Fed Dot Plot Pares Back Expectations for Rate Cuts in 2024;

CPI Cools More Than Expected in May

• The Fed held their monetary policy stance unchanged at their June decision as universally expected, and kept their policy statement and forward guidance largely unchanged.

• However, the Fed’s quarterly dot plot shows policymakers think fewer rate cuts are likely to be appropriate before year-end than they thought the last time they published a dot plot, back in March.

• CPI cooled a little more than expected in May, with annual core CPI registering the least since mid-2021.

• Comerica expects for the Fed to make one or two quarter percentage point rate cuts by year-end, with two cuts slightly more likely than one.

• The Fed will continue to reduce the size of the balance sheet at the slower pace they announced in May, and will likely end balance sheet reductions in the first half of 2025.

As universally expected, the Fed held the federal funds target steady at 5.25%-5.50% at their June 12 decision. While the FOMC’s policy statement was nearly unchanged from the May statement, FOMC members did revise the quarterly dot plot to indicate most policymakers think fewer rate cuts will be appropriate this year than they thought likely the last time they published a dot plot, in March. In the latest dot plot, 15 of 19 FOMC members think either one or two quarter percentage point rate cuts will likely be appropriate by the end of 2024. By comparison, 15 of 19 members thought three or more rate cuts would be appropriate in the prior dot plot.

The dot plot also shows that FOMC members raised their projections for total and core PCE inflation this year, largely reflecting hotter-than-expected inflation data released since March. They held steady their projections for real GDP growth and the unemployment rate in 2024, but slightly raised their projection of the unemployment rate in 2025 and 2026. Policymakers saw risks to the unemployment rate and inflation skewed to the upside, meaning they think both are more likely to be higher than projected.

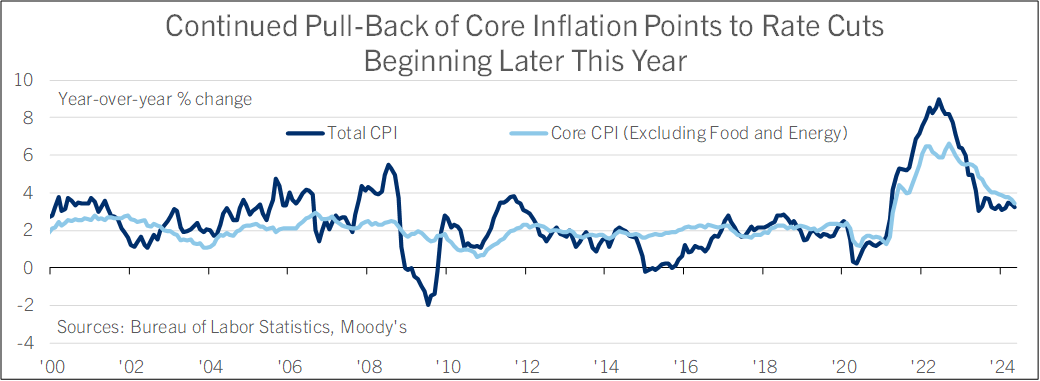

The FOMC’s monetary policy statement was little changed in June. Where May’s statement said that “in recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective,” the June statement read, “in recent months, there has been modest further progress” (emphasis ours). The changed wording reflects the FOMC’s reaction to the May CPI report, which was published on the morning of the decision, and which showed inflation slowing more than expected. The Consumer Price Index was flat on the month, undershooting the consensus forecast for a 0.1% increase. Gasoline prices fell 3.6%, contributing to a 2.0% decline in energy costs. Food prices rose 0.1%, with food at home unchanged and food away from home up 0.4%. The core CPI excluding food and energy rose 0.2%, also undershooting the consensus forecast for 0.3%. In year-over-year terms, total CPI slowed to 3.3% from 3.4%, while core CPI slowed to 3.4% from 3.6% and was the slowest since mid-2021.

Within the core basket, core goods prices were flat on the month. New vehicle prices fell another 0.5%, and were down 0.8% from a year earlier. Used vehicle prices rose 0.6% after a larger decline in April but were still down 9.3% on the year. Core services rose 0.2% on a 0.4% increase of shelter costs, while core services excluding energy and shelter (sometimes called Supercore CPI) were flat on the month.

The clearest trend in recent CPI reports is a continued slowdown of core inflation, which in annual terms pulled back in May to the least in over three years (See chart). But its path lower has been a bumpy one, interrupted by several hotter-than-expected inflation reports in the opening months of 2024.

Following the Fed decision and the cooler-than-expected CPI report, Comerica is maintaining its forecast for the Fed to begin reducing the federal funds rate with a quarter percentage point rate cut in September, followed by a second cut in December. But the decision between one or two cuts will be a close call, and a slim majority of FOMC members think one cut by year-end would be more appropriate than two. However, the members favoring two cuts are probably a majority of the FOMC’s voting membership, since only a minority of the regional fed presidents vote in each meeting, and they tend to be leerier of rate cuts than the Fed governors.

Less remarked upon at the June decision, the Fed slowed the pace at which they are reducing the size of their balance sheet in June to a maximum of $60 billion per month from $95 billion previously, a change they announced at the May FOMC decision (a.k.a. Quantitative Tightening or QT). The Fed will likely continue to reduce the balance sheet at this slower pace through the turn of the year, and eventually end balance sheet reductions in the first half of 2025 when total Fed assets reach between $6.6 and $6.9 trillion.

For a PDF version of this publication, click here: Fed Dot Plot Pares Back Expectations(PDF, 117 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.