Key takeaways:

- The job market hit an air pocket in the fourth quarter. Payrolls fell on net in October and November, with a modest gain in November failing to offset October’s larger drop.

- The federal government shed jobs as workers who accepted buyouts earlier in 2025 fell off payrolls. Healthcare & social assistance and construction added jobs in October and November, but other private industries saw employment fall on net.

- November saw the highest unemployment rate and slowest wage growth since 2021. This jobs report increases pressure on the Fed to cut rates again when they meet next in late January.

- Job growth will likely resume after the turn of the year due to lower interest rates and more expansionary fiscal policy.

Headwinds from federal job cuts and weakness across many private industries weighed on employment in the fourth quarter. Employers added 64,000 nonfarm payroll jobs in November after a larger loss of 105,000 in October. The November jobs report provided the first view of October’s data, which was delayed by the government shutdown. The three-month moving average of payrolls growth slowed to 22,000 in November from 62,000 in the September jobs report, published on November 20. Federal government jobs fell 157,000 in October and 5,000 in November as federal employees who accepted deferred resignation packages earlier in 2025 fell off payrolls.

Private hiring looked decent at first glance in the last two months, adding 52,000 jobs in October and 69,000 in November. But those gains were heavily skewed toward healthcare & social assistance, which rose a combined 129,000 in the two months—construction was another lonely bright spot, up 27,000. Most other industries showed either meager gains or outright losses. Professional and business services edged up 5,000, wholesale trade was flat, mining and logging edged down 3,000, information shed 9,000, and manufacturing fell 14,000. Industries that usually see heavy holiday hiring disappointed. Leisure & hospitality and retail each rose just 4,000 each, and transportation & warehousing fell 18,000. The jobs report’s statistics are adjusted to remove seasonal swings, so weak seasonal hiring shows up as net losses in the reported numbers.

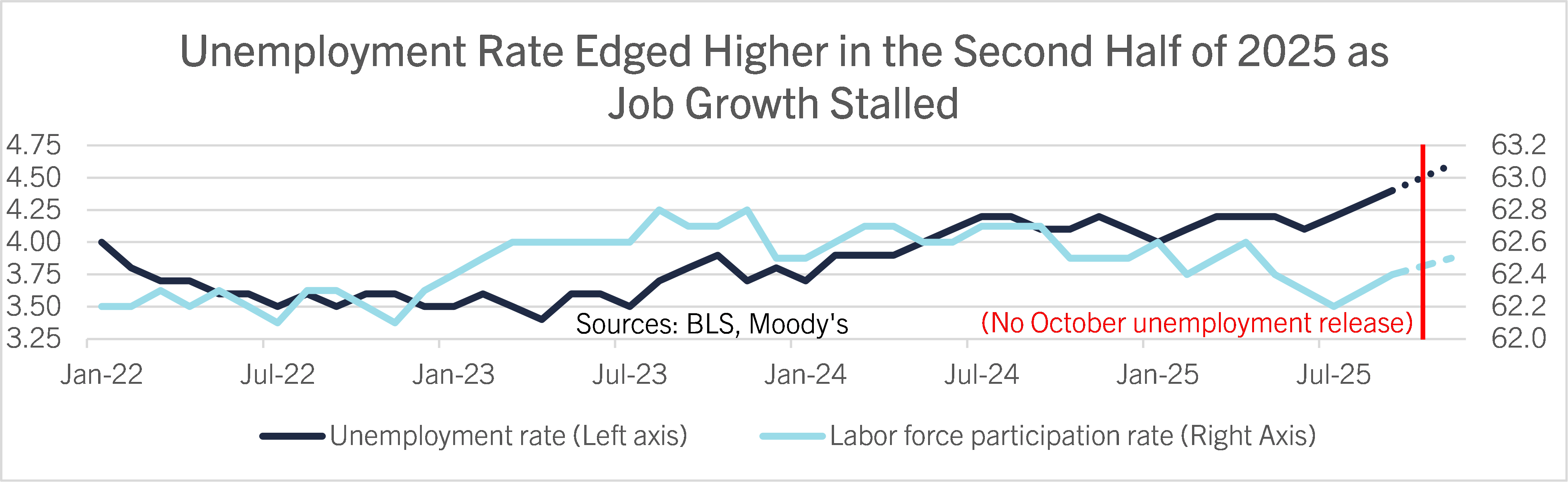

The unemployment rate rose to 4.6% in November from 4.4% in September and was the highest since September 2021; there is no unemployment rate for October because of the shutdown. Rounding made November’s increase look bigger than it was. Before rounding, the unemployment rate was up just over a tenth of a percent over the last two months, to 4.56% from 4.44%. The labor force participation rate edged up to 62.5% in November from 62.4% in September. Within the survey of households, the labor force increased 325,000 in October and November combined, employment rose 96,000, and unemployment rose 228,000.

There were big jumps in the unemployment rate of groups that tend to be harder hit in labor market downturns. The unemployment rate for Black or African American workers jumped to 8.3% from 7.5% in September and is up from 6.0% in May. The unemployment rate for teenagers 16 to 19 years old leaped to 16.3% from 13.2% in September. Like the overall unemployment rate, the unemployment rates for these two groups were the highest since 2021. Unemployment rates for these groups tend to be leading indicators of the broader job market, so their big increases in November suggest downside risks for the job market ahead.

Wage growth softened, too. Average hourly earnings rose 0.1% on the month in November after a 0.4% increase in October and a 0.2% increase in September. From a year earlier, earnings growth slowed to 3.5% in November from 3.7% in September and October and was the slowest since May 2021.

The November jobs report pressures the Fed to cut rates further. Hiring momentum has weakened, with just 17,000 jobs added per month since April. The Fed will want to arrest this deterioration and help labor demand regain traction. This will be uncomfortable for the Fed, since inflation looks set to edge higher in early 2026 from tariff passthrough. But the softening job market makes a sustained pickup in inflation from tariffs look less likely than it seemed six months ago, when the job market was stronger. In addition, inflation is behaving better outside of the goods and services directly affected by tariffs. Gas and diesel prices are falling as WTI crude retreats to the lowest since early 2021, and shelter inflation has cooled, too. Comerica forecasts for the Fed to cut the federal funds target by a quarter of a percent at their next decision on January 28. The Fed is forecast to cut rates a cumulative three quarters of a percent in 2026.

The economy will get a boost in 2026 from lower interest rates, as well as from more accommodative fiscal policy as the July 4 tax and spending bill boosts federal spending and after-tax incomes. That should help stabilize hiring in the new year. Comerica forecasts for employers to add 46,000 jobs per month in 2026. With the labor force growing more slowly, the unemployment rate is forecast to close next year at 4.3%, down about a quarter percentage point from its November level.

For a PDF version of this publication, click here: Jobs Market Hit an Air Pocket(PDF, 117 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.