Noteworthy

- The World’s Dollar Addiction Is Hard to Kick

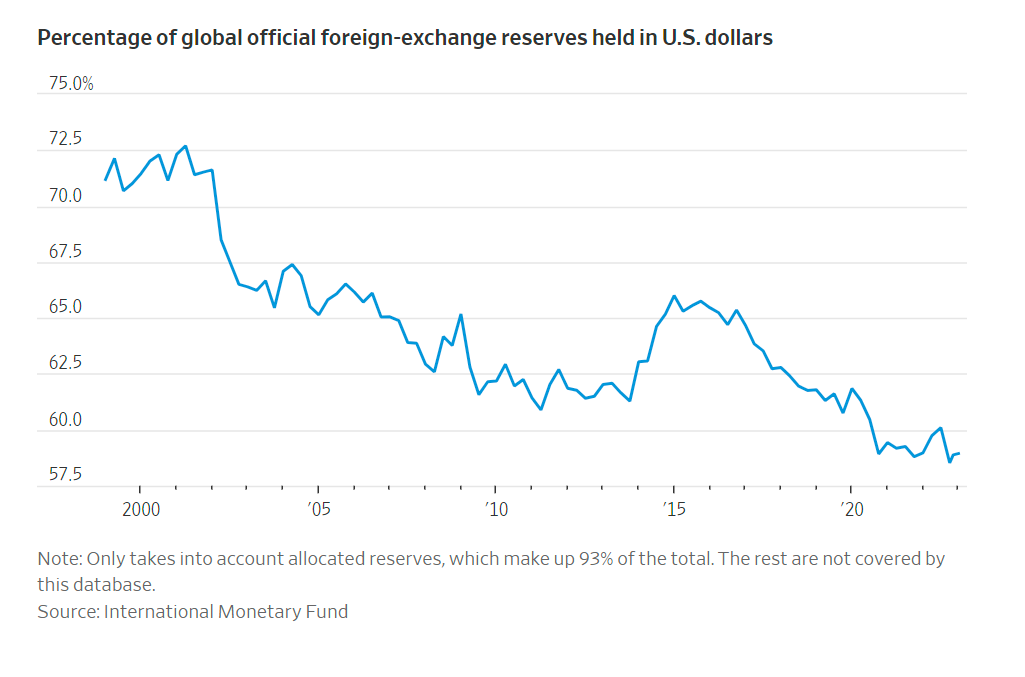

Though the share of global foreign-exchange reserves in U.S. dollars remains near a 25-year low, there is little sign of rapid de-dollarization.

Many central banks and governments around the world want to kick their dollar addiction. They aren’t getting very far—except when forced.

The percentage of official foreign-exchange reserves allocated to U.S. dollars globally was 58.9% in the second quarter of the year, figures published a few days ago by the International Monetary Fund show, broadly unchanged from the 25-year-low first reached in the fourth quarter of 2020.

Though the dollar serves as the bedrock of international financial markets, the backlash against globalization in recent years has prompted much talk of “de-dollarization.” Since Russia’s invasion of Ukraine, which dealt another blow to the established order, dollar reserves have fallen 2.9%, despite a jump in the currency’s value. At constant exchange rates, the drop would have been 6.6%.

In July, only about 30% of Russia’s export transactions were in dollars and euros, compared with roughly 85% at the start of 2022, a report a report by the Bank of Russia suggests, thanks to a jump in ruble settlements and the introduction of the Chinese yuan. The country’s sovereign-wealth fund is also saving in yuan, as are some households.

Indeed, some reserve managers have turned to the Chinese currency, and President Xi Jinping is intent on promoting the habit. IMF data shows that renminbi reserves have tripled since 2016.

Brazil has embraced it as a trade and reserve currency, with President Luiz Inácio Lula da Silva recently urging emerging nations to diversify away from the dollar. Argentina, which has been left without dollars following hefty payments to the IMF, has resorted to swapping yuan with the People’s Bank of China in exchange for wider adoption of the Chinese currency. This is ironic for a country that is debating whether to fully dollarize its economy as part of its presidential election campaign.

Then there is Beijing itself, which has a gargantuan $3.2 trillion reserve pot and is explicitly seeking to decouple from the West. U.S. figures show that China has slashed its holdings of Treasurys by 21% since January 2022.

Yet the shifts look surprisingly small given the enormous shock to the system administered by the U.S. move last year to freeze Russia’s overseas assets. As Elsa Lingos, global head of Foreign-Exchange Strategy at RBC Capital Markets, put it in a note to clients this week: “If this is de-dollarization, it’s happening at a ridiculously slow pace.”

Yes, the dollar share has declined steadily over the past 25 years, but this was in the context of the euro’s creation in 1999 and a long rally in the dollar after the 2008 financial crisis. Central-bank reserve managers tend to cut their dollar allocations whenever the greenback is strong, to avoid getting burned by an overvalued currency. Their big diversification push in recent years has been primarily driven by the search for higher yields in other Western currencies such as the Canadian and Australian dollars.

Ultimately, only countries that had little choice, such as Argentina and Russia, have taken strong action to sidestep the U.S. Despite Brazil’s stated intentions, 80% of its reserves are still in dollars.

There is little evidence China is really moving away from U.S. assets either. A big reason for its reduced Treasury holdings is the hit to bond prices from higher interest rates. According to Brad Setser, senior fellow at the Council on Foreign Relations, a simultaneous rise in holdings in Belgium and Luxembourg also suggests that some assets have simply moved offshore.

Meanwhile, balance-of-payments data point to Chinese state banks plowing proceeds from Treasurys back into the U.S., in the form of higher-yielding mortgage-backed securities.

Of course, last year’s weaponization of the U.S. monetary system against Russia is likely to lead to further pockets of de-dollarization in the long run, especially if tensions with China ratchet up further. The rise of non-dollar cross-border payments systems—especially to pay for oil—shows that nations are aware of the geopolitical need for alternatives.

The true gauge of the dollar’s power, however, isn’t its weight in foreign reserves and trade invoicing, but its role as the preferred currency for international debt issues and the haven to which investors flee in times of distress. Viewed in the round, dependence on the greenback is a habit that the world has shown very few signs of shaking.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.