Noteworthy

- Dollar Jumps in First Trading Day of 2024; Scandies, Franc Slide

The New Year started off on a positive note for the U.S. dollar as it gained across the board versus its peers. Previously, the euro currency traded as high as $1.1084 on December 28th, but is now below $1.0950. Similarly, the Canadian dollar is at a one-week low to start 2024. However, 2024 could be the year of the Japanese yen.

The Japanese yen has been one of the worst performing currencies over the past couple years. It could do better in 2024.

The yen has lost around 20% against the dollar since the end of 2021, under-performing other major currencies. Japan’s central bank kept its ultra-low interest rates while most of its peers have been raising rates aggressively. Higher yields outside of Japan have driven the currency lower and lower.

While inflation has picked up in Japan—like almost everywhere else—it remains low compared with other developed economies. Japan’s core inflation rate, which excludes fresh foods, was 2.5% from a year earlier in November, down from 4.2% at the beginning of 2023. Though that is already above Bank of Japan’s 2% inflation target, the central bank has been unwilling to raise interest rates too quickly, fearing a hit to the economy.

The Bank of Japan (BOJ) may eventually tighten its monetary policy, especially if it judges that inflation has moved sustainably above its target. The central bank has already made a couple tweaks to its “yield-curve control” policy, which seeks to keep its long-term bond yields low. The yen has risen around 7% against the dollar since mid-November, partly as traders expect the BOJ to give up its negative interest rate policy sometime in 2024.

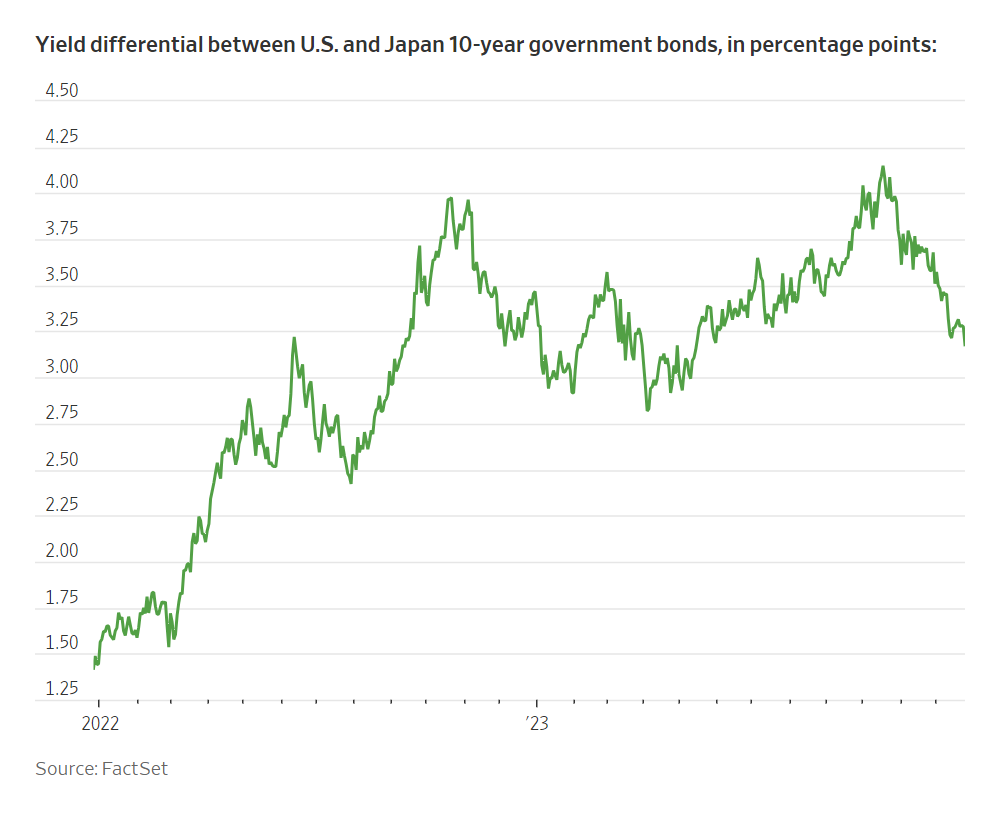

Yet one of the biggest supports for the yen in 2024 will likely come from the Federal Reserve. Its rate increase cycle has likely come to an end already, and the central bank has indicated cuts could be coming. The yield differential between 10-year government bonds in Japan and the U.S. has narrowed by almost one percentage point in the past two months, due to plummeting U.S. bond yields. Japanese bond yields did, in fact, also fall during that period.

Japan stayed put when every other major central bank was raising interest rates, betting it could withstand negative pressure on the yen. That gamble now seems to have paid off.

Contact Comerica Foreign Exchange

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.