Key Takeaways:

- Existing home sales fell more than expected in April, while new home sales rose.

- March had the highest months’ supply for existing listings since 2016, though the absolute level of listings is down by a third since then.

- Existing home sales might rebound in April since mortgage rates dipped early in the month on economic uncertainty.

- If the economy weakens and the Fed cuts rates, lower mortgage rates could aid home sales in 2025 and 2026 and cushion a slowdown.

- However, foreign investors are shying away from U.S. capital markets amid the trade conflict, pushing mortgage rates higher.

- If foreign investors can’t be reassured that their money is welcome in our country, a housing downturn could become a tail risk in 2025 and 2026.

Existing home sales pulled back 5.9% to a 4.02 million seasonally-adjusted annual rate in March, below the 4.13 million consensus. Existing home sales fell 2.4% on the year. Listings of existing homes rose to 1.33 million, up from 1.11 million in March 2024. Existing listings were equivalent to 4.0 months’ supply at the March sales pace, up from 3.2 months in March 2024. This was the highest level of months’ supply for the month of March since 2016, but both sales and listings are way down from then—listings are down by nearly a third.

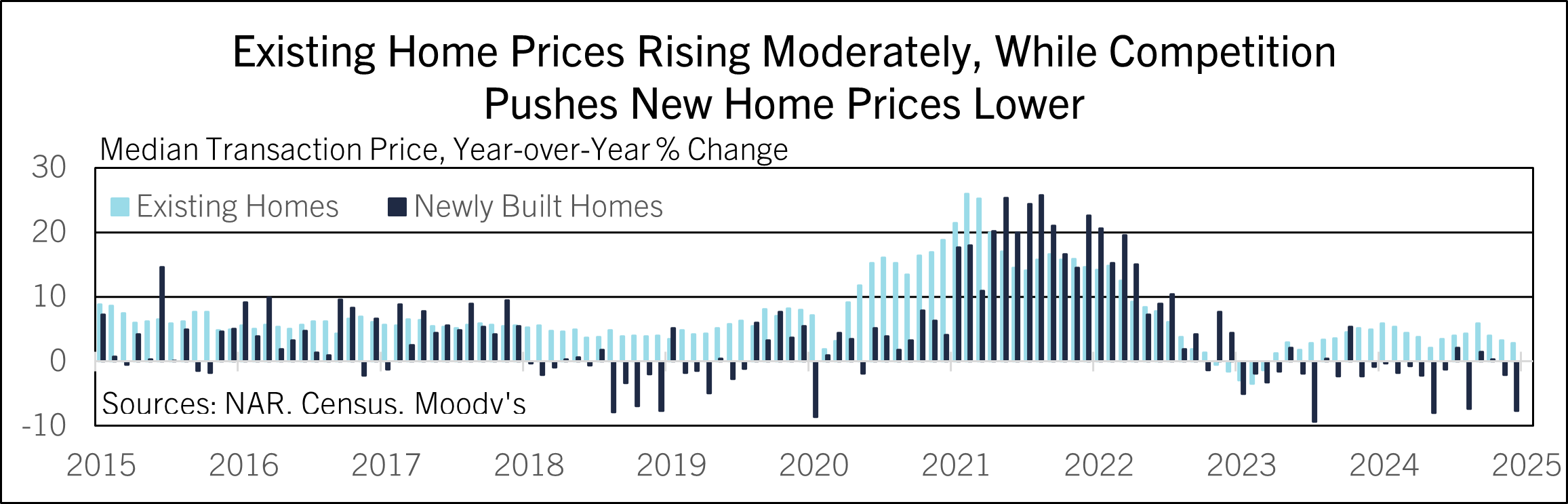

New home sales jumped 7.4% in March after a 3.1% increase in February and were up 6.0% from a year earlier. New home listings pulled back to 8.3 months’ supply at the March sales pace. In absolute terms, new home listings are near the highest since 2008. The median price of an existing home sold rose 2.7% on the year in March to $403,700, while the median price of a new home sold fell 7.5% on the year to $403,600.

Considering both releases, housing sales were choppy in March, with a big jump in new sales but a drop in existing sales. In the newly built segment, builders are offering mortgage rate buydown incentives and trimming floorplans to ease affordability challenges, helping to keep units moving. They are also discounting, making newly-built homes unusually price competitive with existing ones—it’s quite unusual for the median sale price of an existing home to be higher than a new home in the U.S., as it was in March. This partly reflects that new construction is concentrated in the South, where prices are lower.

The long-term outlook for U.S. housing is bullish. Working-age Americans want more living space than before the pandemic because more of them work remotely. That increases demand for home offices and other living space. Higher demand for residential space is the flip image of chronically weak demand for office space.

But in the near term, home sales will depend on crosswinds in the broad macro backdrop. Increased uncertainty about the economic outlook caused mortgage rates to dip in early April, which could help existing sales rebound when this month’s data are published in May.

However, mortgage rates have risen over the rest of April as foreign investors shied away from parking their money in U.S. capital markets. That has pushed up long-term interest rates, like mortgage rates, relative to shorter-term interest rates. Short-term interest rates are largely set by the Fed. Long-term rates are influenced by the Fed, but also by the decisions of the investing public, including foreign investors.

Typically, when the economy slows and the Fed cuts rates, mortgage rates fall and help housing propel a rebound from the soft patch. In recent years, high mortgage rates have been a big headwind to home sales, so sales have a lot of room to rebound if rates come down. Comerica’s April forecast sees mortgage rates falling this year and next and supporting growth of existing and new home sales, despite prices that are high relative to disposable incomes.

However, housing won’t rebound if foreign investors can’t be reassured that holding dollars is still a good idea. If foreign investors’ concerns about their exposure to the U.S. economy deepen, mortgage rates and other long-term interest rates might stay high even if the economy enters a recession and the Fed cuts short-term rates more than expected. That would increase the tail risk of a painful housing correction.

For a PDF version of this publication, click here: Choppy Home Sales in April(PDF, 117 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.