Noteworthy

- U.S. Hiring Pace Continued to Moderate in November: Unemployment Rate Unexpectedly Falls

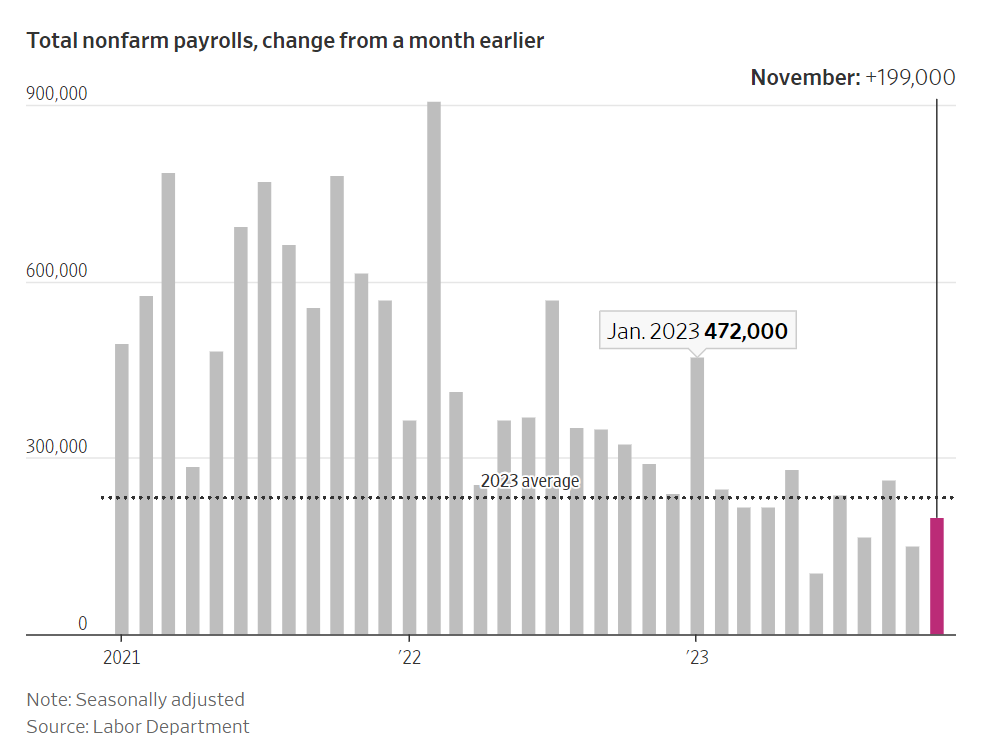

Employers hired at a moderate pace in November for the second straight month, the latest sign of a cooldown in the labor market heading into 2024.

The U.S. economy added 199,000 jobs last month, the Labor Department reported Friday. That number was aided by the end of auto strikes, which resulted in roughly 30,000 jobs added back to payrolls. November marked the second consecutive month job gains have fallen below the average for 2023.

The unemployment rate edged lower to 3.7%, higher than earlier in the year, but still near historic lows. Average hourly earnings advanced roughly 4% from a year earlier. That is above pre-pandemic rates but marks a slowdown from gains in 2022 and early 2023.

The recent cooldown in hiring demand hasn’t triggered a large rise in unemployment and job losses, prompting optimism the U.S. economy can achieve a so-called soft landing, where inflation cools without a recession. The Federal Reserve has likely ended a series of interest-rate increases that aimed to fight inflation by cooling the economy, and many analysts are now watching the labor market for clues about when the central bank could begin to cut rates.

Recent trends are pointing in the right direction where you are seeing things progress toward the soft landing. Comerica Bank’s chief economist, Bill Adam’s made the following observations:

The labor market added more jobs than expected in November and was generally stronger than expected given the pullback in job openings, higher continued jobless claims, and the modest employment reported in ADP’s tally of private payrolls.

Employers added fewer seasonal jobs for the holidays than is typical of November, which held back seasonally adjusted employment in the payroll survey. But job growth was very strong in the (admittedly volatile) survey of households, so the trend looks intact.

Monthly activity indicators like retail sales and industrial production point to a slowdown in real GDP growth in the fourth quarter after a red-hot third quarter, but the jobs report says the U.S. economy is very unlikely to be in recession, or on the cusp of one.

The strong jobs report and solid growth of aggregate payrolls will bolster consumers’ spending power in the holiday season—volumes of holiday purchases will grow modestly this year while prices are about flat.

With year-over-year growth of average hourly earnings continuing to moderate, and output per hour (productivity) rising in the revised third quarter data released earlier this week, the risk of wage-price pressures aggravating inflation in 2024 seems less scary than it did six months ago.

The Fed will be encouraged to see higher labor force participation and see the resilience of the job market as indicating there is no urgent need to cut rates to prevent a recession. Comerica forecasts for the Fed to hold the federal funds target steady at the current level until beginning to reduce it with a first quarter percentage point rate cut in June 2024.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.