Key Takeaways:

- Benchmark house price indexes were weaker than expected in April. More timely data show house prices softening further in May.

- Existing home sales were anemic in May, with the listings-to-sales ratio up to the highest since 2016.

- Consumer confidence fell in June as views of the job market weakened to a post-pandemic low.

- Some Fed governors are starting to push for a rate cut, but Chair Powell continues to advocate a wait-and-see approach to setting rates.

- Comerica forecasts for the Fed to hold rates unchanged in the second half of 2025.

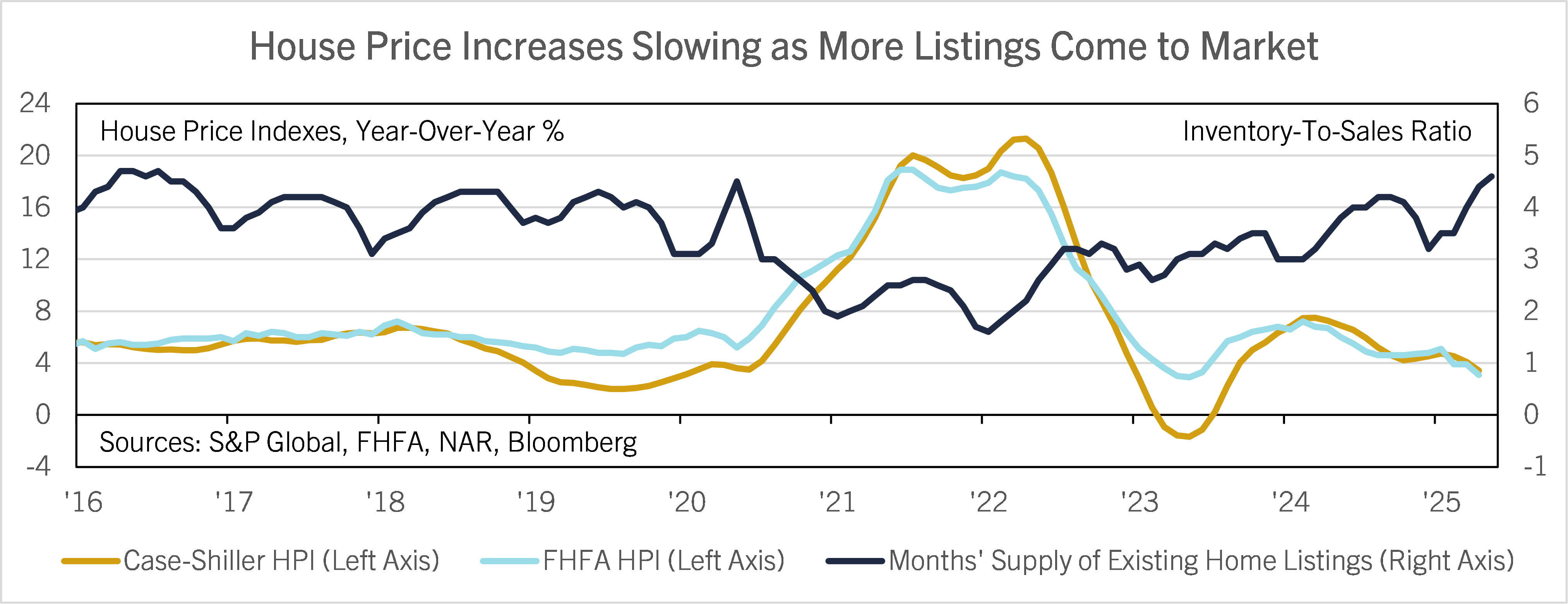

House prices fell more than expected this spring. The FHFA Purchase-Only House Price Index fell 0.4% on the month in April, worse than the consensus forecast for no change. From a year earlier, the FHFA Purchase-Only HPI rose 3.7%, down from 3.9% in April to its slowest increase since June 2023. The S&P CoreLogic Case-Shiller 20-City House Price Index (Case-Shiller HPI) fell 0.3% in April, with March revised from a 0.1% decline to a 0.2% decline. From a year earlier, the Case-Shiller HPI rose 3.4%, down from 4.1% in March.

Other more timely house price indexes show this weakness extending into May. The median price of an existing home sold in the U.S. rose 1.3% on the year in May, down from 1.8% in April to its lowest since June 2023. Existing home sales were an anemic 4.03 million in May, up 0.8% from April but down 0.7% from a year earlier. The listings-to-sales ratio was the highest since 2016 in May. The Zillow House Value Index registered a weak 0.8% year-over-year increase in May, the weakest since August 2023, and in seasonally-adjusted terms has fallen for three consecutive months.

The Conference Board’s Consumer Confidence Index® was weaker than expected in June, pulling back to 93.0 from 98.4 in May; the consensus forecast expected a modest gain. The survey’s Labor Differential fell to the lowest since early 2021, when the unemployment rate was over 6%—this component measures the share of consumers saying jobs are “plentiful” less those saying they are “hard to get,” and is a good cross-check of the unemployment rate. Like the Labor Differential, the Present Situation sub-index was down on the month—it was the second weakest since early 2021.

Other recent survey data have been mixed. The Manufacturing Purchasing Managers Index (PMI) from S&P Global was unchanged at 52.0 in the June flash estimate, while the Services PMI pulled back to 53.1 from 53.7. Business surveys from the New York, Philadelphia and Richmond branches of the Federal Reserve are holding in negative territory in this month’s releases.

In a statement to Congress today, Chair Powell reiterated his support for a wait-and-see approach to responding to the big policy changes out of the White House and Congress in the last few months. On tariffs, Powell says, “The effects on inflation could be short lived—reflecting a one-time shift in the price level. It is also possible that the inflationary effects could instead be more persistent… For the time being, [the Fed is] well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.” This essentially repeats the Fed’s guidance at their June 18 decision, which was the consensus view of the members of their rate setting committee. Since that meeting, Fed Governor Waller and Fed Vice Chair for Supervision Bowman have broken with the consensus and advocated for a July rate cut.

The Fed is being pulled in opposite directions by the latest economic data. On the one hand, the second quarter’s jobs, housing, survey, and business activity data look shaky. House prices are falling, consumers are grumpy, and labor demand is trending down. On the other hand, businesses are saying in surveys that their input costs are rising due to tariff hikes, which will likely push up prices that consumers pay later this year. It’s little surprise that some of the Fed’s policymakers want to hold rates steady while others want to cut.

In addition to the conflicting data flow, the Fed needs to consider fiscal policy—specifically, expectations for more deficit-funded stimulus in 2026 as the reconciliation bill comes into effect. Another big variable is how immigration policy will affect labor supply. Foreign-born workers accounted for four fifths of all labor supply growth in the United States in the half-decade ended in January. While job growth is slowing, labor force growth is also likely to slow given much less immigration. International flows into the job market are difficult to measure in real time. With less job growth but also less labor supply growth, Comerica forecasts for the unemployment rate to hold mostly steady in the second half of 2025. As such, Comerica forecasts for the Fed to hold the federal funds target rate unchanged in the second half of 2025 as they monitor the effects of higher tariffs, and wait to see the effects of more-than-offsetting cuts to other taxes in 2026.

For a PDF version of this publication, click here: House Prices and Consumer Confidence Fall(PDF, 116 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.