Noteworthy

- U.S. Dollar Climbs for Sixth Day, Sets Fresh Year-to-Date High The U.S. Dollar

One year ago today, the British pound appeared headed for the once unthinkable: parity with the U.S. dollar.

Sterling dropped to $1.0350—its lowest level ever—in the early hours of September 26, as Asian financial hubs kicked off trading. Investors feared the currency could breach a 1-1 exchange rate with the dollar.

That didn’t end up happening. The pound stabilized throughout the day as European and U.S. trading came online.

Nevertheless, the episode became a symbol of Britain's economic and political malaise. It also showcased the risks looming in the global financial system after the era of ultra-low interest rates that had enabled governments, companies, and households to borrow aggressively.

The pound's rout kicked off a few days earlier, on Sept. 23, 2022, when a new U.K. government headed by Liz Truss unveiled plans for a huge program of subsidies and tax cuts, paid for by borrowing, to revive the economy.

Market backlash was fast and fierce, with investors alarmed by the potential impact on inflation and interest rates, as well as the sustainability of U.K. finances.

Long-term government bonds tumbled alongside the pound, ensnaring a little-known hedging strategy used by pensions. The Bank of England stepped in to rescue the bond market.

Truss resigned after 45 days in office, becoming the shortest-ever serving U.K. prime minister.

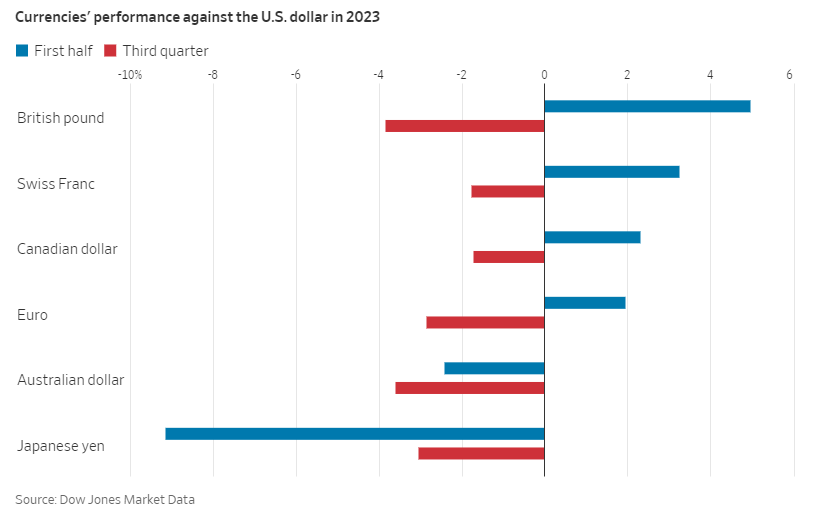

One year on, the pound is trading above $1.21 but is under pressure. After surging 5% in the first half of this year—the best performance of any major, developed currency against the U.S. dollar—it is once again lagging.

Weak growth prospects, the long-term effects of Brexit, ongoing questions over debt sustainability and a stubborn inflation problem have all made investors wary of holding U.K. assets.

Bank of America analysts recently cut their sterling forecast, now expecting to see the currency at $1.18 by year-end, compared with an earlier prediction of $1.24.

The pound may not be back on the road to parity, but its best days are likely behind it for the foreseeable future.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.