Summary

- Canadian dollar remains firm, despite giving back some recent gains.

- The U.S. dollar gains final 4 days of the year, despite suffering an approximately 8% loss in 2025.

- Japanese yen ends year flat near 157 per U.S. dollar after touching 140 in April.

- Japanese yen, China’s yuan forecast to gain in 2026 even versus firmer U.S. dollar: Standard Chartered Bank.

- U.S. Treasury yield steady at 4.15% on the benchmark 10-year bond yield.

- Mexico peso ends year on firm note, having gained over 13% in 2025 versus the U.S. dollar.

- British pound sterling slips marginally to end best year since 2017; gilts gain.

- U.S. weekly jobless claims 199,000 in December 27 week versus 218,000 forecasts; four-week average 218,750.

- Australian dollar / New Zealand dollar hits 7-week high on China data.

- Asian currencies head for first gain in five years. CNY tops 7/USD for first time since 2013, or 31 months.

- Brazil real caps best year since 2016 on weak U.S. dollar, interest rates.

Noteworthy

U.S. Dollar Records Worst Year Since 2017, On Positive Note

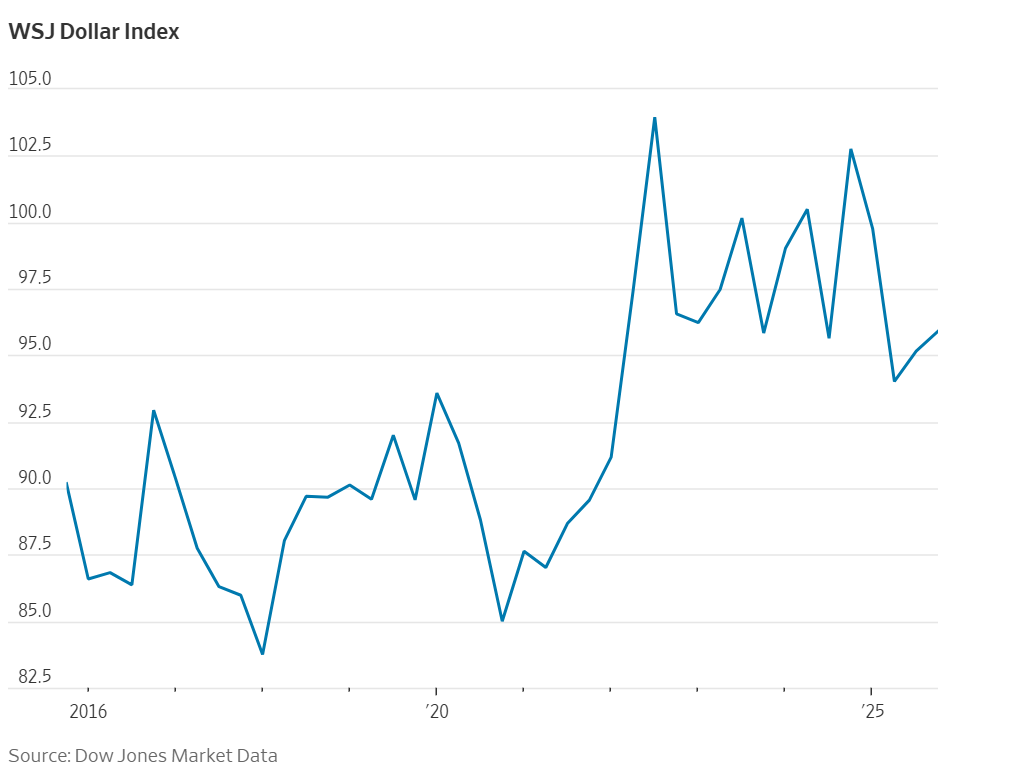

The U.S. dollar's bull run went into reverse in 2025:

- The U.S. dollar is on track to end the year down almost 8% against a basket of currencies. That would mark its biggest annual drop since 2017.

- The euro currency has jumped more than 13% versus the dollar, on track for its best year since 2017.

- The British pound sterling has risen almost 8% against the dollar, also its largest yearly gain since 2017.

The U.S. dollar diverged this year from other U.S. assets. Stock markets largely brushed off broad span tariffs and other big shifts in economic policy, as well as the White House's pressure on the Federal Reserve.

For dollar investors, policy volatility forced a rethink of their exposure. Overseas investors moved to hedge dollar investments. Other factors weighing on the dollar included debt sustainability concerns and interest-rate cuts.

Wall Street is bracing for the dollar to weaken further in 2026. Goldman Sachs analysts project the U.S. dollar will average a 2.8% decline against global currencies in the next 12 months.

The euro currency could gain another 6.6% against the dollar, according to Goldman, as Germany's infrastructure-and-defense spending kicks into higher gear.

Other financial houses are more neutral with a few predicting dollar gains in 2026, especially if the U.S. Federal Reserve fails to reduce interest rates further as economists and traders expect.

The dollar’s fall this year and in 2017 coincide with the first years of President Trump’s two terms in office. The dollar regained some ground in 2018, rising 4.4%, but may be unlikely to experience a similar recovery in the year ahead.

Contact Comerica Foreign Exchange

This publication has been prepared for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice. The information contained herein has been obtained from sources believed to be reliable, but Comerica does not represent, or guarantee, its completeness or accuracy. The views expressed herein are solely those of the author(s) at the time of publication. Comerica will not be responsible for updating any information contained within this publication, and such information is subject to change without notice. Comerica does not assume any liability for any direct, indirect or consequential losses that may result from reliance upon this publication.