Summary

- U.S. economy contracted 0.3% in Q1 2025, the first decline in three years, primarily due to imports surging ahead of Trump's tariffs add period after tariffs.

- The PCE price index at 2.3% YoY in March was down from February but above market expectations.

- The U.S. Dollar Index gained 0.70% this week despite negative data, supported by trade agreement optimism.

- Euro-zone GDP grew 0.4% in Q1, exceeding expectations and previous quarter.

- Canadian GDP contracted 0.2% in February as the incumbent liberal party won election with thin margin.

- British pound remained relatively stable despite mixed economic signals.

U.S. GDP, Inflation and the U.S. Dollar

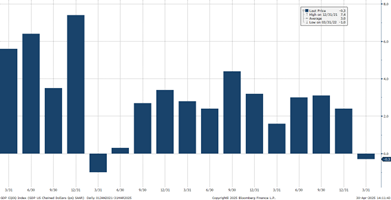

On Wednesday April 30th, the Bureau of Economic Analysis reported a 0.3% annualized decline in GDP for the first quarter. This is first time the U.S. economy has contracted in three years. This downturn has been largely attributed to a surge in imports as businesses accelerated purchases before President Trump's tariffs come into effect. This led to a sharp increase in the trade deficit which offset gains in domestic demand. The contraction follows 2.4% GDP growth in Q4 2024. The trade deficit in goods played a pivotal role in the GDP drop, reflecting the effects of President Trump's tariff policies.

U.S. GDP QoQ

So far, the Federal Reserve has left the Federal funds rate unchanged; noting the unpredictability of tariff impacts and the need to get a clearer picture of their economic effects. Many economists and company CEOs fear that tariffs will end up causing inflation and unemployment.

The March Consumer spending report from the Commerce Department showed consumer spending rising at the strongest pace this year, with a big jump in vehicle sales-likely consumers trying to get ahead of the tariffs.

On the inflation front, the Personal Consumption Expenditure price index increased 2.3% YoY in March 2025. This was the lowest increase in five months, but it was still above the market expectations of 2.2%. In February PCE prices rose 2.7%.

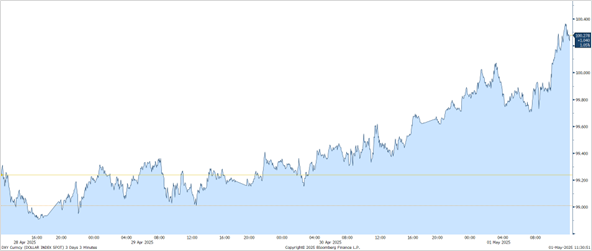

In terms of price action, the US Dollar Index (DXY) has had a positive week gaining 0.70% despite the negative data releases. The driver of this week’s rally seems to be a more positive market sentiment, supported by optimism around possible trade agreements with many of the U.S trading partners including China, which could soften the impact of tariffs. Such possibility seems to have improved investors risk outlook, reducing the pace of flows out of US dollar assets that we saw last week.

Euro Area GDP and the Euro

Eurostat reported Euro-zone GDP growth at 0.4% in Q1 2025 versus 0.2% in the previous quarter, exceeding market expectations of 0.2%. This increase in economic activity is attributed to stronger domestic demand, due to lower inflation, lower borrowing costs and optimism prompted by Germany's agreement to loosen fiscal constraints, and expectations of increased infrastructure and defense spending in the coming months.

The euro currency has faced a relatively quiet week, with its performance largely influenced by cautious signals from the European Central Bank and ongoing geopolitical uncertainties. Like the Fed, ECB policymakers have maintained a wait-and-see approach, emphasizing the need for sustained evidence of inflation convergence before considering any major policy shifts. Economic data, particularly from Germany and France, have shown mixed results, contributing to a lack of direction for the currency in the last few days.

Discussions around trade tariffs and fiscal stability within the Eurozone have also limited the upside momentum, for the euro. As of this writing, the EUR/USD pair is trading around 1.1283, reflecting pressure from a stronger U.S. dollar.

Canadian Election and Canadian Dollar (CAD)

The Canadian dollar faced moderate pressure this week, shaped by a mix of domestic economic data, central bank policy updates, and political developments.

The GDP figures released this week showed a 0.2% contraction in February and growth of 1.6% YoY, highlighting

challenges in Canada’s economic momentum. The Bank of Canada has maintained a cautious stance, with market analysts focused on any signs of monetary policy shifts as economic growth and US tariffs continue to be a concern.

On the political front, the Canadian federal election this week concluded with a closely watched outcome, a victory for the incumbent liberal party, which retained power with a very thin margin. This result has introduced debates over path of fiscal policy, with investors assessing the election’s long-term implications for business confidence and public spending.

The USD/CAD pair is trading around 1.3862, reflecting slight strength of the US dollar against most currencies this week.

British Pound (GBP)

The British pound, has seen relatively stable performance this week, underpinned by mixed economic data and corporate earnings reports from key U.K. firms.

Positive earnings from companies like HSBC and British Petroleum provided temporary support to market sentiment, while broader global risk appetite and trade concerns, have put pressure on the British pound.

The GBP/USD pair is trading near 1.3267, reflecting marginal weakness as investors balance mixed economic signals domestically against the backdrop of U.S trade negotiations.

Japanese Yen (JPY)

The Bank of Japan unanimously decided to hold interest rates as anticipated at 0.5%. Amid trade policy uncertainty, the Bank also slashed its growth and inflation forecasts, downgrading the likelihood of future hikes.

In mid-April, Japanese Prime Minister Shigeru Ishiba announced a series of stimulus packages for corporate financing and subsidies to lower the cost of fuel and electricity to help industries and households affected by the Tariffs.

The USD/JPY pair is trading at 145.52, reflecting lowered growth expectations as the Bank of Japan continues to monitor economic and price data in relation to interest rate policy.

Contact Comerica Foreign Exchange

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.