Summary

- Canadian dollar slips against stronger U.S. dollar despite continued oil price gains, remains near 8-week low.

- 10-Year Treasury yield tops 4.15%.

- Japanese yen falls to weakest since November after Bank of Japan (BOJ) rate message.

- U.S. weekly jobless claims at 218,000 last week versus 220,000 forecast.

- Japanese funds buy record amount of U.S. sovereign debt in 2023.

- Treasury Secretary Yellen sees no sign of issues selling Treasuries as debt climbs.

- U.K. pound sterling drifts before Bank of England’s (BoE) Mann – BoE’s Mann says her vote for U.K. rate hike was ‘not easy’.

- Swiss franc falls to weakest level versus U.S. dollar in nearly 2 months this week.

- Mexico’s Amlo to attend North America summit in April.

- Australian dollar higher on hawkish RBA comments on lagging the U.S. Fed.

- China inflation touches lowest level since 2009 as CPI falls for 16th straight month. Yuan volatility lowest since November before holiday.

- Crude oil rises for a fourth day.

Noteworthy

- U.S. Dollar Rises Modestly; Japanese Yen Drops Most in G-10 as BoJ Downplays Fast Hikes

The U.S. Dollar

After a small, corrective dip in the U.S. dollar since Tuesday’s peaks, there are some tentative signs of a generally firmer U.S. dollar emerging in trading today.

Most major currencies are lower against the U.S. dollar on the session, with only the Swedish krona (SEK) and Swiss franc (CHF) registering a minor (less than 0.1% as of this writing) gain overall.

The Japanese yen (JPY) is leading losses, dropping back through 149 despite relatively stable U.S. yields. Comments from Bank of Japan (BOJ) Deputy Governor Uchida indicated that it was hard to see rates rising “rapidly” after ending its’ negative interest rate policy.

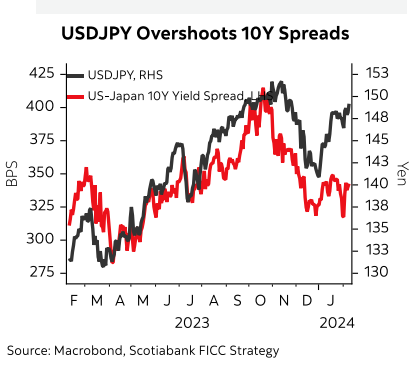

Japanese yen swaps were pricing in a steady, if very moderate, rise in the benchmark rate to 0.25% by December earlier this week but Uchida’s comments have lopped 3bps off tightening expectations. Still, for the Japanese yen specifically, today’s losses continue the recent trend of U.S. dollar/Japanese yen overshooting the relative move in U.S./Japan yield spreads, leaving the Japanese yen veering towards becoming fundamentally oversold, we think.

The U.S. dollar index (DXY) is showing some signs of short-term technical strength though, with the index basing around the 104 area yesterday; gains today may be setting the index up for a retest of the 104.55/60 peaks seen at the start of the week.

It’s a relatively quiet day for calendar risk again in the U.S.—weekly claims, Wholesale Inventories plus Fed Governor Barkin (voter) with two speaking appearances. But markets may be giving the U.S. dollar a bit of a lift ahead of tomorrow’s annual U.S. CPI revisions—not usually a big issue for markets until last year’s surprising and quite significant upward revisions.

Note China reported lower than expected CPI (-0.8% Y/Y in January) earlier, the weakest clip since 2009.

Contact Comerica Foreign Exchange

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.