance between employers’ and workers’ negotiating power.

The more normal job market will dampen price pressures over time and will reassure the Fed that the economy is still moving two steps forward, one step back toward lower inflation. Overall, the April jobs report suggests the U.S. job market is coming down to earth after a whiplash recovery from the 2020 recession. It feels a little early to declare that the U.S. economy has made a soft landing, since the Fed is still holding interest rates restrictively high. But the April jobs report helps clear the path to that destination.

For a PDF version of this publication, click here: Labor Market Normalization(PDF, 115 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.