Key Takeaways:

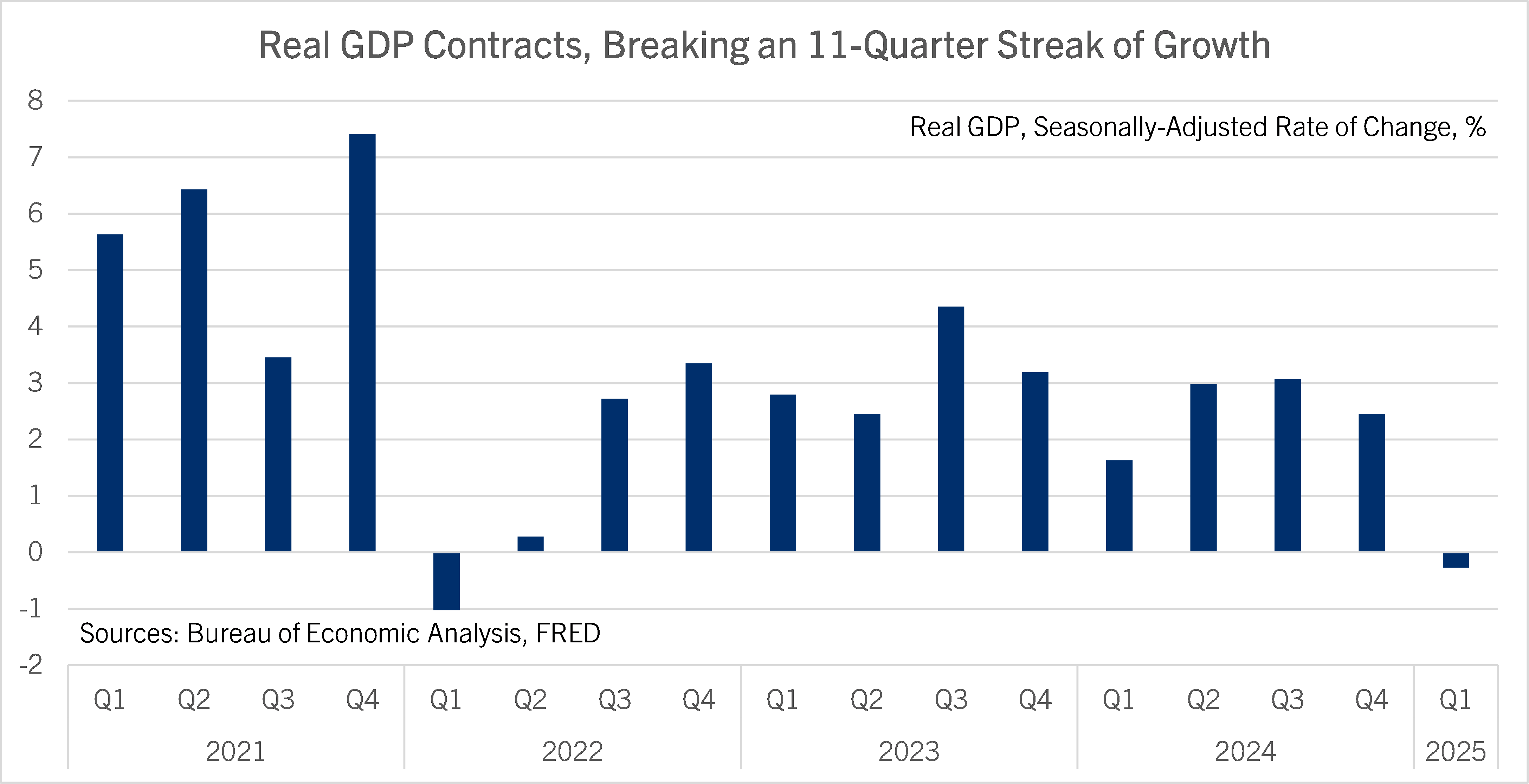

- Real GDP contracted in the first quarter of 2025, its first drop in three years.

- Businesses splurged on imports, inventories, and equipment before tariffs began to raise prices. Consumer spending was slower and the federal government’s direct expenditures plunged.

- Inflation accelerated across all major measures.

- The backward-looking GDP report is less relevant to the outlook than usual, since trade policy changed much more than expected in April.

- Private job growth slowed in April, according to ADP. Downside risks to the outlook are increasing.

- The Fed will likely hold interest rates steady at the May meeting, but a rate cut is possible in June.

Real GDP contracted at a 0.3% annualized pace in the first quarter, down from 2.4% growth in the fourth quarter of 2024. This was the first quarter of contraction since the first quarter of 2022. Business spending on imports surged in the first quarter as companies front-ran tariffs. Goods imports surged at a 50.9% annualized pace, feeding into a big runup of inventories, which contributed 2.25 percentage points to real GDP growth. Businesses also made big purchases of equipment, mostly information processing equipment.

Federal government expenditures in the GDP report plunged 5.1% annualized. The GDP report only measures direct federal spending on goods and services, and doesn’t include money spent on Medicare, Medicaid, Social Security, or debt interest. Those categories collectively account for most federal outlays. Personal consumption expenditures growth slowed to 1.8% annualized in the first quarter from 4.0% annualized in the fourth quarter of 2024. From a year earlier, real GDP grew 2.0%, which was its slowest increase since the fourth quarter of 2022.

At the same time that growth slowed, inflation accelerated. The GDP price index picked up to a 3.7% annualized increase from 2.3% in the fourth quarter of 2024 and registered the hottest increase since the fourth quarter of 2022. The personal consumption expenditures price index increased 3.6% annualized after a 2.4% annualized increase in the fourth quarter of 2024 and rose the fastest since the first quarter of 2023. The core PCE price index rose at a 3.5% annualized rate, the fastest increase since the second quarter of 2023.

In separately released data, the private payroll processing company ADP estimated that U.S. employers added 62,000 jobs to payrolls in April, well below the 115,000 consensus forecast. April saw the weakest monthly increase in the ADP measure of employment since July 2024. The Bureau of Labor Statistics will issue their report on payroll jobs growth on May 2, which is seen as more authoritative than the ADP report.

Looking at GDP, the ADP release, as well as other recent economic data, the economy is weakening in the first half of 2025. Businesses and consumers pulled forward purchases to get ahead of tariffs in the first quarter and throttled back spending and investment plans in other areas. Cuts to federal outlays are a headwind, too.

Given the unexpectedly large hikes to tariffs in April, the backward-looking GDP report for the first quarter says less about the economy’s trajectory than a GDP report usually does. That makes April’s jobs data more important for understanding the economy. According to ADP, private employers scaled back hiring in the month. Between the GDP report, that ADP report, and the pullback in business and consumer surveys in April, the economy looks to be losing momentum. Risks to the economic outlook are increasing. At the same time, inflation picked up in the first quarter and looks set to accelerate further near-term.

The Fed won’t be happy to see a weak GDP report with higher inflation, but they won’t be much surprised by it, either. Chair Powell has said that the Fed expects April’s larger-than-expected increases in tariffs to slow growth and raise inflation. The Fed will likely hold rates steady at their decision in the first week of May given that so much is unknown about the end state of tariff policy and how it will affect the economy. However, a rate cut at the Fed’s meeting in June is a live possibility. Comerica forecasts for the Fed to cut the target for their policy rate by a cumulative three quarters of a percent by the end of 2025.

For a PDF version of this publication, click here: Real GDP Contracted Slightly in the First Quarter(PDF, 114 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.