Noteworthy

- Dollar Steady Ahead of Expected Interest Rate Hike

- Federal Reserve Set to Raise Rates to 22-Year High

The U.S. Dollar

The Federal Reserve is set to raise interest rates by a quarter-percentage point on Wednesday to a 22-year high, with most investors focused on what it would take for the central bank to lift rates again later this year.

Economic growth has likely been too firm in recent months for Fed Chair Jerome Powell to signal that Wednesday’s increase in the Fed’s benchmark short-term rate will be the last of the current tightening cycle, as investors anticipate. The recent slowdown in inflation also makes it hard for central bank officials to firm up plans for any additional rate increase.

The central bank will announce its decision at 2:00 p.m. Eastern time. Powell will answer questions from reporters at 2:30 p.m. Officials won’t release quarterly interest-rate and economic projections after their two-day meeting this week.

Stocks wavered at the open ahead of the Fed decision and as a slew of companies announced earnings.

The Fed last month held interest rates steady in a range between 5% and 5.25%, its first pause after 10 consecutive increases since March 2022, when officials raised them from near zero. Interest-rate increases slow the economy through financial markets by lowering asset prices and raising the cost of borrowing.

Despite better news on inflation this month, officials are motivated to lift rates this week in part because overall hiring and economic activity since May has been stronger than anticipated. In addition, some officials want to see that inflation continues to ease before ending increases.

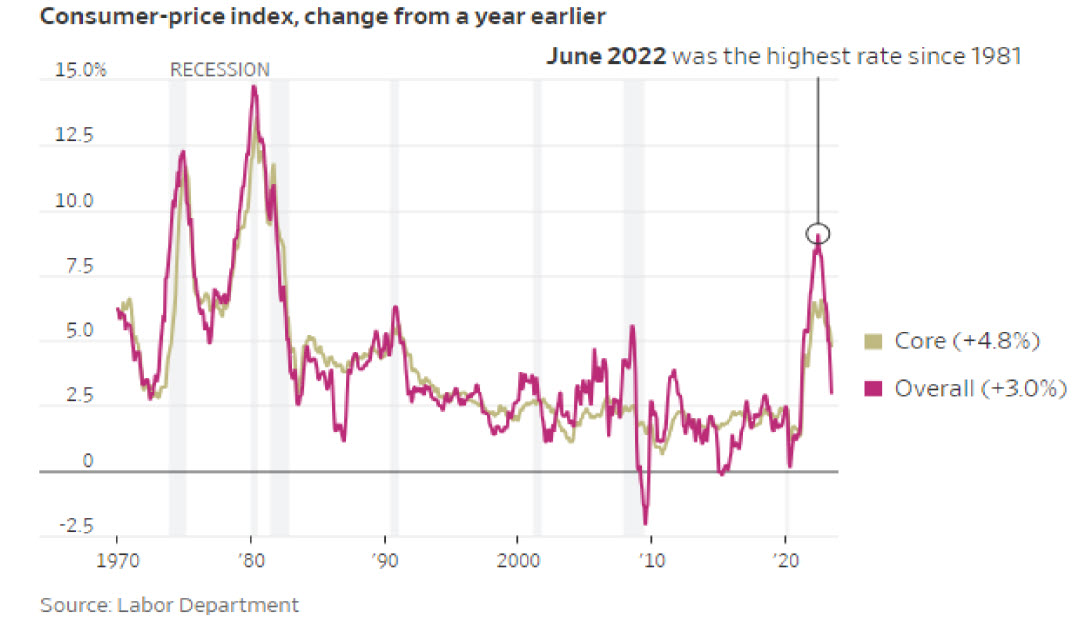

The consumer-price index for core inflation, which excludes volatile food and energy prices, posted its smallest monthly increase in more than two years in June, rising less than 0.2% from the prior month.

Fed governor Christopher Waller in a July speech said he wants to see evidence that the latest inflation slowdown wasn’t a fluke. The recent report, he said, “warmed my heart, but…I’ve got to make policy with my head. And I can’t do that on one data point.”

Most Fed officials in June penciled in two more rate hikes this year. Investors will heavily parse Powell’s press conference for signs that the central bank’s next meeting is “live,” meaning a rate increase will be strongly considered at the September 19-20 meeting.

Investors also will be looking for clues that the central bank might be comfortable holding rates steady in September and waiting longer to see how the economy unfolds. Powell framed last month’s decision to pause increases as an effort to give officials more time to study the impact of the Fed’s past moves.

Fed officials meet eight times a year, or roughly twice each quarter. While Powell said last month he wouldn’t rule out raising rates at consecutive policy meetings, he said moving rates up at a slower, quarterly pace could be expected to continue if the economy evolves in line with current expectations.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.