Noteworthy

- U.S. Dollar Trades Within Recent Ranges, British Pound Leads Losses on Slowing Inflation

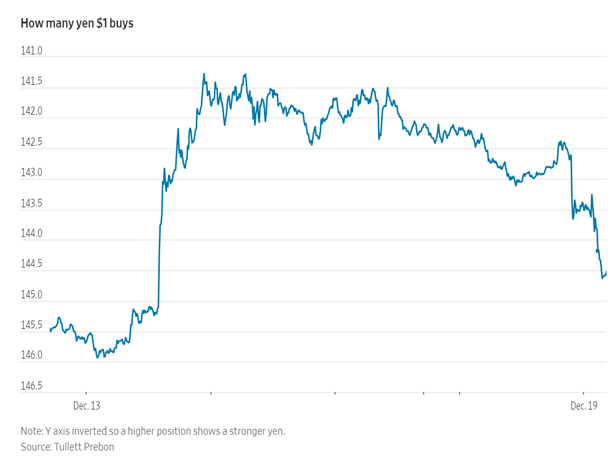

The Japanese yen weakened sharply after the Bank of Japan (BoJ) made no policy move at its latest meeting and gave no hint about near-term changes.

The BoJ decided to maintain short-term interest rates at minus 0.1%, and Gov. Kazuo Ueda said he wanted to see more evidence that Japan is finally having a positive cycle of rising wages and prices.

The yen shed more than 1% Tuesday, trading as weak as 144.68 to the dollar on Tuesday.

Japanese government bonds rallied as the 10-year yield fell to the lowest level since the Bank of Japan’s July tweak.

The Nikkei 225 (stock) index climbed 1.4%.

While many analysts expect the BoJ to end negative interest rates in the first half of next year, Ueda didn’t give any clues on Tuesday.

Ueda said it would be difficult for the BoJ to say "it would raise rates next month" or to show its outlook for short-term rates as the Federal Reserve does, because it could confuse the markets.

Ueda also acknowledged possible Fed rate cuts would affect foreign-exchange rates but said it would be inappropriate for the BoJ to rush a policy change just to preempt the Fed.

The Japanese yen weakened after Ueda said he can’t yet see Bank of Japan hitting 2% inflation goal with certainty. However, at below 143.84 it was substantially stronger than the 151.78 level it attained on November 14th.

Elsewhere, the Swiss franc rose to its highest level versus the U.S. dollar since July 1st.

In contrast, the U.K. pound sterling fell to a three-week low after British inflation slowed.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.