Noteworthy

- U.S. Dollar Drops for a Fourth Day; Euro, Pound Hold Above 200-DMA

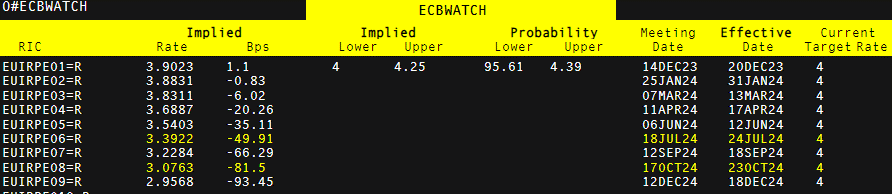

Despite prominent European Central Bank (ECB) officials emphatically stating the conversation around rate cuts is premature, the futures market anticipates nearly 100 basis points of cuts in 2024 which paces alongside US expectations. Therefore, the euro currency no longer holds a notable advantage as far as interest rate expectations are concerned.

Nevertheless, EUR/USD has put in a strong performance after U.S. inflation data fell encouragingly on Tuesday. The unwinding of US outperformance is forcing markets to reassess whether the world’s largest economy is showing signs of frailty like the rest of the major economies.

A massive move higher of around 1.7% yesterday made a strong case for a bullish reversal, even surpassing the key 200-day simple moving average (SMA) in the process. The 200 SMA is widely followed as a longer-term trend filter as the pair is yet to even test the level, this time as support.

1.0830 is the most immediate level of support and should the pair hold above it, would bode well for further bullish momentum, particularly if US retail sales data continues the trend of weaker fundamental data.

US retail sales carries more importance in light of the recent trend of softening US data. Markets will be particularly concentrated on the health of the US consumer given the sizeable contribution it made to the massive Q3 GDP figure. Thereafter, the final number for EU core inflation is due but there is little to suggest this will vary much, if at all.

Tomorrow there is a notable concentration of Federal Reserve speakers, and it will be interesting to see if they pose any resistance to the more dovish sentiment moving through markets after the lower US inflation data.

Implied rate hikes and cuts based off the futures market

Source: Refinitiv, prepared by Todd A. Blonshine

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.