Inflation Took Two Steps Forward, One Step Back in April;

Smaller Tax Refunds Weighed on Retail Sales Last Month

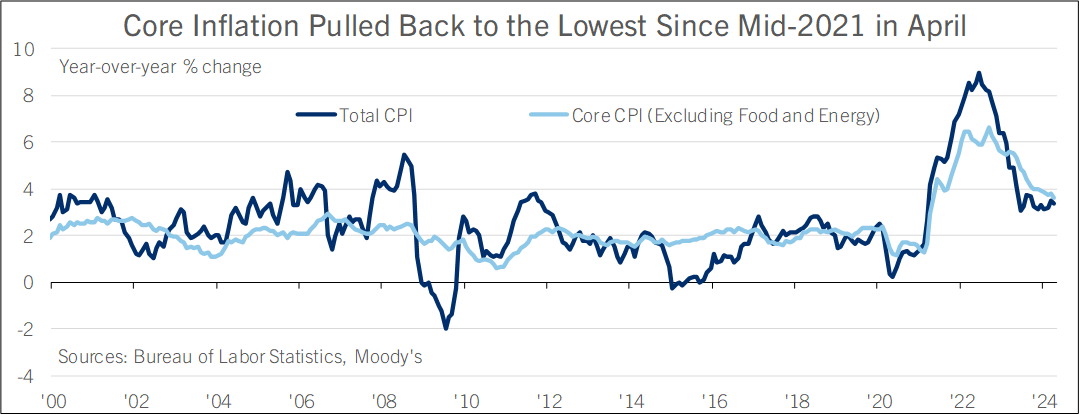

• CPI inflation slowed in April and was a little cooler than expected.

• Core CPI registered the smallest year-over-year increase since mid-2021, but Supercore CPI didn’t look as encouraging.

• Separately, retail sales were weaker than expected in April, with downward revisions to February and March. Tax refunds were smaller this year than last, weighing on consumer spending.

• Cool retail sales and core CPI bolster the case for the Fed to start cutting interest rates this year.

Inflation slowed in April, with the core CPI moderating to the least since mid-2021. However, much of the slowdown in core inflation was because of falling car prices and a slower increase of shelter costs. Supercore service price inflation went in the other direction, rising to the fastest in a year in April. The CPI report is consistent with a two-steps-forward, one-step-back return to inflation near the Fed’s 2% target.

The Consumer Price Index for All Urban Consumers (CPI-U or just CPI) rose 0.3% in April from March, slightly below the 0.4% consensus forecast. From a year earlier, the CPI slowed to 3.4% from 3.5% in March. Food prices were unchanged, with food at home down 0.2% and food away from home up 0.3%. From a year earlier, food at home was up 1.1% and food away from home up 4.1%. Energy prices rose 1.1% on a 2.8% increase in gasoline, offset by a 0.7% drop in energy services (electricity and piped gas charges).

Core CPI excluding food and energy rose 0.3%, matching the consensus forecast. From a year earlier, core CPI slowed to 3.6% from 3.8% in March and was the slowest since April 2021. Core goods prices fell 0.1%, largely due to a 0.4% drop in new car prices and a 1.4% drop in used car and truck prices. Core service prices rose 0.4%, with shelter up 0.4%, transportation services up 0.9%, and medical care services up 0.4%. CPI services prices less energy and housing (a.k.a. Supercore CPI) rose 0.4% after 0.7% and registered the slowest monthly increase since December. Even so, Supercore CPI registered the highest year-over-year increase since April 2023.

Trends were mixed among the components of the Supercore CPI sub-index. Motor vehicle insurance rose 1.8% on the month and surged 22.6% on the year. Home healthcare service charges rose 0.1% on the month after jumping in March, but were still up 13.9% on the year. Motor vehicle maintenance and repair costs were flat on the month but up 7.6% on the year. Tenant and household insurance fell 0.1% on the month but rose 4.0% on the year. Medical care services rose 0.4% on the month and 2.7% on the year. Haircuts were up 1.2% on the month and 4.7% on the year.

Separately released data on retail sales show economic growth kicked off the second quarter on a weak note, and implied downward revisions to consumer spending data for the first quarter. Retail and food service sales undershot the consensus forecast for a 0.6% increase in April, registering no change. March was revised down slightly to a 0.6% increase from 0.7% previously. February was revised down to a 0.7% increase from 1.0% previously.

Motor vehicle and parts dealer sales fell 0.8% in April, and gasoline station sales rose 3.1% on higher gas prices. Control (core) retail sales, which exclude motor vehicle dealers, gas stations, and a couple of other volatile categories, and which go into the calculation of nominal GDP, fell 0.3% in April, with March revised down to a 1.0% increase from 1.1% previously, and February revised to no change from a 0.4% increase. Food service and drinking place sales rose 0.2% in April, slower than the increase in prices of food away from home. Nonstore retail, principally e-commerce, fell 1.2%.

April’s weak retail sales report is likely signal and not noise, since the ISM Services PMI was the weakest in April since December 2022 and the second weakest since the recession of 2020. Consumers received smaller tax refunds this year than in 2023, which weighed on spending last month. Also, the downward revisions to February and March’s retail sales imply downward revisions to personal consumption expenditures in the next estimate of first quarter real GDP growth.

Cooling core inflation and weak retail sales bolster the case for the Fed to cut interest rates. High interest rates are weighing on durable goods prices and slowing the increase of shelter costs in the CPI basket. The Fed would probably cut rates at their next decision on June 12 if they weren’t coming out of the biggest surge in inflation in over 40 years. But after missing their inflation target badly during the post-pandemic recovery, they are anxious to do better on that half of their dual mandate, even if that means risking a weaker economy and job market.

Comerica forecasts for the Fed to begin cutting the federal funds rate with an initial cut in September, followed by another cut in December. High interest rates will be a major headwind to the economy this year, especially since fiscal policy is less stimulative than it was in 2023. Real GDP growth slowed to 1.6% annualized in the first quarter after a strong stretch in the second half of 2023. It will likely stay in low gear in the rest of 2024. That will allow the U.S. economy’s productive capacity to catch up with demand, further slowing inflation.

For a PDF version of this publication, click here: Inflation Took Two Steps Forward(PDF, 180 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.