Noteworthy

- Beijing Is Caught in a Catch-22 as Economy, Currency Stumble

The U.S. Dollar

China’s central bank wants to boost the country’s sluggish economy while keeping its currency stable. That is proving a difficult juggling act.

The People’s Bank of China cut several interest rates on Tuesday, the same day the country released a raft of July data that painted a grim picture of China’s economy. The lowering of interest rates is designed to give the economy a boost, but it is also putting pressure on the currency.

The offshore yuan traded around 7.34 per U.S. dollar during Asian trading hours on Wednesday morning, moving closer to its record low of 7.38 set during intraday trading last October. It recovered later in the day, but currency strategists think the selling pressure will remain.

Earlier on Wednesday, the central bank set its daily fixing for the onshore yuan at 7.1986 per dollar. This allows the currency to trade in a narrow range in the tightly controlled domestic market.

The country’s housing market is in a yearslong slump, badly hurting confidence in an economy where rising property prices were for many years a key source of wealth. Official data shows home sales are down, and prices have been slipping. Recently, one of the biggest surviving Chinese property developers, missed two dollar-bond interest payments last week, fueling a wider market rout.

China’s exports are shrinking, and consumer prices recently slipped into deflationary territory. Retail sales, industrial production and fixed-asset investment all grew at a slower pace in July than they did a month before. Data for youth unemployment, which hit a record high of 21.3% in June, will no longer be published.

That is putting Beijing in a Catch-22 situation. The central bank is officially committed to using monetary policy to maintain a stable currency value “and thereby promote economic growth,” but at the moment its major policy tool—the level of interest rates—can boost only one side of that equation.

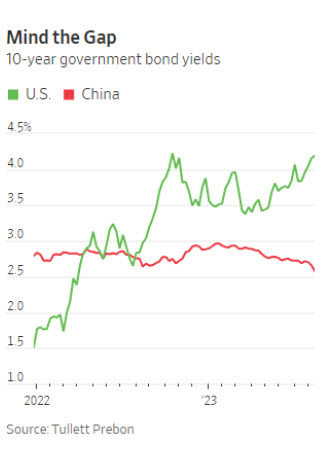

Interest rates are a key driver of currency values since foreign investors tend to move their money into countries where they can get the highest returns. The historic rise of U.S. interest rates over the past year and a half had already put pressure on the yuan, as the U.S. dollar strengthened against a variety of currencies. The difference between 10-year government bond yields in the U.S. and China is at its widest level in more than a decade, according to data from Tullett Prebon.

The offshore yuan, which trades more freely than the onshore currency, has depreciated 5.4% against the U.S. dollar this year.

Most economists say that interest-rate cuts are not enough to solve China’s economic problems and that a big fiscal stimulus package is required. But the government has so far proved reluctant to spend a lot more to help the economy.

Beijing’s continued lack of clarity over its policy response has also made it more difficult to forecast where the yuan is heading, said Sim Moh Siong, currency strategist at Bank of Singapore. He added that there was a chance of a strong policy response which would help stabilize the yuan.

This week’s cut to interest rates follows a similar move in June, when China’s central bank lowered the rate on loans under its one-year medium-term lending facility. That encouraged Chinese banks to lower their own lending rates.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Capital Markets does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Capital Markets personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Capital Markets, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.