Benefits of digital payments for business owners

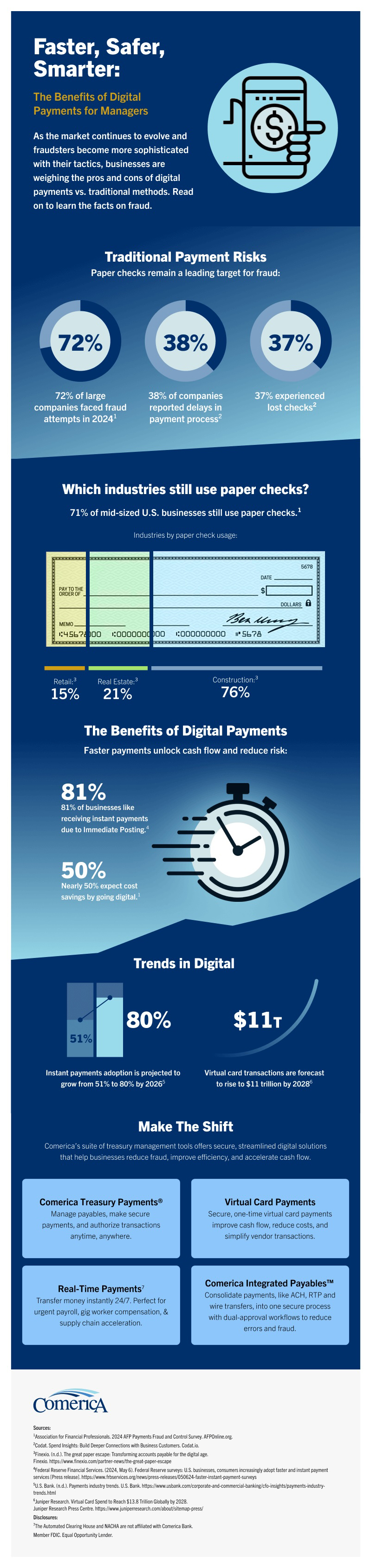

What’s the safest and smartest way to manage payments? As the market continues to evolve and fraudsters get more sophisticated with their tactics, businesses are weighing the pros and cons of digital payments versus traditional methods like paper checks.

Read on to learn more about key facts to consider for your company.

Want to learn more about digital payment solutions that can be customized to your business needs? Visit our Cash management solutions page.

This information is provided for general awareness purposes only and is not intended to be relied upon as legal or compliance advice.

This article is provided for informational purposes only. While the information contained within has been compiled from source[s] which are believed to be reliable and accurate, Comerica Bank does not guarantee its accuracy. Consequently, it should not be considered a comprehensive statement on any matter nor be relied upon as such.