Summary

- Canadian dollar gains as oil prices rise, U.S. CPI in focus.

- 10-Year Treasury yield rises to above 4.04%.

- U.S. dollar rises marginally after faster-than-expected inflation.

- Chris Christie drops out of U.S. Presidential race.

- U.S. December CPI rose 0.303% month-over-month; U.S. core prices rose 0,309% month-over-month.

- Euro currency trades within recent range just below $1.10.

- U.S. December real average weekly earnings rose 0.5% year-over-year.

- U.K. pound sterling stable within recent ranges above $1.27.

- Japanese yen remains weaker trading above 145 per one U.S. dollar rising to best levels since October.

- U.S. weekly jobless claims at 202,000 last week; estimate 210,000.

- AUD/USD keeping two large Friday options expirations in play.

- China’s yuan gains amid strong PBOC fixing.

- Dollar swap spreads drop to low after Fed’s Williams taper talk.

Noteworthy

- Inflation Edged Up in December After Rapid Cooling Most of 2023

Inflation firmed up at year’s end, after the pace of price gains fell by nearly half in 2023.

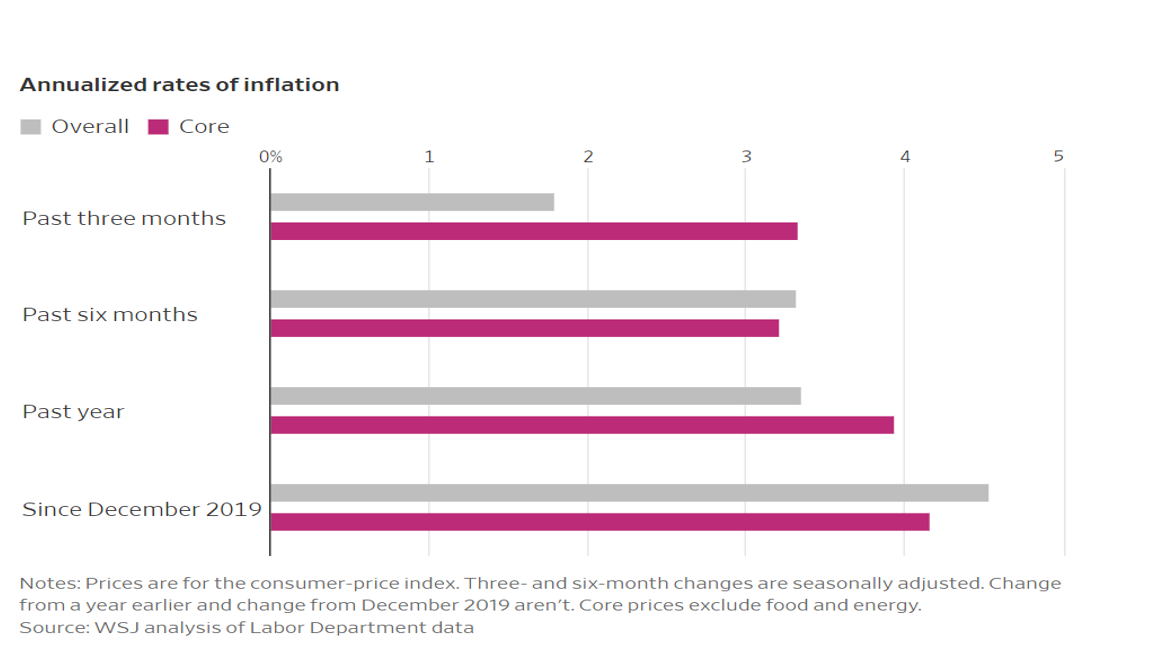

The consumer-price index climbed 0.3% in December from the prior month and increased 3.4% from a year earlier, the Labor Department said Thursday. That compares with November’s 0.1% monthly gain and marks an acceleration from that month’s 3.1% annual increase.

Core prices, which strip out volatile food and energy items, rose 0.3% in December from the prior month—the same monthly increase as November and slightly faster than would be consistent with the Federal Reserve’s long-term inflation target of 2%. Core prices increased 3.9% from a year earlier, a modest slowing from November’s 4% annual increase. Thursday’s report isn’t likely to change the Fed’s near-term policy outlook.

Overall inflation is well down from 6.5% at the end of 2022, and wages have grown, meaning many consumers are seeing their dollars go further. However, pockets of fast-rising prices remain, such as those for auto insurance and repairs. The rapid cooling of core price increases over the past year has raised hopes of a soft landing, where inflation can be tamed without a surge in unemployment or a recession. Core inflation is often viewed as a better predictor of inflation’s future path than the overall numbers.

“The progress on inflation since June 2022 has been remarkable,” said David Kelly, chief global strategist at J.P. Morgan Asset Management. “The bottom line is that the most likely path for inflation from here is not upwards or sideways but rather down.”

Prices rose in December as Americans paid more for rent, auto insurance and dental visits, while furniture, toys and sporting goods fell. Energy costs increased 0.4% on the month driven by a rise in gasoline and electricity prices, on a seasonally adjusted basis.

Fed officials aren’t likely to change interest rates when they meet later this month, Jan. 30-31, and they use a separate inflation gauge, the personal-consumption-expenditures price index, to determine whether they are achieving their 2% inflation goal. That index will be released later this month by the Commerce Department.

Inflation using that gauge has fallen to just over 2.5%, a “clearly positive development,” said New York Fed President John Williams in remarks Wednesday. While he indicated the central bank still has “a ways to go to get inflation back” to the target, he called out “significant progress” bringing down inflation for labor-intensive services, which many economists think will be the most difficult part of the Fed’s inflation fight.

Most officials have indicated that they made their final rate increase last July, when they lifted their benchmark rate to a range between 5.25% and 5.5%, a 23-year high.

Many indicated they will eventually want to lower rates if inflation continues to decline because otherwise, holding rates steady would lead inflation adjusted or “real” rates to rise, creating an unnecessarily restrictive setting. Officials anticipated at least three-rate cuts this year at their December meeting.

As a result, markets widely expect the Fed’s next move will be to lower rates, with many anticipating the first reduction in March. Inflation readings in the months to come could have a much bigger bearing on when the central bank makes its first cut. “It will only be appropriate to dial back the degree of policy restraint when we are confident that inflation is moving toward 2% on a sustained basis,” Williams said on Wednesday.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.