Noteworthy

- U.S. Dollar Retreats for Fourth Day as Focus Turns to FOMC Dots

The U.S. Dollar

All eyes are on the Federal Reserve meeting this week. Central bankers at Asia’s two largest economies will be paying extra attention.

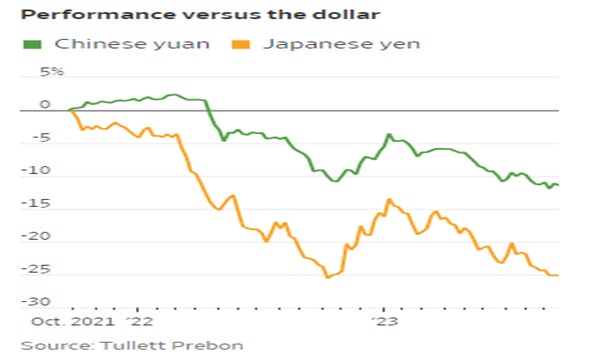

The Chinese yuan and Japanese yen are both hovering at their lowest levels against the dollar in more than a decade. The yuan has lost 13% versus the dollar since the beginning of 2022 while the yen has dropped 22%.

Both countries are grappling with weakening currencies—but their economies are in quite different situations. China must ward off deflation as its real estate implosion continues to weigh on industry and consumer sentiment. Japan, on the other hand, is contending with its highest inflation in decades.

Yet there are some important similarities too. Both countries’ central banks have pursued relatively loose monetary policies as growth challenges have mounted—in contrast with most other developed economies, which have been raising rates rapidly. China has been cutting interest rates and the amount of cash banks must hold in reserve to juice up its economy. Japan is hesitant to give up its longstanding policy of targeting ultralow interest rates in fear that the country could eventually slip back into deflation or near-deflation too—a problem it wrestled with for years in the wake of its own burst asset bubble in the 1990s.

Widening interest rate differentials with the U.S. have put both currencies under pressure. Yields on Japan’s 10-year government bonds are 3.6 percentage points lower than on U.S. equivalents. The difference between Chinese and U.S. bonds is 1.7 points.

Both currencies have nonetheless staged a modest rebound from their lows lately. The People’s Bank of China warned speculators not to bet against the yuan earlier this month. Around the same time, Bank of Japan Gov. Kazuo Ueda told domestic media that an end to the BoJ’s negative rate policy could be in the cards if its 2% inflation target is sustained.

The risk of capital outflows probably makes China uneasy. It saw net outflows pick up to $42 billion in August, the fastest pace since 2016, according to Goldman Sachs. Given the country’s semi-closed capital account, there are many tools it can deploy to slow the pace of depreciation. Borrowing costs for the offshore yuan have gone up, which could deter some short-term speculators.

Yet ultimately, economic fundamentals—and monetary policy—will still drive the yuan’s trend. While the Fed looks likely to pause its rate increases, a stronger-than-expected economy could keep U.S. rates higher for longer. To stabilize its economy, China will likely need more monetary and fiscal stimulus than has been unveiled so far meaning an even higher interest rate differential and probably, higher imports once fiscal stimulus starts to kick in. Both of those will tend to weigh on the currency, especially if U.S. rates stay parked at their current high level in 2024.

In Japan, meanwhile, the central bank looks likely to tighten eventually as it becomes more confident that inflation—at a low level—has become more baked into households’ expectations. Japan’s core inflation, which excludes fresh food, has stayed above the central bank’s 2% target for more than a year already. Japan’s 10-year government bond yields rose to their highest level since 2014 recently.

China and Japan’s plunging currencies may chart different paths going forward—especially since the yen is already down so far against the dollar over the past two years. But they could both use an assist from the Fed, which may not be forthcoming for quite a while.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.