Key Takeaways:

- Job growth was reassuringly normal in the April jobs report.

- The unemployment rate held unchanged and job growth in the survey of households was solid.

- Wages rose modestly on the month but still outpaced inflation.

- While other data have pointed to softer labor demand, the benchmark monthly jobs report looks fine.

- The Fed will hold rates steady at their May 7 decision. Comerica forecasts for the Fed to cut rates three quarters of a percent in the second half of 2025, but risks are tilted toward fewer cuts than forecast.

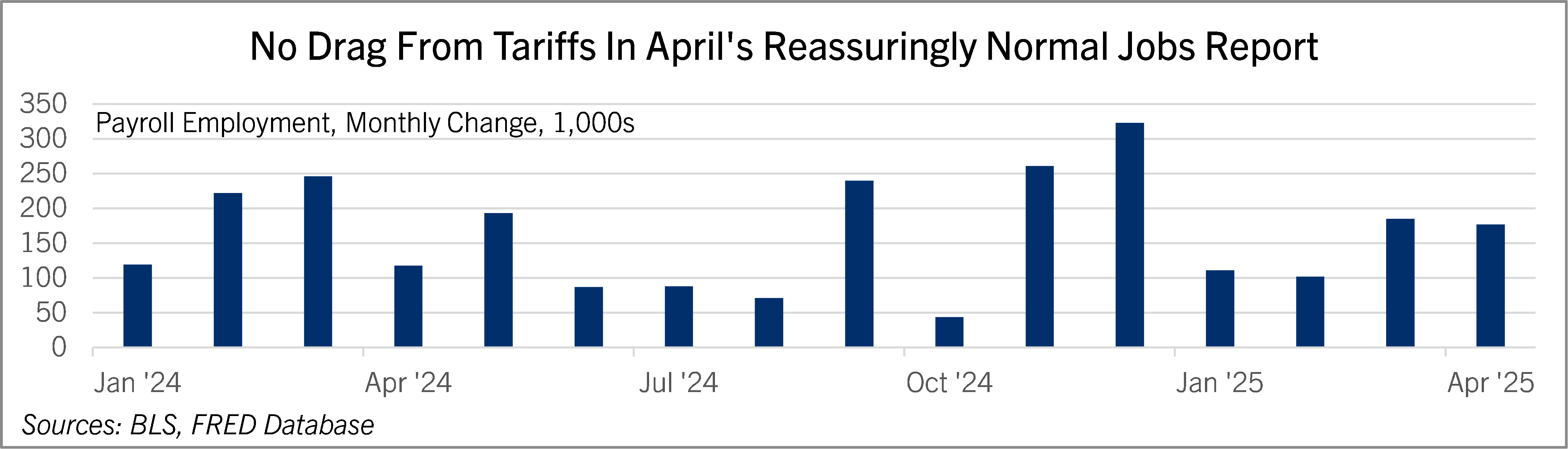

April’s solid jobs report allays some fears of an immediate drag from tariff uncertainty. U.S. employers added 177,000 nonfarm payroll jobs, above the 138,000 consensus forecast. Comerica forecast 115,000. Job growth in February and March were revised down a net 58,000. After revisions, payrolls averaged a moderate 155,000 increase in the last three months. From a longer-term perspective, job growth is trending slower. Payrolls growth averaged 144,000 per month so far in 2025, down from 168,000 per month in 2024 and 216,000 per month in 2023.

By industry, there were 11,000 jobs added in private goods-producing industries in April, with construction fueling the entire net increase. A 1,000 drop in manufacturing jobs was offset by an equal increase of mining and logging jobs. Private service-providing industries added 156,000 jobs, with a 58,000 increase in healthcare and social assistance, a 29,000 increase in transportation and warehousing, and a 24,000 increase in leisure and hospitality. Jobs edged slightly lower in retail, utilities, and “other services” like drycleaning shops. Government employment rose 10,000. Federal workers who have received layoff notices or accepted buyouts, but who are still receiving pay, are counted as employed in the jobs report.

The unemployment rate was unchanged at 4.2% in April. That matched the consensus forecast but was better than Comerica’s forecast of an uptick to 4.3%. Details of the survey of households were quite good: Employment rose 436,000 and the labor force increased 518,000. With more people entering the workforce than finding jobs, the number of unemployed rose 82,000. The labor force participation rate edged up to 62.6% from 62.5% in March and 62.4% in February.

The unemployment rate for Asian American workers fell to 3.0% from 3.5%, but rose for other racial and ethnic groups: Black or African American workers’ unemployment rate edged up to 6.3% from 6.2%, Hispanic or Latino workers’ rose to 5.2% from 5.1%, and White workers’ rose to 3.8% from 3.7%. The unemployment rate for adult men over age 20 rose to 4.0% from 3.8% while the unemployment rate for adult women was unchanged at 3.7%. The unemployment rate for teenagers fell to 12.9% from 13.7%. Average hourly earnings rose 0.2% from a month earlier and were up 3.8% on the year, unchanged from March. They outpaced the CPI, which rose 2.4% on the year in April. The average workweek held steady at 34.3 hours (March was revised up from 34.2 hours in the prior report).

The jobs data for April are reassuring, but a number of other economic indicators point to uncertainty ahead. Many recent surveys reflect rising concern about the economic outlook given higher tariffs. There are some indications that businesses are reining in plans for hiring and capital spending. Consumers front-loaded purchases of cars and other long-lasting products in late 2024 and early 2025, and demand for those goods could weaken. And many consumer-facing companies released cautious earnings guidance in the first quarter earnings season or pulled guidance entirely, a hint that their proprietary indicators of consumer spending could be weakening. Also, ADP’s measure of payrolls growth was quite a bit weaker in April than the government’s data. Job growth in the government survey was stronger than ADP for most of 2024, but the government’s data was ultimately revised down to be closer to ADP’s when their statisticians factored in more comprehensive, slower-to-gather data sources.

But the Fed attaches a lot of weight to the Bureau of Labor Statistics’ monthly jobs report. The report carries more weight in their decision-making than those secondary indicators we just listed, or even than the Fed’s own forecasts. And April’s report from the BLS looked just fine. Even if jobs grow slower this year, labor force growth is also slowing due to less immigration, so the year-to-date pace of job growth is enough to keep up with jobseekers entering the workforce.

The Fed is pulled in two directions by tariffs. On the one hand, they’re concerned that slower job growth could raise unemployment. On the other hand, they’re worried about inflation. In the near term, they are likely to hold interest rates steady. The Fed will hold the federal funds target unchanged at the May 7 decision. Comerica’s forecast sees job growth slowing further in the next few quarters, which is expected to make the Fed cut their target rate by three quarters of a percentage point in the second half of 2025. However, the Fed sees the bar to rate cuts as higher amid rising inflation than during a conventional slowdown, when inflation slows. That means that the Fed is more likely to cut rates by less than Comerica forecasts than to cut rates more than Comerica forecasts.

For a PDF version of this publication, click here: April's Reassuringly Normal Jobs Report(PDF, 118 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.