Summary

- Canadian dollar rebounds from two-month low as shares firm.

- 10-Year Treasury yield tops 4.32% at peak after hotter-than-expected CPI Tuesday.

- Japanese yen tops 150 yen per dollar, but no sight of BoJ intervention yet as traders’ eye 157 level.

- Japanese yen slides to lowest level against Great British pound sterling since 2015.

- Japan 10-year bond yield rises above 0.75%, highest since December.

- U.S. dollar to gain up to 7% as U.S. inflation runs hot, Acadian says.

- Barclay’s moves Fed rate-cut forecast to June from May after hot U.S. CPI.

- Swiss franc down against G-10 peers as Swiss inflation slows.

- U.K. pound sterling hits six-month high versus euro currency Tuesday after strong British wage data, before tumbling Wednesday.

- Most G-10 currencies gain; U.K. pound sterling extends drop on soft British CPI.

- Traders pile into BoE rate-cut wagers after U.K. CPI holds steady.

- EIA: Crude = 12.018 Bbl, median est. +3,350 Bbl.

Noteworthy

- U.S. Dollar Up to 3-Month High on Higher Interest Rates

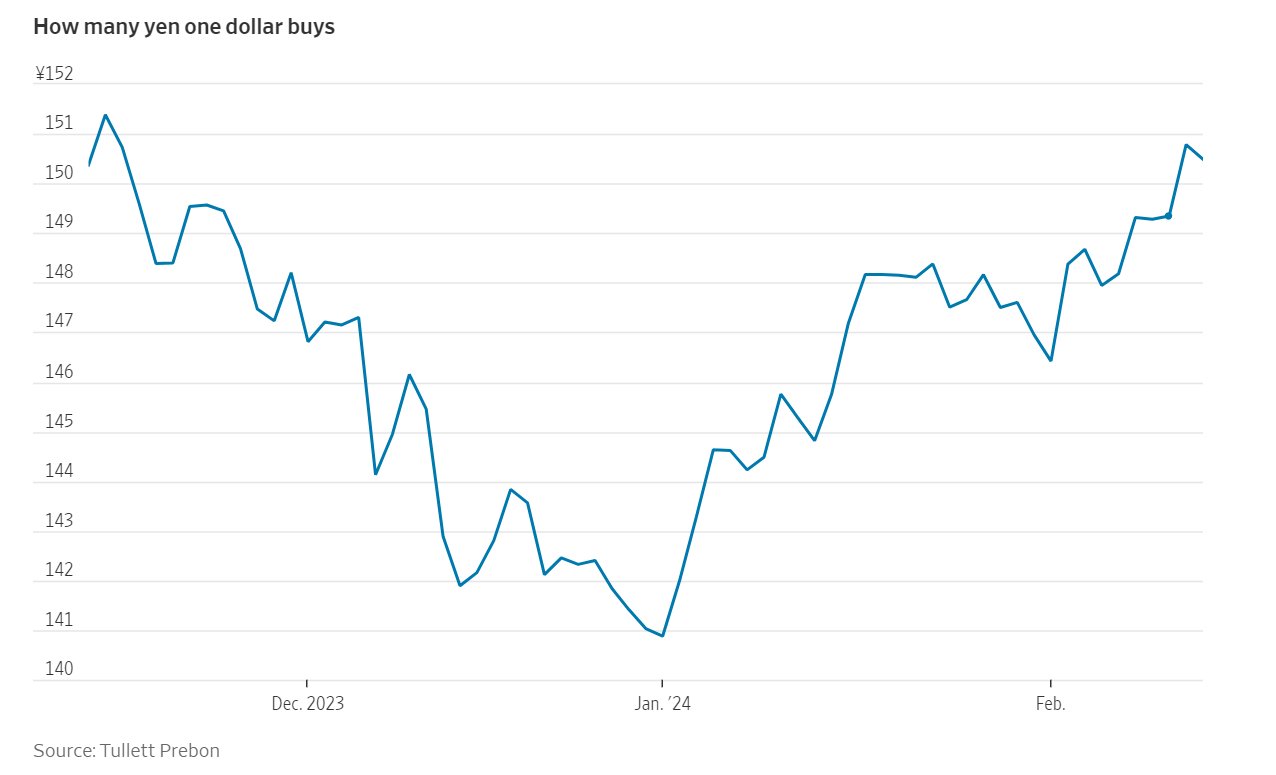

The Japanese yen weakened past 150 per U.S. dollar for the first time in nearly three months, prompting a senior Japanese official to threaten action to stabilize the currency.

The move lower in the yen came after stronger-than expected U.S. inflation data suggested that rate cuts by the United States Federal Reserve may not be imminent.

FX traders revamped their expectations for an imminent interest-rate cut to a minimum of this summer at the earliest.

“Rapid movements have significant negative effects on the economy,” Masato Kanda, vice minister of finance for international affairs, said Wednesday. “We will monitor the foreign exchange market carefully with a high sense of tension and take appropriate action if necessary.”

Japan last officially intervened in currency markets to support the yen in October 2022.

The U.S. inflation data heightened expectations that the interest-rate differential between the U.S. and Japan would remain wide, meaning investments in the U.S. dollar would continue to earn higher returns.

Bank of Japan Governor Kazuo Ueda said last week that the bank was likely to keep rates low even if it ends negative rates.

After starting the year at about 141 yen to the dollar, the Japanese currency has weakened considerably, putting Tokyo officials on alert.

A weak yen boosts exporters’ revenue earned overseas and could help push up the Nikkei Stock Average to its record high of 38,915.87, marked on December 29, 1989. The index, which had gained 2.9% on Tuesday, fell 0.7% to 37,703.32 at Wednesday’s close.

Elsewhere the U.S. dollar index touched a 3-month high as interest rates moved sharply higher after the hotter-than-expected CPI.

Contact Comerica Foreign Exchange

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.