Noteworthy

- Dollar Extends Gains After U.S. Payrolls Beat, Rising for 6th Day

Employers hired at a solid pace in December, capping a year of steady gains for a job market that continues to defy expectations and remains a bright spot in a gradually cooling economy.

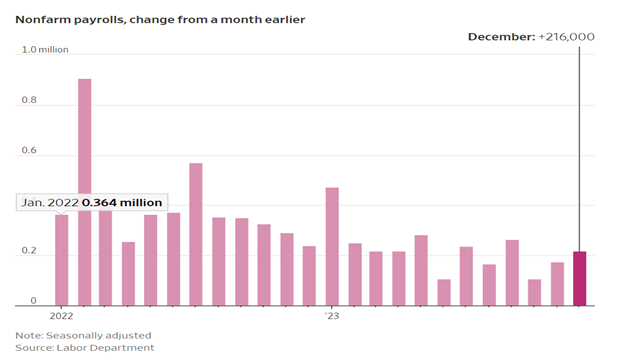

The U.S. economy added 216,000 jobs last month, the Labor Department reported Friday. That was larger than November’s gain of 173,000, and better than forecasters were expecting. Hiring was revised down in both October and November. For all of 2023, employers added 2.7 million jobs, a slowdown from 2022, but a better gain than in the years preceding the pandemic.

Hiring was broad based last month, with healthcare and government leading job gains. Transportation and warehousing employers shed jobs. The unemployment rate in December held at 3.7%. The jobless rate began 2023 at 3.4%, matching lows not seen since the late 1960s, and remains low despite inching higher late last year.

Wages rose a healthy 4.1% annualized last month from a year earlier. More broadly, there are signs the tight labor market conditions that prompted employers to offer robust pay raises in early 2023 continue to wane.

The labor market’s slowing but steady pace during 2023, coupled with a sharp slowdown in inflation, has fueled optimism that the economy can achieve a so-called soft landing. That would mean inflation eases without a recession.

Federal Reserve officials have signaled they are comfortable for now maintaining their benchmark federal-funds rate at a 23-year high as they await more evidence that inflation is falling back to their 2% target. At their meeting last month, most officials penciled in at least three rate cuts this year, a sign the central bank is done lifting rates.

Friday’s report will do little to alter that calculus and keeps the central bank on track to hold rates steady at its next policy meeting, Jan. 30-31. It suggests the labor market is no longer at risk of overheating, particularly as private-sector hiring has eased over the past few months. But it also doesn’t point to material weakness that might move up the Fed’s timetable for cutting rates.

At the start of 2023, the job market and broader economy were widely expected to slow substantially, the anticipated result of the Fed’s aggressive interest-rate hiking campaign. Instead, strong consumer spending and an increase in available workers helped underpin the economy this past year, allowing hiring to chug along as labor shortages eased.

There are signs of cooling. Employers had far fewer open positions at the end of 2023 compared with the start, and workers are quitting their jobs at a lower rate than before the pandemic began. Yet, unemployment and layoffs remain low, and vacancies are higher than 2019 levels, suggesting demand for workers is still solid.

For most of 2023, employers added more than 200,000 jobs each month. That was a much slower pace of job creation than comparable periods in 2021 and 2022, as the economy initially rebounded from the Covid-19 pandemic, but better than in the years leading up to 2020.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.